A bearer is an individual or entity that holds or carries something, such as a document, title, or financial instrument, on behalf of the rightful owner. Understanding the roles and responsibilities of a bearer is crucial in financial transactions, legal matters, and property rights to protect your interests effectively. Discover more about how bearers impact various sectors and what you need to know by reading the rest of this article.

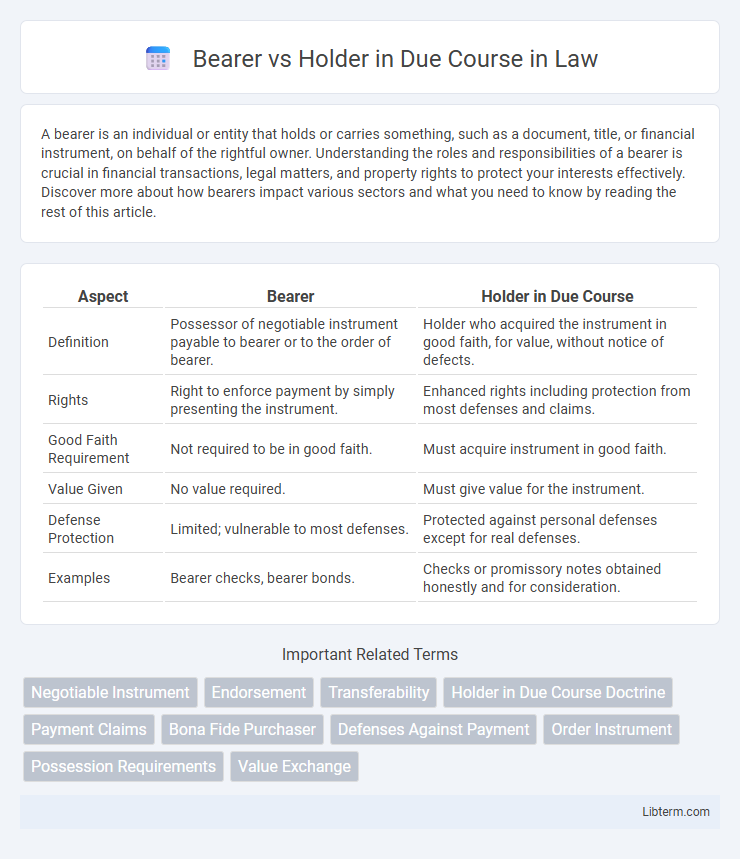

Table of Comparison

| Aspect | Bearer | Holder in Due Course |

|---|---|---|

| Definition | Possessor of negotiable instrument payable to bearer or to the order of bearer. | Holder who acquired the instrument in good faith, for value, without notice of defects. |

| Rights | Right to enforce payment by simply presenting the instrument. | Enhanced rights including protection from most defenses and claims. |

| Good Faith Requirement | Not required to be in good faith. | Must acquire instrument in good faith. |

| Value Given | No value required. | Must give value for the instrument. |

| Defense Protection | Limited; vulnerable to most defenses. | Protected against personal defenses except for real defenses. |

| Examples | Bearer checks, bearer bonds. | Checks or promissory notes obtained honestly and for consideration. |

Introduction to Negotiable Instruments

Bearer instruments are negotiable instruments payable to whoever holds them, granting immediate possession-based rights without requiring endorsement. Holder in due course refers to a party who acquires a negotiable instrument for value, in good faith, and without notice of defects or claims, enjoying enhanced protections against defenses. Understanding the distinction between bearer and holder in due course is crucial for determining rights and obligations under the Uniform Commercial Code governing negotiable instruments.

Defining Bearer and Holder in Due Course

Bearer refers to a person who possesses a negotiable instrument payable to the bearer or to whom it is endorsed without restriction, enabling them to claim payment. Holder in Due Course is an individual who has acquired a negotiable instrument for value, in good faith, and without notice of any defects, granting them enhanced legal protection against claims and defenses. The key distinction lies in the Holder in Due Course's qualified ownership and protection, while a Bearer's rights arise solely from possession.

Legal Framework: Key Statutes and Provisions

The legal framework distinguishing Bearer and Holder in Due Course lies primarily within the Uniform Commercial Code (UCC) Article 3, which governs negotiable instruments. Under UCC SS3-301, a Holder in Due Course possesses an instrument for value, in good faith, and without notice of defects, thereby gaining protection from certain defenses. Conversely, a Bearer holds the instrument payable to bearer or endorsed in blank but lacks the enhanced protections granted to Holders in Due Course, making the distinction crucial in enforcing negotiable instruments.

Rights and Liabilities of a Bearer

A bearer of a negotiable instrument possesses the right to receive payment and enforce the instrument against all parties liable on it, as the instrument is payable to whoever holds it. Bearers bear the liability of presenting the instrument for payment within the prescribed period and risk losing enforceability if the instrument is lost or stolen, given the transferability by possession alone. Unlike a holder in due course who acquires the instrument in good faith and has protection against many defenses, a bearer's rights focus primarily on possession, with corresponding liabilities tied to maintaining possession and timely presentation.

Distinct Privileges of Holder in Due Course

A Holder in Due Course (HDC) enjoys distinct privileges, such as acquiring the instrument free from many defenses that could be raised against the original payee, including personal defenses like fraud or breach of contract. Unlike a mere bearer, the HDC obtains the instrument in good faith, for value, and without notice of defects, securing enhanced protection under the Uniform Commercial Code. This status allows the Holder in Due Course to enforce payment even if the underlying transaction is contested, safeguarding negotiable instruments from ordinary claims and defenses.

Transfer and Negotiation: Bearer vs Holder in Due Course

Bearer instruments are payable to whoever holds the document and can be transferred through simple delivery without endorsement, facilitating easy negotiation and transferability. Holder in due course status applies to holders of negotiable instruments who acquire them for value, in good faith, and without notice of defects, offering stronger legal protection and requiring proper negotiation or endorsement for transfer. Bearer instruments often allow more flexible, quick transfers, whereas holders in due course benefit from enhanced legal rights but depend on formal negotiation steps.

Comparison Chart: Bearer vs Holder in Due Course

Bearer instruments are payable to whoever holds the document, allowing easy transfer of ownership without endorsement, while Holder in Due Course rights arise from a holder who has obtained the instrument in good faith, for value, and without notice of defects. Bearer instruments pose higher risks of loss or theft due to their negotiability through mere possession, whereas Holders in Due Course gain enhanced protection from personal defenses against payment claims. The comparison highlights that Bearers rely on physical possession for enforcement, whereas Holders in Due Course benefit from legal safeguards protecting their title in commercial transactions.

Common Legal Cases and Precedents

Bearer instruments grant rights to the person in possession, allowing immediate negotiation and payment without endorsement, commonly seen in bearer checks used to prevent forgery. Holder in Due Course (HDC) status provides legal protection against certain defenses, as established in cases like *Commercial Credit Co. v. Cluff*, ensuring the HDC takes the instrument free from prior claims or personal defenses. Courts routinely distinguish these roles in disputes over negotiable instruments, emphasizing possession for Bearers and legitimate acquisition for Holders in Due Course to resolve liability and enforce payment.

Practical Implications in Financial Transactions

Bearer instruments grant possession as evidence of ownership, enabling immediate transfer of value through physical delivery without endorsement, which streamlines payments but increases risk of loss or theft. Holder in due course status protects bona fide purchasers from prior claims or defenses, providing enhanced legal security and enforceability in negotiable instruments, essential for commercial financing and credit transactions. Understanding the distinctions influences risk management, legal rights, and transferability in financial dealings involving checks, promissory notes, and drafts.

Conclusion: Key Differences and Summary

Bearer instruments grant entitlement to whoever physically holds the document, enabling easy transfer without endorsement, while holders in due course receive negotiable instruments in good faith, for value, and without notice of defects, providing stronger legal protections against defenses. Bearer status emphasizes possession as proof of rights, whereas holder in due course status relies on formal negotiation and protection from claimants. Understanding these distinctions is crucial for negotiable instrument transactions, affecting risk, transferability, and enforceability.

Bearer Infographic

libterm.com

libterm.com