Separate property refers to assets owned individually by one spouse before marriage or acquired through inheritance or gifts during the marriage. This type of property remains under the sole control of the owner and is not subject to division upon divorce in most jurisdictions. To understand how separate property affects your financial rights, read the rest of this article.

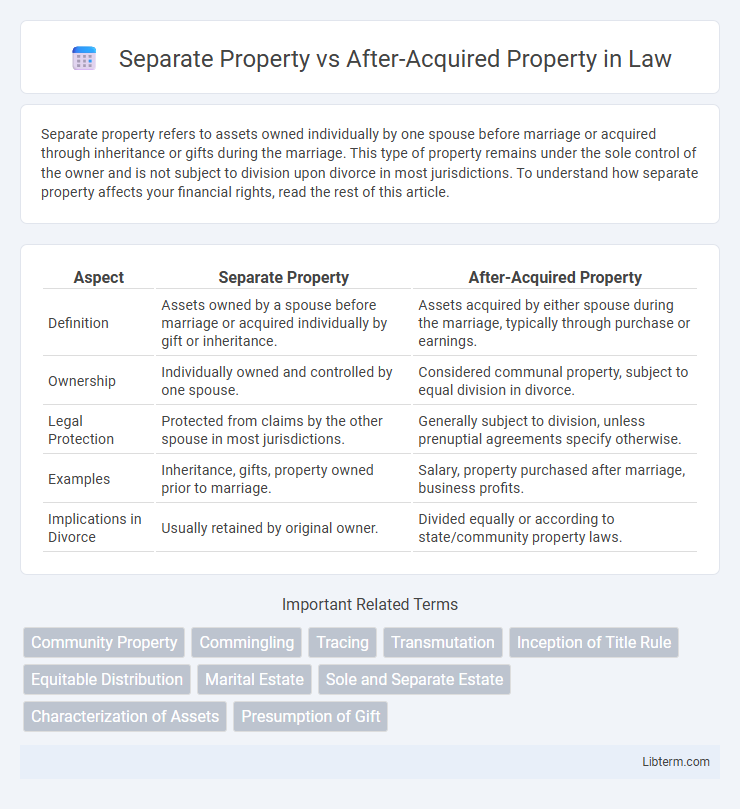

Table of Comparison

| Aspect | Separate Property | After-Acquired Property |

|---|---|---|

| Definition | Assets owned by a spouse before marriage or acquired individually by gift or inheritance. | Assets acquired by either spouse during the marriage, typically through purchase or earnings. |

| Ownership | Individually owned and controlled by one spouse. | Considered communal property, subject to equal division in divorce. |

| Legal Protection | Protected from claims by the other spouse in most jurisdictions. | Generally subject to division, unless prenuptial agreements specify otherwise. |

| Examples | Inheritance, gifts, property owned prior to marriage. | Salary, property purchased after marriage, business profits. |

| Implications in Divorce | Usually retained by original owner. | Divided equally or according to state/community property laws. |

Understanding Separate Property: Key Definitions

Separate property refers to assets owned individually by one spouse before marriage or acquired through inheritance or gifts during marriage, maintaining distinct ownership rights. After-acquired property involves assets obtained after marriage, which may be subject to marital property rules depending on jurisdiction and the method of acquisition. Recognizing these distinctions is essential for equitable division of property during divorce or estate planning.

What Constitutes After-Acquired Property?

After-acquired property refers to assets obtained by an individual during the course of a marriage or legal relationship but are not initially owned at the outset of the union. This property typically includes income, gifts, or inheritances received after marriage, which may or may not be subject to division depending on jurisdictional laws and prenuptial agreements. Understanding the distinction between separate property, owned before marriage, and after-acquired property is crucial for equitable distribution in divorce or estate settlements.

Legal Distinctions: Separate vs After-Acquired Property

Separate property refers to assets owned solely by one spouse before marriage or received individually through gift or inheritance, remaining distinct during the marriage. After-acquired property encompasses assets obtained during the marriage, often subject to division upon divorce, unless protected by a valid prenuptial agreement or specific state laws. Legal distinctions hinge on timing, method of acquisition, and applicable jurisdictional statutes that determine property classification and division rights.

Common Examples of Separate Property

Common examples of separate property include assets owned before marriage, inheritances received by one spouse during the marriage, and gifts explicitly given to one spouse. Separate property remains exclusive to the individual spouse and is not subject to division upon divorce. Understanding these distinctions is crucial for asset protection and equitable distribution in divorce proceedings.

Acquisition and Classification of After-Acquired Property

After-acquired property refers to assets obtained by an individual during the marriage but considered separate because they originated from separate property or were acquired by gift, inheritance, or specific agreements. The acquisition of after-acquired property is crucial in distinguishing its classification, often requiring clear documentation or tracing to prove the separate origin of the property. Courts typically examine the source and timing of acquisition to determine whether after-acquired property maintains its status as separate or becomes marital property subject to division.

Impact of Marriage on Property Status

Marriage can alter the classification of property, especially when separate property is commingled with after-acquired property. Separate property includes assets owned before marriage, whereas after-acquired property refers to assets obtained during the marriage. The impact of marriage often causes the transformation of separate property into marital property through commingling or transmutation, affecting ownership rights and division upon divorce.

Legal Rights in Divorce: Separate and After-Acquired Assets

Separate property consists of assets owned by one spouse before marriage or acquired through inheritance and gifts, remaining legally protected from division during divorce. After-acquired property refers to assets obtained during the marriage but specifically excluded from community property based on jurisdictional laws or prenuptial agreements. Understanding these legal distinctions is crucial for equitable asset distribution and protecting individual rights in divorce proceedings.

Protecting Separate Property in Marriage

Protecting separate property in marriage requires clear documentation and proper legal measures to distinguish assets acquired before marriage from those obtained during the marriage. Separate property typically includes assets like inheritance, gifts, or property owned prior to marriage, which must be maintained separately to avoid commingling with marital property. Prenuptial agreements and careful financial record-keeping are essential strategies to safeguard separate property rights in jurisdictions recognizing equitable distribution or community property laws.

State Laws Affecting Property Classification

State laws significantly influence the classification of separate property versus after-acquired property during divorce proceedings, with variations in definitions and treatment across jurisdictions. Separate property typically includes assets owned before marriage or acquired by gift or inheritance, while after-acquired property involves assets obtained during marriage but post-separation or through specific transactions. Community property states like California often maintain strict distinctions, whereas equitable distribution states apply nuanced rules, affecting rights to property division and requiring detailed legal analysis per local statutes.

Strategies for Managing After-Acquired Property

Effective strategies for managing after-acquired property involve clear documentation to distinguish it from separate property, ensuring proper record-keeping of acquisition dates and sources. Establishing post-marital agreements or amendments can protect individual interests by specifying how after-acquired assets are treated in community or separate property regimes. Regular legal consultations help align property management with evolving state laws and personal financial goals, minimizing conflicts during divorce or estate planning.

Separate Property Infographic

libterm.com

libterm.com