A trustee holds legal responsibility to manage assets or property on behalf of beneficiaries, ensuring fiduciary duties are met with utmost care and honesty. Understanding the role of a trustee is crucial when establishing trusts or handling wills to safeguard your loved ones' interests. Explore the full article to learn how trustees operate and what your obligations might be.

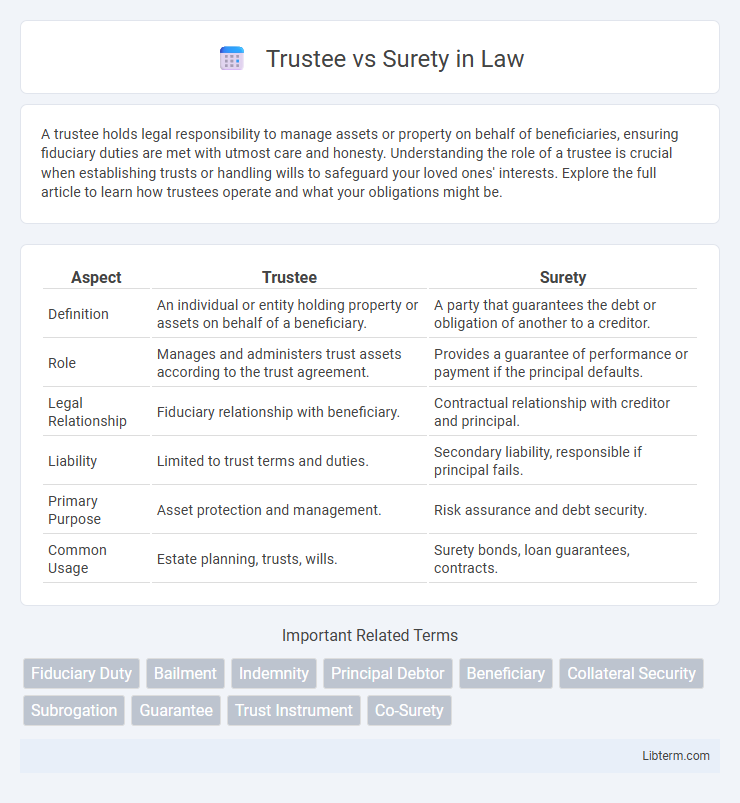

Table of Comparison

| Aspect | Trustee | Surety |

|---|---|---|

| Definition | An individual or entity holding property or assets on behalf of a beneficiary. | A party that guarantees the debt or obligation of another to a creditor. |

| Role | Manages and administers trust assets according to the trust agreement. | Provides a guarantee of performance or payment if the principal defaults. |

| Legal Relationship | Fiduciary relationship with beneficiary. | Contractual relationship with creditor and principal. |

| Liability | Limited to trust terms and duties. | Secondary liability, responsible if principal fails. |

| Primary Purpose | Asset protection and management. | Risk assurance and debt security. |

| Common Usage | Estate planning, trusts, wills. | Surety bonds, loan guarantees, contracts. |

Understanding the Role of a Trustee

A trustee is a legal entity or individual appointed to hold and manage assets in a trust for the benefit of beneficiaries, ensuring fiduciary duties such as loyalty, care, and impartiality are met. Unlike a surety, who guarantees the performance of another party's obligation, a trustee actively administers the trust property according to the terms set forth in the trust agreement. Understanding the trustee's role involves recognizing their responsibility to preserve and protect trust assets while acting solely in the beneficiaries' best interests.

Defining Surety: Responsibilities and Duties

A surety is a party that guarantees the performance or obligations of another, often in financial or contractual contexts, by assuming responsibility if the principal fails to meet their commitments. The surety's duties include ensuring the principal's adherence to contract terms, providing financial security to the obligee, and stepping in to fulfill obligations or cover losses if the principal defaults. This role is critical in construction bonds, loan agreements, and other arrangements requiring risk mitigation.

Key Differences Between Trustee and Surety

Trustees hold legal title to assets for the benefit of beneficiaries, managing and protecting trust property according to fiduciary duties, whereas sureties provide a guarantee to obligees that a principal will fulfill an obligation, often involving a financial commitment if the principal defaults. Trustees have ongoing responsibilities related to trust administration and asset management, while sureties primarily serve as a risk mitigation mechanism in contractual and financial agreements. The legal obligations of trustees emphasize loyalty and care toward beneficiaries, contrasting with sureties' contractual obligation to compensate for non-performance or default.

Legal Obligations of Trustees

Trustees have fiduciary duties to manage trust property in accordance with the terms of the trust and for the benefit of the beneficiaries, ensuring loyalty, prudence, and impartiality. They must keep accurate records, provide regular accountings, and avoid conflicts of interest to fulfill their legal obligations. Unlike sureties who guarantee the performance of another party, trustees bear direct responsibility for administration and distribution of trust assets under trust law.

Legal Obligations of Sureties

Sureties bear a legally binding obligation to guarantee the performance or payment of another party's debt or duty, assuming full liability if the principal defaults. Their liability is secondary to the principal's, but once the principal defaults, sureties must satisfy the obligation without delay. Courts strictly enforce surety agreements to protect creditors and maintain financial trustworthiness in contractual relationships.

Fiduciary Relationship: Trustee vs Surety

A trustee holds a fiduciary relationship, managing assets strictly in the best interest of the beneficiary with a legal duty of loyalty and care. A surety, however, acts as a guarantor without a fiduciary duty, primarily responsible for ensuring debt or obligation fulfillment if the principal defaults. The trustee's role demands ethical management and transparency, whereas the surety's focus lies in financial guarantee rather than fiduciary oversight.

Scope of Liability: Trustee Compared to Surety

The scope of liability for a trustee is fiduciary and limited to managing trust assets according to the trust agreement and acting in beneficiaries' best interests, whereas a surety's liability is more direct and financial, guaranteeing the performance or obligations of another party under a contract. Trustees hold legal title to trust property but are personally liable only for breaches of fiduciary duty, while sureties assume contingent liability that activates if the principal fails to meet contractual obligations. Surety liability often extends to the full amount of the guarantee, contrasting with the trustee's obligation to prudently administer assets without personal financial risk beyond negligence or misconduct.

Appointment and Removal: Trustee vs Surety

Trustee appointment involves a formal acceptance of fiduciary duties to manage trust assets for beneficiaries, whereas surety is typically appointed through a contractual bond to guarantee another party's performance. Trustees can be removed by court order or according to trust terms if they breach duties, while sureties are released from obligations once the principal's performance is fulfilled or the bond is discharged. The regulatory framework governing trustee removal often emphasizes protection of beneficiaries, contrasting with surety agreements focused on risk mitigation for obligees.

Real-Life Examples of Trustee and Surety Roles

A trustee manages assets in a trust for beneficiaries, exemplified when a family member controls an inheritance until heirs reach maturity. A surety guarantees a contractor's performance by providing a bond to the project owner, ensuring project completion or financial compensation if the contractor defaults. In real estate, trustees hold property titles while sureties back construction contracts to protect stakeholders from financial loss.

Choosing Between Trustee and Surety: Factors to Consider

Choosing between a trustee and surety hinges on the nature of obligation and risk involved; trustees manage assets for beneficiaries, ensuring fiduciary duties are met, while sureties provide a financial guarantee to secure performance or payment. Consider the level of control required, as trustees exercise discretion over trust property, whereas sureties act as security without decision-making power. Assess the legal implications and potential liabilities tied to each role to determine the most suitable option for your specific financial or contractual needs.

Trustee Infographic

libterm.com

libterm.com