Public auctions offer a transparent and competitive way to purchase goods, properties, or assets by placing bids openly to the highest offer. They often attract a diverse range of buyers, ensuring fair market value and quick transactions. Discover how you can maximize your opportunities and succeed in the bidding process by reading the rest of this article.

Table of Comparison

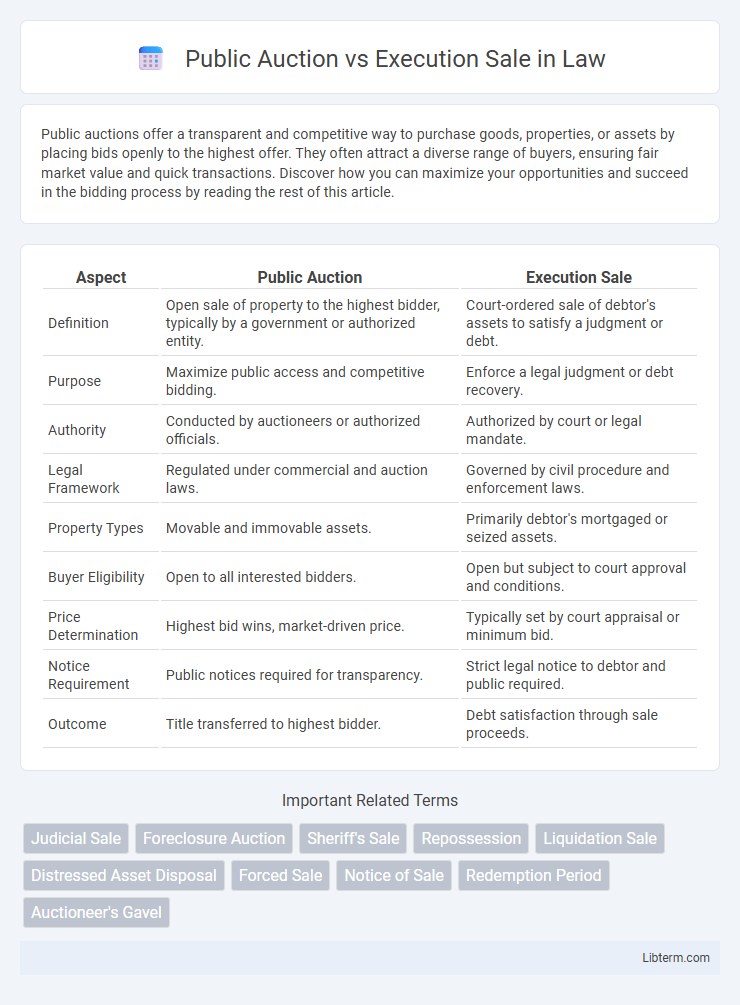

| Aspect | Public Auction | Execution Sale |

|---|---|---|

| Definition | Open sale of property to the highest bidder, typically by a government or authorized entity. | Court-ordered sale of debtor's assets to satisfy a judgment or debt. |

| Purpose | Maximize public access and competitive bidding. | Enforce a legal judgment or debt recovery. |

| Authority | Conducted by auctioneers or authorized officials. | Authorized by court or legal mandate. |

| Legal Framework | Regulated under commercial and auction laws. | Governed by civil procedure and enforcement laws. |

| Property Types | Movable and immovable assets. | Primarily debtor's mortgaged or seized assets. |

| Buyer Eligibility | Open to all interested bidders. | Open but subject to court approval and conditions. |

| Price Determination | Highest bid wins, market-driven price. | Typically set by court appraisal or minimum bid. |

| Notice Requirement | Public notices required for transparency. | Strict legal notice to debtor and public required. |

| Outcome | Title transferred to highest bidder. | Debt satisfaction through sale proceeds. |

Introduction to Public Auction and Execution Sale

Public Auction is a competitive bidding process where assets, including real estate or personal property, are sold to the highest bidder in an open marketplace, often conducted by an auctioneer. Execution Sale refers to the court-ordered sale of a debtor's property to satisfy a judgment debt, typically involving legal procedures and oversight to ensure proper transfer of ownership. Both processes are designed to facilitate asset liquidation but serve distinct legal and financial purposes.

Defining Public Auction: Key Features

Public auction is a transparent bidding process where assets or properties are sold to the highest bidder in an open forum, often used to ensure fair market value through competitive offers. Key features include public notice, open participation from any interested buyers, and immediate sale upon the conclusion of bidding, typically without reserve price constraints. Unlike execution sales, public auctions prioritize voluntary participation and market-driven pricing rather than court-mandated asset liquidation.

Understanding Execution Sale: Core Concepts

Execution sale is a legal process where a debtor's assets are sold to satisfy a court judgment or enforce a debt repayment. This sale is typically conducted by a sheriff or authorized officer following a court order, distinguishing it from a public auction organized voluntarily by the owner. Understanding execution sale involves recognizing its role in debt recovery, the mandatory legal framework guiding the sale, and the priority of claims satisfied through the proceeds.

Legal Framework Governing Both Sales

Public auctions and execution sales are governed by distinct legal frameworks that regulate their processes and ensure fair transactions. Public auctions typically follow laws set by municipal or state authorities, emphasizing transparency, bidding procedures, and the rights of sellers and bidders. Execution sales are regulated by judicial or court orders, involving specific statutes that oversee the seizure and sale of assets to satisfy court judgments or debt claims.

Purposes and Objectives of Each Sale Type

Public auctions are designed primarily to facilitate transparent market-driven sales, allowing property or assets to be sold to the highest bidder in an open forum, thereby maximizing value for the seller. Execution sales focus on enforcing court judgments by liquidating debtor assets to satisfy outstanding debts, aiming to fulfill legal obligations rather than achieving market price optimization. Both sale types serve different legal and financial purposes, with public auctions emphasizing voluntary transactions and execution sales centered on compulsory debt recovery.

Key Differences Between Public Auction and Execution Sale

Public auctions involve the voluntary sale of assets to the highest bidder, typically organized by owners or authorized agents to maximize market value. Execution sales are court-ordered auctions conducted to satisfy a creditor's lien or judgment, where the primary goal is debt recovery rather than market price optimization. Key differences include the nature of authorization, purpose of sale, and the legal framework governing the transaction.

Procedures and Processes Involved

Public auction involves an open bidding process where goods or properties are sold to the highest bidder, often conducted by an auctioneer following a scheduled announcement and detailed advertisement. Execution sale is a court-ordered process that typically arises from a judgment debtor's failure to satisfy a debt, involving the seizure and sale of assets by a legal authority to satisfy the creditor's claim. The procedures for execution sales include legal notices, asset valuation, and supervised sales under judicial oversight, while public auctions emphasize competitive bidding and transparency to maximize sale value.

Rights and Obligations of Buyers and Sellers

In a public auction, buyers acquire property rights immediately upon the auctioneer's confirmation of the highest bid, obligating them to fulfill payment terms promptly, while sellers are required to transfer clear title and disclose any encumbrances. In contrast, an execution sale often involves court oversight where buyers assume rights only after judicial confirmation, and sellers are bound to comply with court orders regarding asset liquidation and debt satisfaction. Both processes impose strict liabilities on buyers to settle payments and on sellers to provide transparent documentation, ensuring legal transfer of ownership and protection of creditor interests.

Common Challenges and Pitfalls

Public auctions and execution sales often face challenges such as limited bidder participation and inadequate marketing, resulting in undervalued asset sales. Both processes can encounter legal complications due to improper documentation or failure to comply with statutory requirements, leading to delays or cancellations. Common pitfalls include inaccurate property valuations and insufficient transparency, which undermine buyer confidence and reduce overall sale efficiency.

Conclusion: Choosing Between Public Auction and Execution Sale

Selecting between a public auction and an execution sale hinges on the urgency of the sale and the desired price outcome. Public auctions often yield higher sale prices due to competitive bidding, making them ideal for sellers prioritizing optimal returns. Execution sales prioritize speed and legal enforcement, appealing to creditors aiming for quick debt recovery through court-mandated asset liquidation.

Public Auction Infographic

libterm.com

libterm.com