Levy refers to the legal imposition of a tax, fee, or fine by a government authority on individuals or businesses. Understanding how levies work is crucial for managing your financial obligations and avoiding penalties. Explore the rest of this article to learn more about different types of levies and how they impact you.

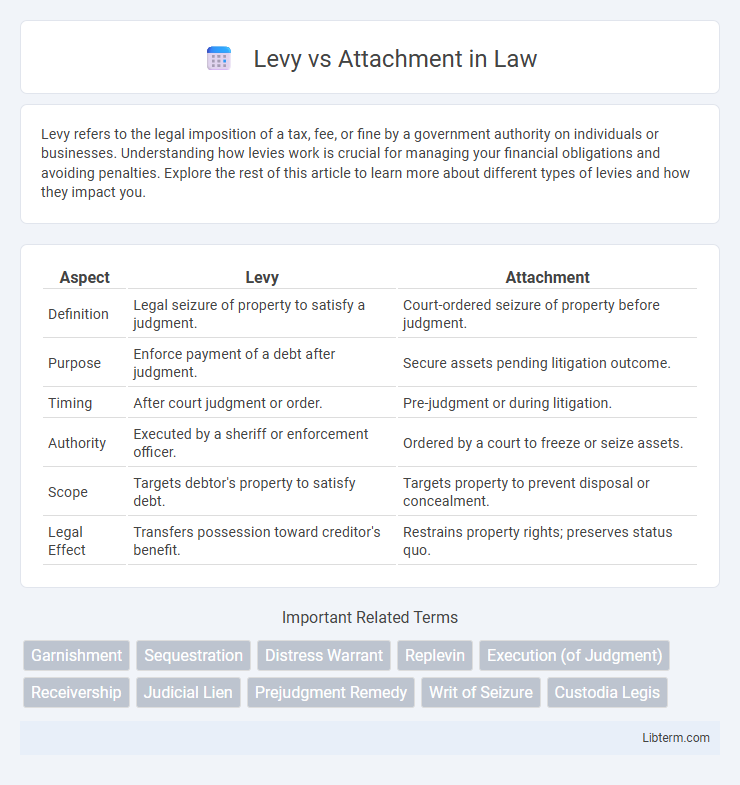

Table of Comparison

| Aspect | Levy | Attachment |

|---|---|---|

| Definition | Legal seizure of property to satisfy a judgment. | Court-ordered seizure of property before judgment. |

| Purpose | Enforce payment of a debt after judgment. | Secure assets pending litigation outcome. |

| Timing | After court judgment or order. | Pre-judgment or during litigation. |

| Authority | Executed by a sheriff or enforcement officer. | Ordered by a court to freeze or seize assets. |

| Scope | Targets debtor's property to satisfy debt. | Targets property to prevent disposal or concealment. |

| Legal Effect | Transfers possession toward creditor's benefit. | Restrains property rights; preserves status quo. |

Understanding the Concepts: Levy vs Attachment

Levy refers to the legal process by which a creditor seizes a debtor's property or assets to satisfy a judgment, typically following a court order. Attachment involves the pre-judgment seizure or freezing of property to secure a potential future judgment, preventing the debtor from disposing of assets during litigation. Understanding these distinctions is crucial for navigating debt recovery and asset protection strategies within the legal framework.

Legal Definitions of Levy and Attachment

Levy refers to the legal process of seizing a debtor's property to satisfy a court judgment, typically executed through a writ of execution allowing officials to take assets such as bank accounts or personal property. Attachment is a pre-judgment remedy involving the court-ordered seizure or freezing of a defendant's property to secure the potential enforcement of a future judgment, preventing the transfer or concealment of assets. Both levy and attachment serve as enforcement mechanisms but differ primarily in timing, with attachment occurring before judgment and levy occurring after a judgment has been obtained.

Key Differences Between Levy and Attachment

A levy refers to the legal seizure of property or assets by a government authority to satisfy a tax debt, directly transferring ownership or control, while an attachment is a court-ordered seizure that restricts the property's use or sale pending the outcome of litigation. Levy typically occurs after a final tax judgment, enabling immediate collection, whereas attachment is a pre-judgment remedy ensuring assets remain available for satisfying potential judgments. The fundamental difference lies in levy being an enforcement action for debt collection, contrasted with attachment serving as a provisional measure to preserve assets during legal disputes.

Procedures Involved in Levy

Levy procedures involve a legal process where a creditor seizes a debtor's property to satisfy a judgment under court authority. The process typically begins with the issuance of a writ of levy, followed by the identification and valuation of assets subject to seizure, including bank accounts, wages, or personal property. Enforcement officers then conduct the actual seizure or garnishment, with strict compliance to legal requirements to protect debtor rights and prevent unlawful takeovers.

Steps for Obtaining an Attachment

Obtaining an attachment requires filing a verified petition or affidavit demonstrating a valid claim against the debtor's property, followed by securing a court order granting the writ of attachment. The petitioner must provide a bond to indemnify the debtor against wrongful attachment and identify the specific properties to be attached. The writ is then served by the sheriff or authorized officer who levies on the property, ensuring legal control over the assets until resolution of the underlying claim.

Impact on Debtors and Creditors

Levy directly seizes a debtor's property or funds to satisfy a creditor's claim, often resulting in immediate asset loss and financial strain for the debtor. Attachment temporarily restricts the debtor's control over property, preserving assets for potential judgment but not yet transferring ownership, which offers creditors a legal safeguard while delaying liquidation. This distinction impacts creditors by affecting the speed and certainty of recovery, while debtors face varying levels of financial disruption and asset control loss during enforcement.

Jurisdictional Variations: Levy vs Attachment

Jurisdictional variations significantly impact the procedures and scope of levy and attachment, with different states or countries establishing distinct rules on timing, property types subject to enforcement, and notification requirements. Levy generally permits direct seizure of assets post-judgment within specified legal frameworks, whereas attachment often functions as a pre-judgment measure to secure assets pending litigation. Understanding local statutes and court rulings is crucial for correctly applying levy or attachment to ensure compliance with jurisdiction-specific enforcement protocols.

Common Uses in Debt Collection

Levy and attachment are critical legal mechanisms in debt collection, with levy involving the actual seizure of a debtor's property to satisfy a judgment, while attachment places a lien or hold on assets to prevent their disposal before a court ruling. Commonly, levies target bank accounts, wages, or physical assets, enabling creditors to directly collect owed amounts. Attachments are frequently used to secure real estate or intangible assets, ensuring they remain available during litigation and enhancing the creditor's chance of recovering debts once the case concludes.

Advantages and Limitations of Each Method

Levy offers direct access to funds by seizing assets or wages, providing immediate enforcement but is limited by exemptions and may disrupt debtor operations. Attachment secures creditor interests pre-judgment by placing a legal claim on property, ensuring asset preservation, though it requires court approval and may delay liquidation. Both methods vary in effectiveness depending on jurisdictional rules, asset types, and urgency of debt recovery.

Choosing Between Levy and Attachment

Choosing between a levy and attachment depends largely on the nature of the debtor's assets and the creditor's legal objectives. A levy allows direct seizure of the debtor's property by the authorities to satisfy a judgment, making it effective for recovering tangible assets or funds from bank accounts. Attachment, often used pre-judgment, freezes or seizes assets to secure claims, providing creditors with a strategic advantage when anticipating recovery but lacking immediate access to the debtor's resources.

Levy Infographic

libterm.com

libterm.com