An executor is a person appointed to manage and distribute a deceased individual's estate according to their will. Understanding the responsibilities and legal obligations involved can help ensure your loved one's wishes are honored smoothly and efficiently. Explore the rest of this article to learn how to choose the right executor and navigate the probate process effectively.

Table of Comparison

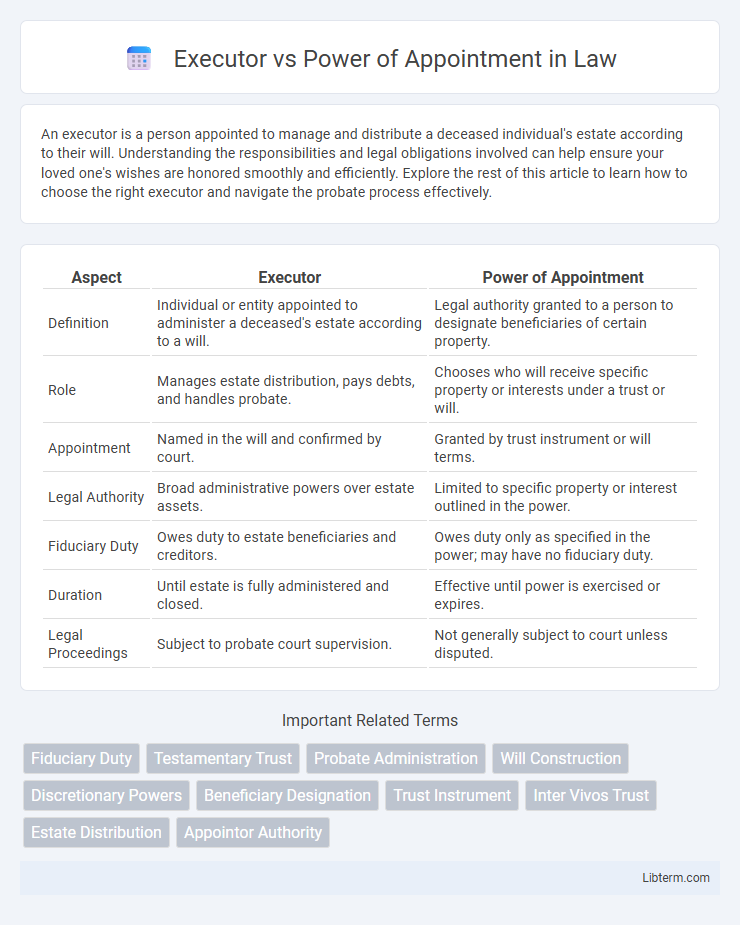

| Aspect | Executor | Power of Appointment |

|---|---|---|

| Definition | Individual or entity appointed to administer a deceased's estate according to a will. | Legal authority granted to a person to designate beneficiaries of certain property. |

| Role | Manages estate distribution, pays debts, and handles probate. | Chooses who will receive specific property or interests under a trust or will. |

| Appointment | Named in the will and confirmed by court. | Granted by trust instrument or will terms. |

| Legal Authority | Broad administrative powers over estate assets. | Limited to specific property or interest outlined in the power. |

| Fiduciary Duty | Owes duty to estate beneficiaries and creditors. | Owes duty only as specified in the power; may have no fiduciary duty. |

| Duration | Until estate is fully administered and closed. | Effective until power is exercised or expires. |

| Legal Proceedings | Subject to probate court supervision. | Not generally subject to court unless disputed. |

Introduction to Executors and Powers of Appointment

Executors are individuals appointed in a will to administer the estate, ensuring debts are paid and assets are distributed according to the deceased's wishes. Powers of appointment grant a designated person the legal authority to allocate property or benefits to chosen beneficiaries within specified limits. Understanding these roles clarifies estate planning mechanisms and the control over asset distribution after death.

Defining the Role of an Executor

An executor is a legally appointed individual responsible for administering a deceased person's estate according to their will, ensuring assets are collected, debts are paid, and the remaining property is distributed to beneficiaries. The executor's duties include filing necessary legal documents, managing estate taxes, and resolving any disputes that arise during probate. This role carries fiduciary responsibility, requiring the executor to act in the best interest of the estate and its beneficiaries.

Understanding Power of Appointment

A Power of Appointment grants an individual the legal authority to designate who will receive certain property or interests from a trust or estate, differing from an Executor who manages the overall administration of an estate. This power can be limited or general, allowing the appointee to distribute assets according to specific terms or at their discretion. Understanding the nuances of a Power of Appointment is crucial for estate planning, as it impacts control over asset distribution and can affect tax consequences and beneficiary rights.

Key Differences Between Executors and Power Holders

Executors manage the distribution of a deceased person's estate according to their will, ensuring debts and taxes are paid while transferring assets to beneficiaries. Power holders under a power of appointment have the authority to decide how certain property or assets are distributed, often within the terms set by the original grantor. Unlike executors who act after death based on court recognition, power holders operate during or after the grantor's life depending on the power's scope and limitations.

Legal Responsibilities of an Executor

The legal responsibilities of an executor include managing and distributing the deceased's estate according to the will and state laws, paying debts and taxes, and safeguarding estate assets during probate. Unlike a power of appointment holder, who selectively designates beneficiaries within specified limits, the executor is legally accountable for executing the entire estate administration process. Proper execution requires fiduciary duty, transparency, and adherence to probate court procedures to avoid legal disputes.

Types of Powers of Appointment

Types of powers of appointment include general powers, which allow the holder to appoint property to themselves, their estate, or creditors, and special (limited) powers, which restrict the appointment to a defined class of beneficiaries excluding the holder or their estate. Executors are responsible for administering a deceased person's estate according to the will and applicable laws, while powers of appointment grant authority over property disposition without transferring executor duties. Understanding the distinctions between general and special powers of appointment is crucial for estate planning and ensuring assets are distributed as intended.

Selecting the Right Person: Executor vs Power Holder

Selecting the right person as an executor or power holder involves evaluating their trustworthiness, organizational skills, and understanding of legal responsibilities. Executors manage estate administration, paying debts and distributing assets per the will, while power holders exercise authority to appoint or redirect assets under a power of appointment. Choosing individuals with financial acumen and impartial judgment ensures efficient estate management and compliance with the decedent's intentions.

Common Scenarios for Each Role

Executors manage the distribution of a deceased person's estate according to a will, handling tasks such as paying debts, filing taxes, and transferring assets to beneficiaries. Powers of appointment allow an individual to designate who will receive certain property or interests, commonly seen in trusts or wills where flexibility is needed for asset distribution. Common scenarios for executors include probating wills and settling estates, while powers of appointment frequently appear in estate planning strategies to adapt to changing family dynamics or unforeseen circumstances.

Potential Conflicts and How to Avoid Them

Potential conflicts between an executor and a power of appointment holder often arise from overlapping responsibilities and differing intentions about asset distribution. Clear delineation of roles in estate planning documents and frequent communication among parties can prevent disputes and ensure smooth administration. Engaging experienced legal professionals to draft and review documents minimizes ambiguity and reduces the risk of litigation.

Conclusion: Making Informed Estate Planning Decisions

Choosing between an executor and a power of appointment depends on the specific goals of estate planning and desired control over asset distribution. Executors are responsible for administering the estate according to the will and court regulations, ensuring legal compliance and debt settlement. Powers of appointment grant appointed individuals flexibility to manage or direct property interests, offering dynamic control while requiring clear legal understanding to avoid conflicts or unintended tax consequences.

Executor Infographic

libterm.com

libterm.com