Flat fee pricing offers a straightforward way to pay for services with a fixed amount, eliminating surprises in your bill. This transparent approach helps you budget effectively and understand exactly what you're getting without hidden costs. Discover how a flat fee can simplify your financial planning by reading the rest of the article.

Table of Comparison

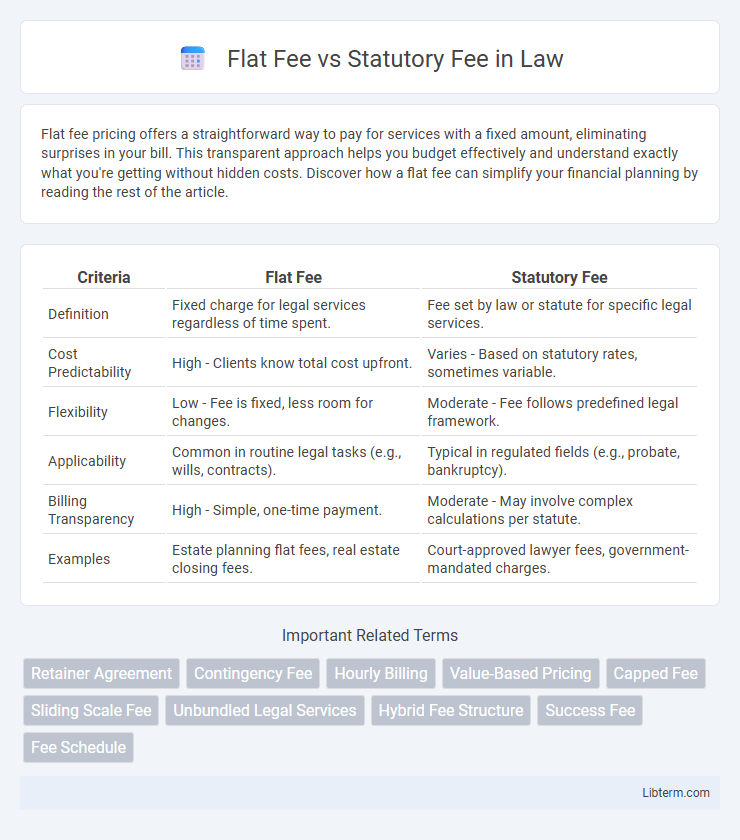

| Criteria | Flat Fee | Statutory Fee |

|---|---|---|

| Definition | Fixed charge for legal services regardless of time spent. | Fee set by law or statute for specific legal services. |

| Cost Predictability | High - Clients know total cost upfront. | Varies - Based on statutory rates, sometimes variable. |

| Flexibility | Low - Fee is fixed, less room for changes. | Moderate - Fee follows predefined legal framework. |

| Applicability | Common in routine legal tasks (e.g., wills, contracts). | Typical in regulated fields (e.g., probate, bankruptcy). |

| Billing Transparency | High - Simple, one-time payment. | Moderate - May involve complex calculations per statute. |

| Examples | Estate planning flat fees, real estate closing fees. | Court-approved lawyer fees, government-mandated charges. |

Introduction to Flat Fee and Statutory Fee Structures

Flat fee structures involve a fixed price agreed upon upfront for specific legal or professional services, providing predictable costs regardless of time spent or outcomes. Statutory fee structures are determined by law or regulation, often with set percentages or minimums for services such as probate or bankruptcy, ensuring standardized charges across similar cases. Understanding the differences between these fee models helps clients make informed decisions based on transparency, predictability, and regulatory compliance.

Defining Flat Fees: What Are They?

Flat fees are predetermined, fixed charges agreed upon for specific legal services, regardless of the time or resources expended. They provide clients with predictable costs, contrasting with hourly billing models that fluctuate based on the attorney's time commitment. This pricing structure is common in routine legal matters such as drafting wills, uncontested divorces, or simple real estate transactions.

Understanding Statutory Fees: Key Features

Statutory fees are predetermined charges set by law or regulatory authorities, ensuring transparency and consistency in billing for legal or administrative services. These fees often reflect standardized costs for specific tasks or filings, making them predictable for clients and professionals alike. Understanding statutory fees helps individuals and businesses budget accurately and avoid unexpected expenses in legal or governmental processes.

Common Industries Using Flat Fee Models

Common industries using flat fee models include real estate, legal services, and digital marketing, where predictable costs simplify budgeting for clients. Real estate agents often charge flat fees for listing services, enabling sellers to avoid variable commission rates. In legal services, flat fees cover standardized processes like wills or uncontested divorces, providing transparent pricing compared to statutory fee schedules.

Sectors Where Statutory Fees Apply

Statutory fees apply in regulated sectors such as legal services, real estate transactions, and government permits, where fees are mandated by law to ensure transparency and fairness. These fees are fixed by statutes or regulatory bodies, minimizing negotiation and variability in costs. Industries like healthcare licensing and intellectual property filings also rely heavily on statutory fee structures to standardize service charges.

Advantages of Flat Fee Arrangements

Flat fee arrangements offer cost certainty and budget control, as clients pay a predetermined amount regardless of time spent, reducing financial unpredictability common in statutory fee models. These agreements promote efficiency by incentivizing service providers to manage tasks swiftly without compromising quality, aligning interests with client outcomes. Clients benefit from simplified billing and transparent expenses, enhancing trust and facilitating easier financial planning compared to variable statutory fees based on hourly rates or percentage calculations.

Benefits and Challenges of Statutory Fees

Statutory fees offer the benefit of transparency and predictability by being regulated and standardized across jurisdictions, which reduces disputes and ensures compliance with legal frameworks. However, challenges include potential inflexibility, as fixed statutory amounts may not reflect the complexity or scope of a service, potentially leading to undercompensation or overcharges. This rigidity can limit customization and responsiveness to client-specific needs compared to flat fee arrangements.

Cost Comparison: Flat Fee vs Statutory Fee

Flat fee pricing offers a fixed, predictable cost regardless of the complexity or duration of a service, making budgeting straightforward for clients. Statutory fees are set by law or regulation and vary based on specific criteria such as transaction value or service type, which can result in higher or fluctuating expenses. Comparing costs, flat fees provide transparency and potential savings when services are routine, while statutory fees may be more cost-effective for low-value or less complex transactions due to their regulated structure.

Choosing the Right Fee Structure for Your Needs

Choosing between a flat fee and a statutory fee depends on the scope and complexity of your project or legal matter. Flat fees provide predictability and often cost savings for well-defined services, while statutory fees are fixed by law and common in regulatory or government-related transactions. Evaluate your budget, service requirements, and potential for additional costs to determine the most suitable fee structure for your specific needs.

Future Trends in Fee Structures

Future trends in fee structures indicate a growing preference for flat fee arrangements due to their transparency and predictability, appealing to clients seeking cost certainty. Statutory fees remain relevant in regulated industries but face pressure as technology and automation drive efficiencies, potentially reducing the justification for rigid fee schedules. Hybrid models combining flat fees with performance-based incentives are emerging, aligning service provider compensation with client outcomes and fostering more flexible, value-driven billing practices.

Flat Fee Infographic

libterm.com

libterm.com