A beneficiary is an individual or entity entitled to receive benefits or assets from a will, trust, insurance policy, or retirement account. Understanding the rights and responsibilities of a beneficiary can ensure your assets are distributed according to your wishes. Explore the rest of this article to learn more about how beneficiaries impact estate planning and financial security.

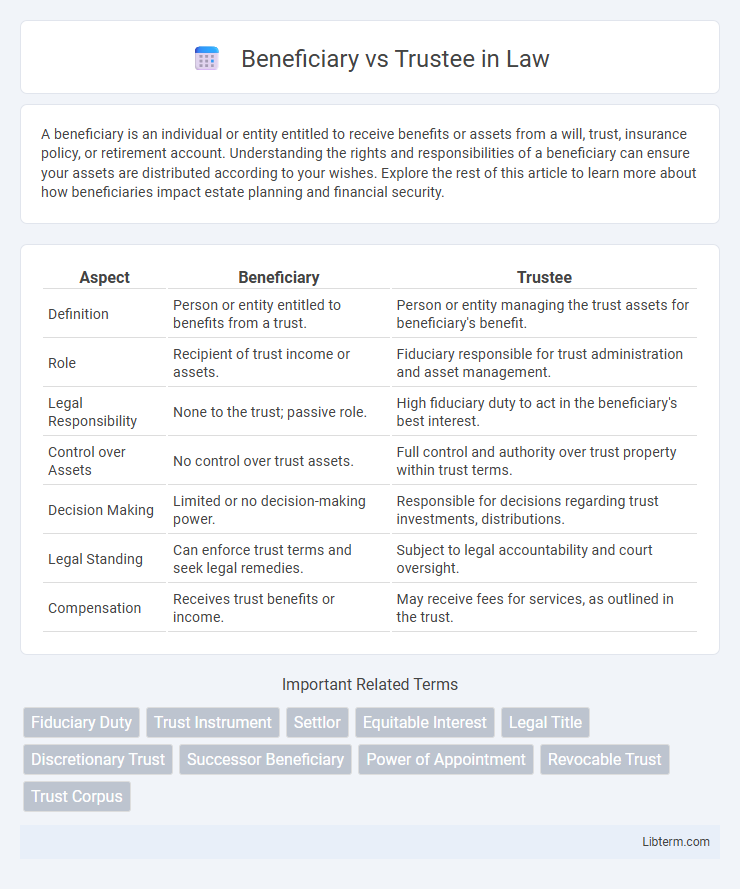

Table of Comparison

| Aspect | Beneficiary | Trustee |

|---|---|---|

| Definition | Person or entity entitled to benefits from a trust. | Person or entity managing the trust assets for beneficiary's benefit. |

| Role | Recipient of trust income or assets. | Fiduciary responsible for trust administration and asset management. |

| Legal Responsibility | None to the trust; passive role. | High fiduciary duty to act in the beneficiary's best interest. |

| Control over Assets | No control over trust assets. | Full control and authority over trust property within trust terms. |

| Decision Making | Limited or no decision-making power. | Responsible for decisions regarding trust investments, distributions. |

| Legal Standing | Can enforce trust terms and seek legal remedies. | Subject to legal accountability and court oversight. |

| Compensation | Receives trust benefits or income. | May receive fees for services, as outlined in the trust. |

Understanding the Roles: Beneficiary vs Trustee

The beneficiary is the individual or entity entitled to receive benefits or assets from a trust, while the trustee is responsible for managing and administering those assets according to the trust terms. Trustees hold a fiduciary duty, ensuring they act in the best interests of the beneficiaries and comply with legal and trust requirements. Understanding the distinct roles clarifies the distribution process and the trustee's accountability in safeguarding trust assets.

Definition of a Beneficiary

A beneficiary is an individual or entity entitled to receive benefits or assets from a trust, will, or insurance policy according to the terms set by the grantor or settlor. In contrast, a trustee is responsible for managing and administering the trust assets on behalf of the beneficiaries, ensuring fiduciary duties are met. The beneficiary holds the equitable interest in the trust property, while the trustee holds the legal title.

Definition of a Trustee

A trustee is an individual or entity legally appointed to manage and administer assets held in a trust on behalf of the beneficiaries according to the terms set forth in the trust document. Trustees have a fiduciary duty to act in the best interests of the beneficiaries, ensuring proper management, investment, and distribution of trust assets. Unlike beneficiaries who receive benefits from the trust, trustees hold authority and responsibility to oversee the trust's administration and compliance with legal obligations.

Key Responsibilities of a Trustee

A trustee holds the fiduciary duty to manage and protect trust assets in the best interest of the beneficiaries, ensuring proper administration according to the trust document and applicable laws. Responsibilities include making prudent investment decisions, maintaining accurate records, and providing transparent communication and regular accountings to beneficiaries. Trustees must also act impartially, avoid conflicts of interest, and distribute trust income or principal as specified by the trust terms.

Rights and Benefits of a Beneficiary

A beneficiary holds the legal right to receive benefits and assets from a trust according to its terms, while the trustee manages and administers those assets fiduciarily. Beneficiaries are entitled to timely information about the trust's administration and can enforce their rights through legal action if trustees fail to fulfill their duties. The key benefits for beneficiaries include access to income distributions, principal payments, and protection under trust law ensuring their interests are prioritized.

Legal Differences Between Beneficiary and Trustee

A beneficiary holds the legal right to receive benefits or assets from a trust, whereas a trustee manages the trust's assets according to the terms set forth in the trust agreement, bearing fiduciary duties to act in the best interests of the beneficiaries. Trustees have the legal responsibility to administer the trust, ensure compliance with relevant laws, and make investment or distribution decisions, while beneficiaries have no control over trust management but can enforce the trustee's obligations. The distinct legal roles and duties define the trustee's active management function versus the beneficiary's passive entitlement to the trust's benefits.

Financial Implications for Trustees and Beneficiaries

Trustees bear fiduciary responsibilities that include managing trust assets prudently, which can lead to significant legal and financial liabilities if mismanaged. Beneficiaries primarily benefit from the trust income and principal distributions but may face tax obligations depending on the trust structure and jurisdiction. Understanding these financial implications is critical to ensure compliance and optimize wealth transfer outcomes for both trustees and beneficiaries.

Common Conflicts Between Trustees and Beneficiaries

Conflicts between trustees and beneficiaries often arise from misunderstandings about fiduciary duties, such as trustees failing to provide transparent accounting or improperly managing trust assets. Disputes frequently occur when beneficiaries believe the trustee is misinterpreting the terms of the trust or acting in self-interest, leading to allegations of breach of trust. Resolving these conflicts typically requires careful legal review of trust documents and sometimes court intervention to enforce trustee accountability and protect beneficiary rights.

How to Appoint a Trustee vs Naming a Beneficiary

To appoint a trustee, individuals typically create a trust agreement outlining the trustee's duties, powers, and succession plan, ensuring legal compliance through notarization or court approval when necessary. Naming a beneficiary involves specifying the person or entity entitled to receive assets from a will, trust, or insurance policy, often requiring clear identification within the legal document to avoid disputes. Properly drafting these provisions with precise language helps define control and distribution of assets, securing the trust's intent and protecting beneficiaries' interests.

Frequently Asked Questions: Beneficiary vs Trustee

Beneficiaries are individuals or entities entitled to receive benefits from a trust, while trustees manage and administer the trust assets according to the trust document. Frequently asked questions focus on the roles, responsibilities, and rights, such as how trustees handle fiduciary duties and the extent of beneficiaries' access to trust information. Understanding these distinctions is crucial for proper trust management and ensuring legal compliance.

Beneficiary Infographic

libterm.com

libterm.com