A judgment debtor garnishee refers to a third party who holds money or property belonging to the judgment debtor and is legally required to withhold those assets to satisfy a creditor's claim. Understanding the role and responsibilities of a garnishee is crucial for protecting your rights and ensuring proper legal procedures are followed during debt collection. Explore the rest of this article to learn how garnishment works and what you need to know if you encounter a judgment debtor garnishee situation.

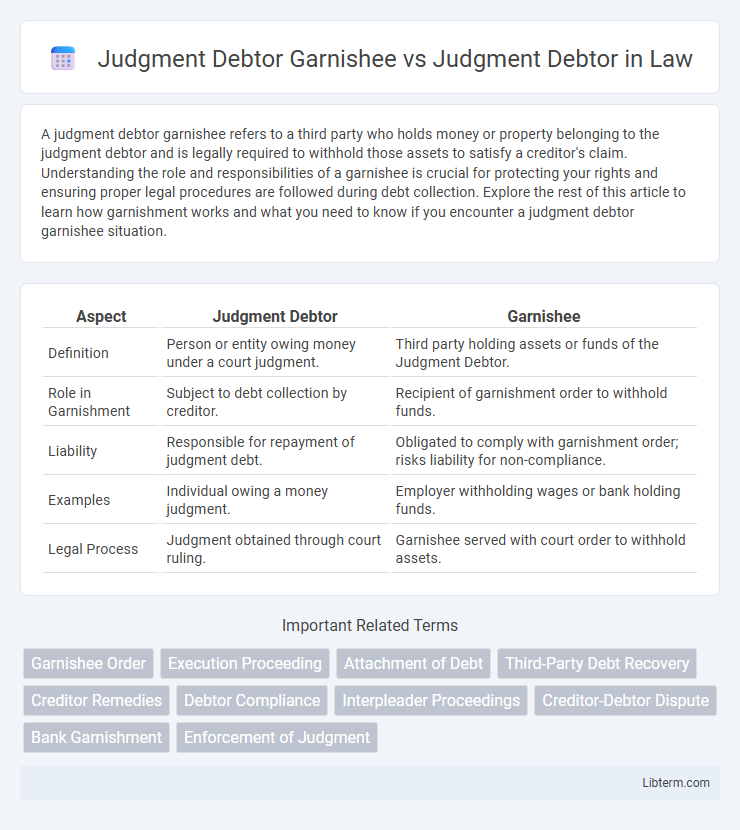

Table of Comparison

| Aspect | Judgment Debtor | Garnishee |

|---|---|---|

| Definition | Person or entity owing money under a court judgment. | Third party holding assets or funds of the Judgment Debtor. |

| Role in Garnishment | Subject to debt collection by creditor. | Recipient of garnishment order to withhold funds. |

| Liability | Responsible for repayment of judgment debt. | Obligated to comply with garnishment order; risks liability for non-compliance. |

| Examples | Individual owing a money judgment. | Employer withholding wages or bank holding funds. |

| Legal Process | Judgment obtained through court ruling. | Garnishee served with court order to withhold assets. |

Understanding the Judgment Debtor: Key Definitions

The judgment debtor refers to the individual or entity legally obligated to satisfy a court judgment, usually by paying a debt or performing a specific act. This party has been found liable in a legal proceeding and must comply with the court's order to resolve the judgment. Understanding the judgment debtor's role is crucial in enforcement actions like garnishment, where a third party (the garnishee) is involved.

Who is a Garnishee in Legal Proceedings?

A garnishee in legal proceedings is a third party, often a bank or employer, who holds assets or owes money to the judgment debtor. The garnishee is legally obligated to withhold these funds and remit them to the judgment creditor to satisfy the debt. Unlike the judgment debtor, who owes the debt, the garnishee acts as an intermediary responsible for transferring funds under court order.

Judgment Debtor vs. Garnishee: Legal Distinctions

Judgment Debtor and Garnishee represent distinct roles in post-judgment debt enforcement, where the Judgment Debtor is the individual or entity ordered to pay a debt by the court, while the Garnishee is a third party holding assets or funds belonging to the Judgment Debtor. Legal distinctions center on responsibilities: the Judgment Debtor must satisfy the debt directly, whereas the Garnishee is obligated to comply with the garnishment order by releasing the debtor's assets to the creditor. Courts impose specific procedural requirements and defenses on the Garnishee, differentiating their liabilities and protections from those of the Judgment Debtor in enforcement proceedings.

The Role of the Judgment Debtor in Debt Recovery

The role of the judgment debtor in debt recovery involves complying with court orders to satisfy the debt owed to the judgment creditor, either through direct payment or facilitating garnishment procedures. While the judgment debtor garnishee is a third party holding assets or funds of the judgment debtor, it is the debtor's responsibility to disclose assets and cooperate fully during the recovery process. Failure of the judgment debtor to meet obligations can lead to enforcement measures such as wage garnishment or asset seizure to ensure debt recovery.

Garnishee Process: How It Affects Judgment Debtors

The garnishee process allows creditors to collect debts by legally instructing a third party, such as an employer or bank, to withhold funds owed to the judgment debtor until the debt is satisfied. Judgment debtors face direct financial impact as their wages or bank accounts may be frozen or reduced without their direct involvement in the transaction. This legal mechanism ensures creditors can enforce monetary judgments efficiently by tapping into assets controlled by garnishees, complicating the debtor's financial liquidity and credit standing.

Court Orders Involving Judgment Debtor and Garnishee

Court orders involving a judgment debtor and garnishee typically enforce the collection of a debt by directing the garnishee, such as an employer or bank, to withhold funds owed to the judgment debtor and remit them to the creditor. The judgment debtor remains liable for the debt, while the garnishee acts under court instructions to satisfy the judgment without assuming personal liability. Garnishment orders require strict compliance from the garnishee, ensuring the creditor's recovery rights are upheld through judicial enforcement mechanisms.

Rights and Responsibilities of Judgment Debtors

Judgment debtors hold the legal obligation to satisfy a court-ordered debt, including prompt payment or negotiating settlement terms to avoid enforcement actions. Their rights include receiving proper notification of garnishment proceedings and contesting incorrect or unlawful garnishments through timely legal motions. Failure to comply with payment obligations or garnishment orders may result in wage garnishment, asset seizure, or other court-enforced remedies against the judgment debtor.

Legal Remedies for Judgment Debtors Against Garnishee Orders

Judgment debtors facing garnishee orders can pursue legal remedies such as filing a motion to quash the garnishment if the order is improper or challenges the validity of the underlying debt. Courts may allow judgment debtors to claim exemptions protecting certain assets from garnishment under state-specific exemption laws, thereby reducing the garnishable amount. In some jurisdictions, negotiation with the garnishee or creditor to establish payment plans or settlements provides an additional avenue for judgment debtors to mitigate the effects of garnishment orders.

Common Legal Challenges in Garnishee Proceedings

Judgment debtor garnishee proceedings often face challenges such as determining the garnishee's responsibility in holding or transferring the debtor's assets and distinguishing between exempt and non-exempt property. Conflicts arise over timely and accurate disclosure of assets by the garnishee, leading to delays or disputes regarding the enforcement of the judgment. Courts frequently address issues of improper garnishment, including the garnishee's failure to comply with legal notices or wrongful freezing of funds not belonging to the judgment debtor.

Protecting Assets: Advice for Judgment Debtors

Judgment debtors facing asset protection challenges must understand the role of the garnishee, often a third party holding the debtor's assets or funds, who is legally obligated to surrender these assets to satisfy a creditor's judgment. Legal strategies such as negotiating payment plans, claiming exemptions on protected assets, and challenging improper garnishments are crucial to limit asset loss. Consulting with a debtor's attorney helps in identifying exempt property under state laws and implementing effective defenses against garnishment to safeguard critical financial resources.

Judgment Debtor Garnishee Infographic

libterm.com

libterm.com