A sole proprietorship is the simplest business structure where one individual owns and operates the entire enterprise, bearing full responsibility for debts and liabilities. This business form offers complete control and straightforward tax advantages but comes with unlimited personal liability risk. Explore the rest of the article to understand how a sole proprietorship can impact your entrepreneurial journey.

Table of Comparison

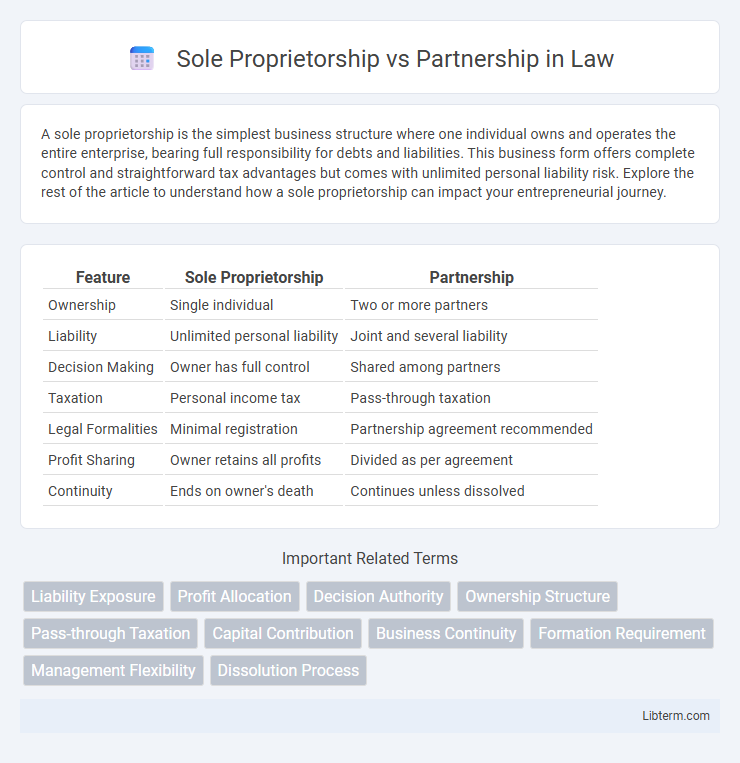

| Feature | Sole Proprietorship | Partnership |

|---|---|---|

| Ownership | Single individual | Two or more partners |

| Liability | Unlimited personal liability | Joint and several liability |

| Decision Making | Owner has full control | Shared among partners |

| Taxation | Personal income tax | Pass-through taxation |

| Legal Formalities | Minimal registration | Partnership agreement recommended |

| Profit Sharing | Owner retains all profits | Divided as per agreement |

| Continuity | Ends on owner's death | Continues unless dissolved |

Introduction to Sole Proprietorship and Partnership

Sole proprietorship is a business structure owned and operated by one individual who assumes full responsibility for liabilities and profits, offering simplicity in setup and control. Partnership involves two or more individuals sharing ownership, responsibilities, and profits according to a legally binding agreement, which can be general or limited in liability. Both structures affect taxation, liability, and decision-making processes differently, influencing business operations and growth potential.

Definition and Key Features

A sole proprietorship is a business owned and operated by one individual who bears full responsibility for all debts and liabilities, offering complete control but unlimited personal liability. A partnership involves two or more individuals sharing ownership, profits, and management responsibilities, with liability typically shared according to the partnership agreement. Key features of sole proprietorships include simplicity and sole decision-making authority, while partnerships emphasize shared resources, combined expertise, and mutual accountability.

Formation and Registration Process

A sole proprietorship requires minimal formation and registration, often needing only local business licenses and permits, making it the simplest and fastest business structure to establish. In contrast, a partnership involves more complex registration steps, including drafting and filing a partnership agreement, and may require state-level registration depending on jurisdiction. Both structures typically need to obtain specific licenses related to their business activities, but partnerships face more stringent regulatory and documentation requirements.

Ownership and Control Structure

A sole proprietorship is owned and controlled by a single individual who has full authority over business decisions and retains all profits but also bears unlimited liability. In contrast, a partnership involves two or more individuals who share ownership, management responsibilities, and profits according to a partnership agreement, distributing both risks and decision-making power. The control structure in partnerships is collaborative, which can influence the speed and style of business operations compared to the sole proprietor's centralized control.

Liability and Risk Exposure

In a sole proprietorship, the owner assumes unlimited personal liability, making them directly responsible for all business debts and legal obligations. Partnerships distribute liability among partners, with general partners facing joint and several liability for business losses and debts. Limited partnerships provide some partners with limited liability, restricting their risk exposure to their investment amount while general partners retain full liability.

Tax Implications and Reporting

Sole proprietorship income is reported directly on the owner's personal tax return using Schedule C, simplifying tax filing but exposing the owner to self-employment taxes on all profits. Partnerships must file an informational return, Form 1065, and issue K-1s to partners, who then report their share of income on individual returns, which can lead to complex allocations and potential liabilities. Both entities avoid double taxation, but partnerships require more detailed reporting and possible tax planning to manage distributions and partner-specific tax situations.

Capital and Fundraising Potential

Sole proprietorships rely primarily on the owner's personal funds or loans, which limits capital availability and fundraising potential significantly. Partnerships combine the financial resources of multiple owners, enhancing total capital and expanding access to diverse funding sources such as business loans, equity contributions, and investor interest. This pooled capital structure in partnerships often facilitates larger-scale investments and business growth compared to sole proprietorships.

Decision-Making and Management Dynamics

Sole proprietorships feature centralized decision-making, where the owner holds full control and responsibility, enabling swift managerial actions without consultation. Partnerships require shared decision-making among partners, promoting collaborative management but potentially causing delays or conflicts due to differing opinions. Effective communication and clearly defined roles in partnerships are crucial to maintaining efficient operational dynamics.

Business Continuity and Succession Planning

Sole proprietorships face significant challenges in business continuity and succession planning due to the business being legally inseparable from the owner, resulting in automatic dissolution upon the owner's death or incapacity. In contrast, partnerships offer more structured succession options through buy-sell agreements and partnership continuity clauses that ensure smoother transitions among remaining partners. Properly drafted partnership agreements facilitate ongoing business operations and ownership transfers, preserving business value across generations.

Pros and Cons: Sole Proprietorship vs Partnership

Sole proprietorship offers simplicity and full control, with minimal regulatory requirements and direct tax benefits, but it carries unlimited personal liability and limited capital-raising ability. Partnership allows shared resources, diverse skills, and easier access to capital, yet involves joint liability and potential conflicts among partners. Choosing between sole proprietorship and partnership depends on balancing control preferences, risk tolerance, and growth objectives.

Sole Proprietorship Infographic

libterm.com

libterm.com