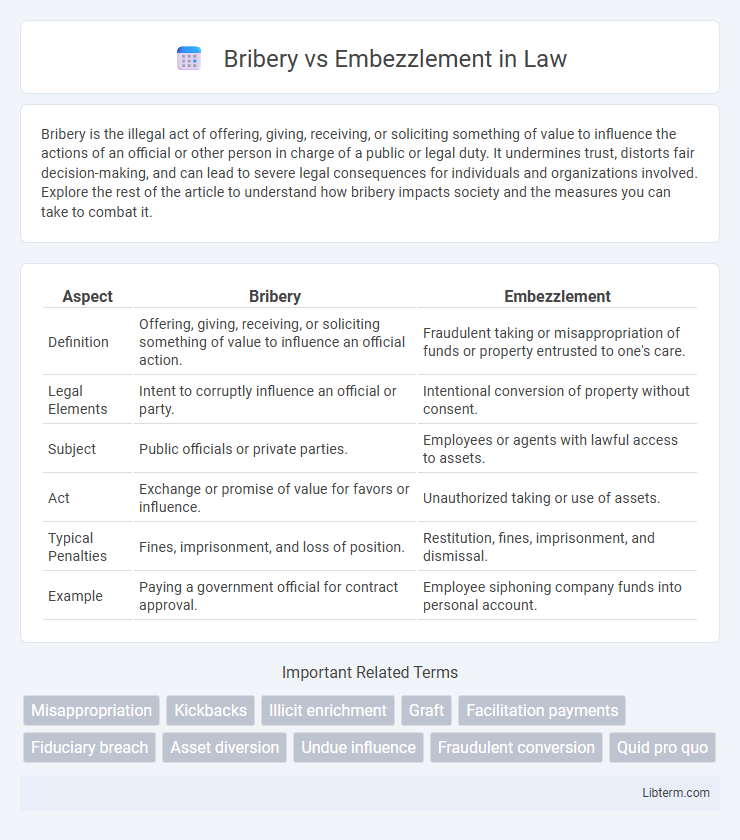

Bribery is the illegal act of offering, giving, receiving, or soliciting something of value to influence the actions of an official or other person in charge of a public or legal duty. It undermines trust, distorts fair decision-making, and can lead to severe legal consequences for individuals and organizations involved. Explore the rest of the article to understand how bribery impacts society and the measures you can take to combat it.

Table of Comparison

| Aspect | Bribery | Embezzlement |

|---|---|---|

| Definition | Offering, giving, receiving, or soliciting something of value to influence an official action. | Fraudulent taking or misappropriation of funds or property entrusted to one's care. |

| Legal Elements | Intent to corruptly influence an official or party. | Intentional conversion of property without consent. |

| Subject | Public officials or private parties. | Employees or agents with lawful access to assets. |

| Act | Exchange or promise of value for favors or influence. | Unauthorized taking or use of assets. |

| Typical Penalties | Fines, imprisonment, and loss of position. | Restitution, fines, imprisonment, and dismissal. |

| Example | Paying a government official for contract approval. | Employee siphoning company funds into personal account. |

Understanding Bribery: Definition and Key Elements

Bribery involves offering, giving, receiving, or soliciting something of value to influence the actions of an official or other person in charge of a public or legal duty. The key elements include the exchange of valuable consideration, intent to corruptly influence, and a quid pro quo arrangement. Recognizing these components helps distinguish bribery from other financial crimes like embezzlement, where funds are misappropriated rather than exchanged for influence.

Embezzlement Explained: Core Concepts and Mechanisms

Embezzlement involves the misappropriation of funds or property entrusted to an individual's care, often occurring within organizational or fiduciary relationships. Key mechanisms include unauthorized diversion of assets, manipulation of financial records, and exploitation of internal controls to conceal theft. Understanding embezzlement requires analysis of legal definitions, detection techniques, and organizational vulnerabilities that facilitate such fraudulent activities.

Legal Distinctions Between Bribery and Embezzlement

Bribery involves offering, giving, receiving, or soliciting something of value to influence the actions of an official or other person in charge of a public or legal duty. Embezzlement refers to the wrongful or illegal misappropriation of funds or property entrusted to an individual's care, typically by an employee or official. Legal distinctions hinge on the nature of the offense: bribery centers on corrupt transactions to gain undue advantage, whereas embezzlement concerns theft or diversion of assets for personal gain.

Common Examples of Bribery in Practice

Common examples of bribery in practice include offering money or gifts to government officials to secure contracts or favors, paying law enforcement officers to overlook violations, and providing kickbacks to procurement officers for preferential treatment in awarding bids. Corporate bribery often involves executives giving incentives to influence regulatory decisions or to gain competitive advantages. These acts undermine fairness, distort market competition, and violate anti-corruption laws.

Typical Scenarios of Embezzlement Cases

Typical scenarios of embezzlement cases often involve employees or trusted individuals misappropriating funds or assets from their employer or organization. Common instances include payroll fraud, where employees inflate hours or salaries, and unauthorized transfers of money to personal accounts. Corporate executives may also embezzle by falsifying financial statements or manipulating expense reports to conceal stolen funds.

Motivations Behind Bribery and Embezzlement

Bribery is primarily motivated by the desire to gain unfair advantages, secure contracts, or influence decisions through illicit payments, often driven by external pressures or opportunities for personal gain. Embezzlement stems from the internal temptation to misuse entrusted funds for personal enrichment, typically fueled by financial need, greed, or a sense of entitlement within an organization. Both crimes undermine trust and integrity but differ in the source of motivation: external manipulation for bribery and internal abuse of power for embezzlement.

The Impact of Bribery and Embezzlement on Organizations

Bribery and embezzlement severely damage organizations by undermining trust, distorting fair competition, and causing significant financial losses, with embezzlement often directly depleting company assets. Bribery leads to skewed decision-making and regulatory non-compliance, resulting in legal penalties and reputational harm. Both crimes erode employee morale and investor confidence, hindering long-term organizational growth and stability.

Laws and Penalties for Bribery vs. Embezzlement

Bribery laws typically classify the act as offering, giving, receiving, or soliciting something of value to influence official actions, with penalties ranging from hefty fines to lengthy prison sentences, often exceeding five years. Embezzlement statutes involve the fraudulent appropriation of funds or property entrusted to an individual, leading to severe punishments including restitution, substantial fines, and imprisonment that may extend beyond a decade depending on the amount misappropriated. Both crimes fall under federal and state jurisdictions, with stricter penalties imposed on public officials and corporations to deter corruption and financial fraud.

Prevention Strategies for Bribery and Embezzlement

Effective prevention strategies for bribery include implementing strict anti-bribery policies, conducting regular employee training on ethical conduct, and establishing transparent reporting mechanisms. Embezzlement prevention focuses on robust internal controls such as segregation of financial duties, periodic audits, and real-time transaction monitoring to detect irregularities early. Both require fostering a culture of integrity and ensuring that whistleblower protections are in place to encourage reporting without fear of retaliation.

Reporting and Investigating Financial Crimes

Reporting financial crimes such as bribery and embezzlement requires detailed documentation of suspicious activities and prompt notification to relevant authorities like the FBI or SEC. Investigations often involve forensic accounting, transactional tracing, and interviews to establish intent and identify perpetrators. Effective collaboration between internal audit teams and law enforcement enhances the detection and prosecution of these white-collar crimes.

Bribery Infographic

libterm.com

libterm.com