Tenancy by the Entirety is a form of joint property ownership exclusively available to married couples, providing rights of survivorship and protection from individual creditors. This arrangement ensures that both spouses hold equal shares and neither can unilaterally transfer property without the other's consent. Discover more about how Tenancy by the Entirety can safeguard Your assets and streamline property succession in the full article.

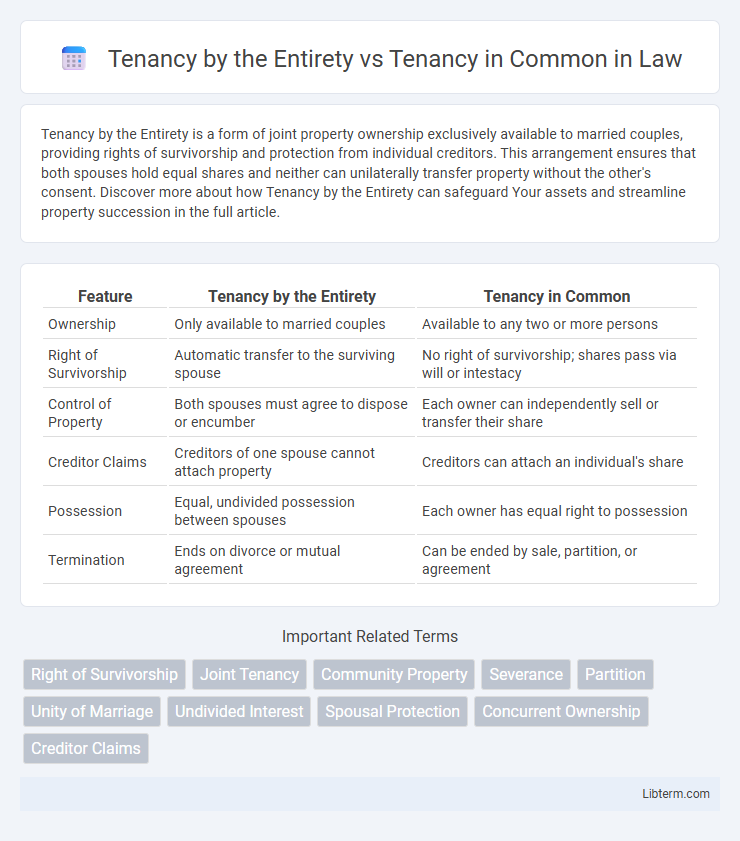

Table of Comparison

| Feature | Tenancy by the Entirety | Tenancy in Common |

|---|---|---|

| Ownership | Only available to married couples | Available to any two or more persons |

| Right of Survivorship | Automatic transfer to the surviving spouse | No right of survivorship; shares pass via will or intestacy |

| Control of Property | Both spouses must agree to dispose or encumber | Each owner can independently sell or transfer their share |

| Creditor Claims | Creditors of one spouse cannot attach property | Creditors can attach an individual's share |

| Possession | Equal, undivided possession between spouses | Each owner has equal right to possession |

| Termination | Ends on divorce or mutual agreement | Can be ended by sale, partition, or agreement |

Introduction to Types of Property Ownership

Tenancy by the Entirety is a form of property ownership available exclusively to married couples, providing equal shares with right of survivorship and protection against individual creditors. Tenancy in Common allows two or more individuals to own property simultaneously, each with distinct, divisible interests that can be sold or bequeathed independently. Understanding these distinctions is crucial for estate planning and asset protection in joint property ownership.

What is Tenancy by the Entirety?

Tenancy by the Entirety is a form of joint property ownership available exclusively to married couples, providing equal rights to both spouses with automatic survivorship, meaning the property passes directly to the surviving spouse upon death. This ownership type offers protection from individual creditors, as debts of one spouse typically cannot affect the property. Unlike Tenancy in Common, Tenancy by the Entirety requires marital status and creates a single legal entity for ownership.

Key Features of Tenancy by the Entirety

Tenancy by the Entirety offers each spouse equal, undivided ownership with right of survivorship, meaning the property automatically passes to the surviving spouse upon death. This form of ownership provides protection from individual creditors of one spouse, as the property cannot be seized to satisfy separate debts. Unlike Tenancy in Common, tenants by the entirety cannot unilaterally transfer or partition the property, ensuring joint control and preserving marital unity in ownership.

What is Tenancy in Common?

Tenancy in Common is a form of concurrent property ownership where two or more individuals hold undivided interests in the same property with no right of survivorship, meaning each owner can sell or bequeath their share independently. Unlike Tenancy by the Entirety, which is reserved exclusively for married couples and includes survivorship rights, Tenancy in Common allows for unequal ownership percentages and distinct shares. This arrangement is common in real estate investments and estate planning due to its flexibility in ownership and transferability of interests.

Core Characteristics of Tenancy in Common

Tenancy in common features separate ownership shares, allowing each co-owner to hold an undivided interest that can be unequal and freely transferred or bequeathed without consent from other owners. This form of co-ownership lacks the right of survivorship, meaning that upon a co-owner's death, their interest passes according to their will or state inheritance laws. Core characteristics include individual control over each owner's share, the possibility of differing ownership percentages, and no protection against unilateral transfer or sale of interest.

Major Differences Between Tenancy by the Entirety and Tenancy in Common

Tenancy by the Entirety is a form of joint property ownership exclusive to married couples, featuring rights of survivorship, which means the surviving spouse automatically inherits the entire property upon the other's death, unlike Tenancy in Common where co-owners hold individual shares that can be willed or sold independently. Unlike Tenancy in Common, Tenancy by the Entirety protects the property from individual creditors of one spouse, preventing liens or claims against the property without both owners' consent. Furthermore, Tenancy in Common allows unequal ownership percentages and no survivorship rights, whereas Tenancy by the Entirety requires equal ownership shares with the inability to partition or alienate property without mutual agreement.

Rights and Responsibilities of Co-Owners

Tenancy by the Entirety grants spouses equal rights to undivided possession with survivorship rights, meaning upon the death of one spouse, the other automatically inherits the entire property. In contrast, Tenancy in Common allows co-owners to hold unequal shares and transfer their interests independently without survivorship protection, making each responsible for their share of property expenses and liabilities. Both forms require co-owners to maintain the property and share costs proportionally, but Tenancy by the Entirety offers stronger protections against creditors and unilateral transfers.

Legal and Financial Implications

Tenancy by the Entirety provides legal protection through survivorship rights, automatically transferring full ownership to the surviving spouse and shielding the property from individual creditors of one spouse. Tenancy in Common allows separate ownership shares without survivorship, exposing each owner's interest to creditors and requiring probate for inheritance transfer. Financially, Tenancy by the Entirety can preserve estate value from legal claims and probate costs, while Tenancy in Common offers greater flexibility for unequal ownership but increases exposure to individual liabilities and potential estate taxes.

Pros and Cons of Each Ownership Structure

Tenancy by the Entirety offers strong creditor protection and automatic right of survivorship, ensuring property passes directly to the surviving spouse without probate, but it is limited to married couples and restricts individual ownership transfer. Tenancy in Common provides flexible ownership shares and the ability to transfer interests freely, making it suitable for unrelated co-owners, yet it lacks survivorship rights and exposes each co-owner to potential creditor claims on their share. Choosing between these structures depends on marital status, desired transferability, and asset protection preferences.

Choosing the Best Ownership Option

Tenancy by the Entirety offers married couples rights of survivorship and protection from individual creditors, making it a secure option for joint property ownership. Tenancy in Common provides flexibility by allowing co-owners to hold unequal shares and transfer interests independently, suitable for non-marital partnerships or investors. Selecting the best ownership option depends on factors like relationship status, desired control over shares, and protection against creditors.

Tenancy by the Entirety Infographic

libterm.com

libterm.com