Sequestration is a legal process where an individual's assets or property are temporarily taken into custody to ensure compliance with a court order or to secure a debt repayment. This procedure protects creditors' rights while maintaining the integrity of the debtor's estate during disputes. Explore the rest of the article to understand how sequestration might impact your financial obligations and legal options.

Table of Comparison

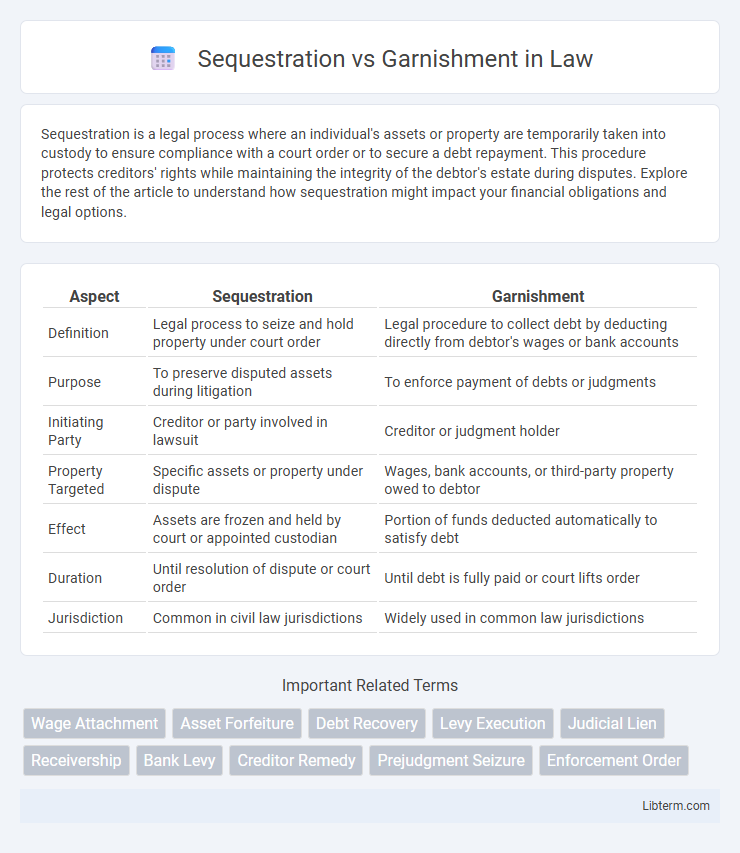

| Aspect | Sequestration | Garnishment |

|---|---|---|

| Definition | Legal process to seize and hold property under court order | Legal procedure to collect debt by deducting directly from debtor's wages or bank accounts |

| Purpose | To preserve disputed assets during litigation | To enforce payment of debts or judgments |

| Initiating Party | Creditor or party involved in lawsuit | Creditor or judgment holder |

| Property Targeted | Specific assets or property under dispute | Wages, bank accounts, or third-party property owed to debtor |

| Effect | Assets are frozen and held by court or appointed custodian | Portion of funds deducted automatically to satisfy debt |

| Duration | Until resolution of dispute or court order | Until debt is fully paid or court lifts order |

| Jurisdiction | Common in civil law jurisdictions | Widely used in common law jurisdictions |

Understanding Sequestration: Definition and Purpose

Sequestration is a legal process wherein a court orders the temporary seizure or isolation of a debtor's assets to preserve them during a dispute or litigation, preventing further dissipation or transfer. Its primary purpose is to protect the creditor's interest by securing the property until a final judgment is made. Unlike garnishment, which involves direct deduction from a debtor's wages or bank accounts, sequestration focuses on asset preservation within a judicial framework.

What is Garnishment? Key Concepts Explained

Garnishment is a legal process where a creditor obtains a court order to withhold a portion of a debtor's wages or bank account funds to satisfy an outstanding debt. Key concepts include the involvement of a third party, such as an employer or bank, who is required to redirect payments directly to the creditor. Wage garnishment limits and exemptions are typically governed by federal and state laws, ensuring a portion of income remains protected for the debtor's basic living expenses.

Legal Framework: Sequestration vs Garnishment

Sequestration involves a court-ordered seizure of a debtor's property to secure a claim, often used in civil litigation under statutory laws such as the Rules of Civil Procedure. Garnishment permits a creditor to collect debts by legally withholding funds directly from a debtor's wages or bank accounts, governed by federal statutes like the Consumer Credit Protection Act and state-specific provisions. Both legal frameworks require strict adherence to due process, ensuring creditors cannot unlawfully seize assets without proper judicial authorization.

How Sequestration Works in Debt Recovery

Sequestration in debt recovery involves legally isolating a debtor's assets to secure payment without immediate transfer of ownership, ensuring the assets are preserved for creditors. Upon court order, a third party, such as a sheriff, takes control of specific property or funds, preventing the debtor from disposing of them until the debt is settled or further legal action occurs. This mechanism contrasts with garnishment, where funds are directly deducted from the debtor's income or bank accounts to satisfy outstanding debts.

The Process of Wage Garnishment

The process of wage garnishment involves a legal order directing an employer to withhold a portion of an employee's earnings to satisfy a debt or court judgment. Employers receive a garnishment notice, calculate the permissible withholding amount based on federal and state laws, and remit the funds directly to the creditor. This procedure continues until the debt is fully paid or the court orders otherwise, ensuring the creditor receives repayment without the debtor losing their employment.

Key Differences Between Sequestration and Garnishment

Sequestration involves court-ordered custody of debtor's assets to preserve property value before judgment, while garnishment directly withholds funds from a debtor's wages or bank accounts after a judgment. Sequestration temporarily freezes assets, preventing their disposal, whereas garnishment actively diverts payments to creditors. The timing and impact on debtor's assets distinguish sequestration as a protective legal measure from garnishment as an enforcement mechanism.

Pros and Cons: Sequestration vs Garnishment

Sequestration offers the advantage of preserving disputed assets while parties resolve conflicts, minimizing premature asset depletion. However, it often requires court approval and can delay access to funds, impacting liquidity. Garnishment provides creditors direct access to a debtor's wages or bank accounts, ensuring timely repayment but may cause financial strain for debtors and involves strict legal procedures to prevent abuse.

Impact on Debtors: Financial and Legal Consequences

Sequestration removes a debtor's assets through court order, freezing property to satisfy debts, which severely restricts financial liquidity and may lead to asset liquidation. Garnishment directly intercepts a portion of the debtor's wages or bank accounts, reducing monthly income and potentially disrupting personal budgeting. Both impose legal constraints, but sequestration often results in longer-term financial instability, while garnishment represents ongoing, periodic deductions impacting daily cash flow.

Sequestration and Garnishment: Frequently Asked Questions

Sequestration is a legal process where a court orders the temporary seizure of property to preserve assets during litigation, while garnishment involves a court-mandated deduction from an individual's wages or bank accounts to satisfy a debt. Frequently asked questions about sequestration include its impact on property rights, the types of assets subject to seizure, and the duration of the sequestration order. Common inquiries about garnishment focus on wage limits, exemptions, the types of debts eligible for garnishment, and the procedural steps creditors must follow.

Choosing the Right Option: Factors to Consider

Choosing between sequestration and garnishment depends on factors such as the urgency of recovering assets, the type of debtor's property involved, and legal jurisdiction requirements. Sequestration is typically preferred when immediate asset control is necessary before judgment, while garnishment suits situations with regular income sources to ensure ongoing debt repayment. Assessing creditor rights, debtor's financial status, and court procedures helps determine the most effective enforcement method.

Sequestration Infographic

libterm.com

libterm.com