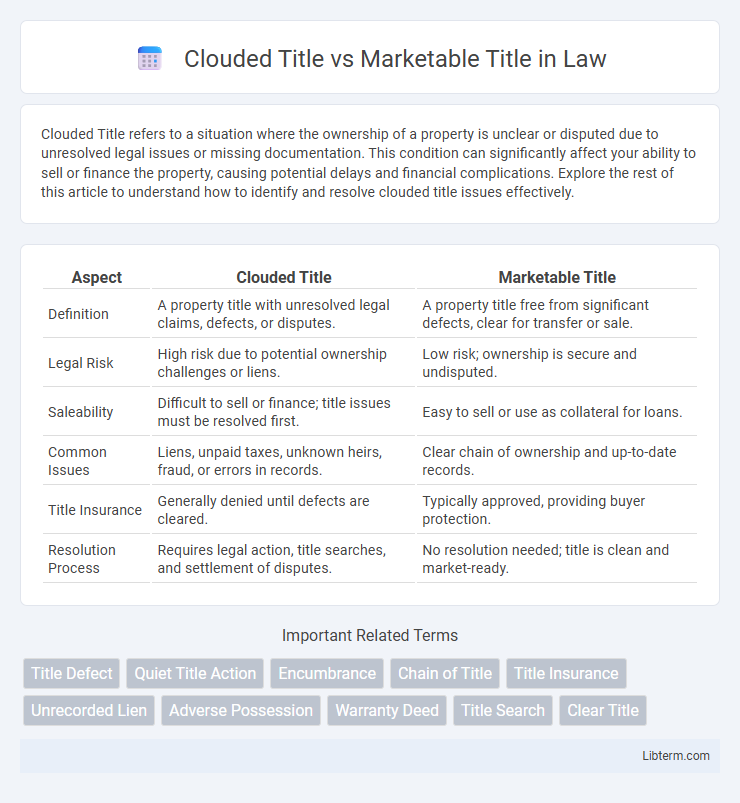

Clouded Title refers to a situation where the ownership of a property is unclear or disputed due to unresolved legal issues or missing documentation. This condition can significantly affect your ability to sell or finance the property, causing potential delays and financial complications. Explore the rest of this article to understand how to identify and resolve clouded title issues effectively.

Table of Comparison

| Aspect | Clouded Title | Marketable Title |

|---|---|---|

| Definition | A property title with unresolved legal claims, defects, or disputes. | A property title free from significant defects, clear for transfer or sale. |

| Legal Risk | High risk due to potential ownership challenges or liens. | Low risk; ownership is secure and undisputed. |

| Saleability | Difficult to sell or finance; title issues must be resolved first. | Easy to sell or use as collateral for loans. |

| Common Issues | Liens, unpaid taxes, unknown heirs, fraud, or errors in records. | Clear chain of ownership and up-to-date records. |

| Title Insurance | Generally denied until defects are cleared. | Typically approved, providing buyer protection. |

| Resolution Process | Requires legal action, title searches, and settlement of disputes. | No resolution needed; title is clean and market-ready. |

Understanding Clouded Title: Definition and Key Features

A clouded title refers to ownership documentation that contains unresolved claims, liens, or legal defects that can hinder the transfer or sale of property. Key features include existing disputes over ownership, unpaid mortgages, or errors in public records that cast doubt on the seller's ability to convey a clear title. Identifying and resolving these issues is essential for establishing a marketable title that guarantees unchallenged ownership rights.

What Is a Marketable Title? Essential Characteristics

A marketable title is a property title free from significant defects or disputes that could affect ownership, making it readily acceptable to a buyer or lender. Essential characteristics include clear ownership, no unresolved liens or encumbrances, and the absence of legal claims that might challenge the title's validity. Ensuring a marketable title protects both buyers and lenders by providing confidence in the legal transfer of property rights.

Causes of Clouded Title in Real Estate Transactions

A clouded title in real estate transactions occurs when there are legal claims, liens, or disputes that affect the ownership of the property, such as unpaid taxes, unresolved wills, or conflicting deeds. These issues prevent the title from being marketable, meaning it cannot be freely sold or transferred without resolving the defects. Marketable title requires a clear chain of ownership free from encumbrances, ensuring the buyer receives uncontested property rights.

The Importance of Marketable Title in Property Sales

A marketable title is crucial in property sales because it guarantees the buyer clear ownership free from significant liens, disputes, or legal questions, ensuring smooth transfer of ownership. Clouded titles, burdened by unresolved claims, defects, or encumbrances, can delay transactions and reduce property value due to potential legal challenges. Securing a marketable title protects both parties by providing confidence in the legitimacy of the sale and facilitating financing and future resale.

Clouded Title vs Marketable Title: Main Differences

Clouded title refers to a property title with unresolved claims, liens, or defects that can hinder ownership transfer, while marketable title is free from significant encumbrances and legally clear for sale. The main difference lies in title clarity; a clouded title presents potential risks in conveyance, whereas a marketable title assures buyers and lenders of undisputed ownership. Resolving issues like unpaid taxes or legal disputes is crucial to convert a clouded title into a marketable title.

Legal Implications of Clouded Title

A clouded title indicates unresolved legal issues or claims that can restrict the owner's ability to transfer clear ownership, potentially leading to costly disputes or litigation. This legal ambiguity undermines buyer confidence and may prevent property sales or refinancing until all liens, encumbrances, or ownership conflicts are resolved. Marketable title, in contrast, guarantees a property free from significant defects or claims, ensuring smooth transfer of ownership and protecting parties from legal challenges.

How to Identify a Marketable Title

A marketable title is identified by its clear ownership history free from liens, disputes, or legal encumbrances that could affect transferability. Verification through a thorough title search that reveals no defects or unresolved claims is essential in confirming marketability. Title insurance further safeguards against hidden risks, ensuring the title's acceptability in real estate transactions.

Common Issues Leading to Title Defects

Common issues leading to clouded titles include unresolved liens, unpaid taxes, judgments, and conflicting ownership claims, all of which obscure clear ownership rights. Marketable titles require the absence of such defects to ensure the property can be readily sold or mortgaged, providing buyers and lenders with confidence. Title searches and title insurance are critical tools used to identify and resolve these defects, ensuring transferability and marketability of the property title.

Steps to Resolve a Clouded Title

Resolving a clouded title involves conducting a thorough title search to identify all liens, claims, or encumbrances affecting the property's ownership. Filing a quiet title action in court can legally clear disputes by confirming rightful ownership and removing defects. Obtaining title insurance after resolution safeguards against future claims, ensuring a marketable title for the property.

Protecting Buyers and Sellers: Title Insurance and Due Diligence

Clouded titles contain defects or unresolved claims that hinder clear ownership transfer, posing risks to buyers and sellers. Marketable titles are free of liens, disputes, or encumbrances, ensuring smooth property transactions and legal ownership verification. Title insurance and thorough due diligence protect parties by covering financial losses from title defects and confirming clear property titles before sale completion.

Clouded Title Infographic

libterm.com

libterm.com