Subrogation allows an insurance company to step into your shoes and recover costs from the party responsible for your loss, ensuring you don't pay twice for the same damages. Understanding how subrogation works can help you navigate claims more effectively and protect your financial interests. Explore the rest of this article to learn how subrogation impacts your insurance claims and what steps you should take.

Table of Comparison

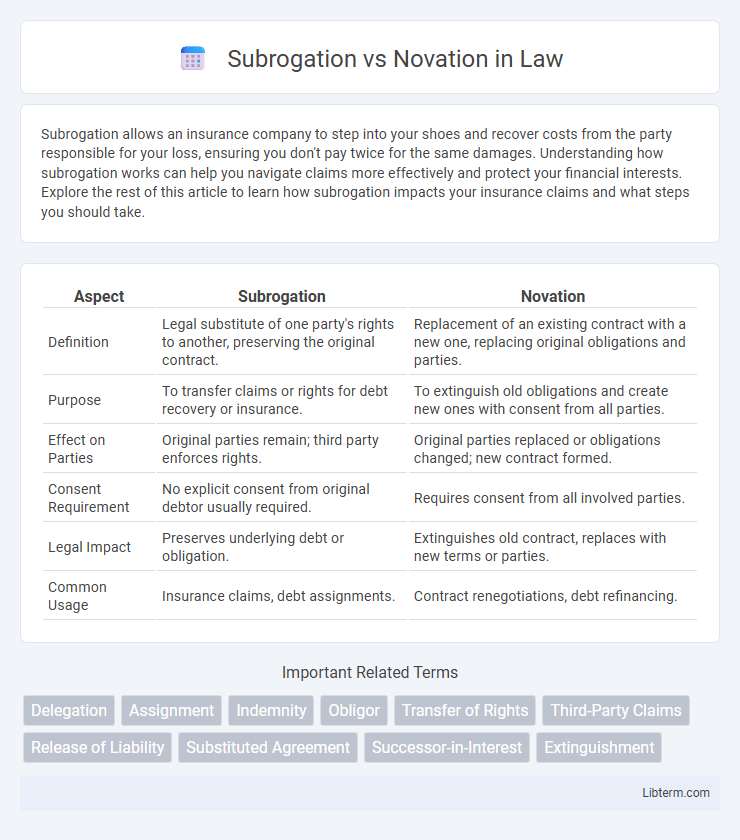

| Aspect | Subrogation | Novation |

|---|---|---|

| Definition | Legal substitute of one party's rights to another, preserving the original contract. | Replacement of an existing contract with a new one, replacing original obligations and parties. |

| Purpose | To transfer claims or rights for debt recovery or insurance. | To extinguish old obligations and create new ones with consent from all parties. |

| Effect on Parties | Original parties remain; third party enforces rights. | Original parties replaced or obligations changed; new contract formed. |

| Consent Requirement | No explicit consent from original debtor usually required. | Requires consent from all involved parties. |

| Legal Impact | Preserves underlying debt or obligation. | Extinguishes old contract, replaces with new terms or parties. |

| Common Usage | Insurance claims, debt assignments. | Contract renegotiations, debt refinancing. |

Introduction to Subrogation and Novation

Subrogation is a legal mechanism allowing one party, typically an insurer, to assume the rights and remedies of another party to recover costs after indemnifying a loss. Novation involves replacing an existing contract with a new one, transferring rights and obligations from the original party to a third party with the consent of all involved. Understanding subrogation centers on recovery and indemnity rights, while novation focuses on the contractual substitution of parties and obligations.

Defining Subrogation

Subrogation is a legal mechanism in which one party assumes the rights and remedies of another party, typically occurring in insurance claims where the insurer seeks reimbursement from a third party responsible for a loss. This process allows the insurer to pursue recovery directly from the liable party while protecting the insured's interests. Unlike novation, which involves substituting one contractual party with another and requires agreement from all parties, subrogation primarily transfers rights without altering the original contract terms.

Defining Novation

Novation is a legal concept that involves replacing an existing contract or party with a new one, transferring all rights and obligations to the new party. Unlike subrogation, where one party assumes the rights of another without changing the contract's terms, novation requires the consent of all parties involved to discharge the original agreement and create a new contractual relationship. This process is commonly used in transferring debt or contractual duties in business transactions and insurance settlements.

Key Differences Between Subrogation and Novation

Subrogation transfers the right to claim or recover debt from one party to another, typically in insurance claims, without altering the original contract terms between the primary parties. Novation replaces an original contract with a new one, substituting a new party and extinguishing the original party's obligations and rights entirely. The key difference lies in subrogation maintaining the original contract's terms while novation creates a new contractual agreement with full consent from all involved parties.

Legal Implications of Subrogation

Subrogation allows an insurer to legally pursue a third party responsible for a loss after indemnifying the insured, effectively stepping into the insured's shoes. This legal mechanism helps recover costs and reinforces the principle of indemnity by preventing double recovery from the at-fault party. Understanding subrogation's impact on contractual rights and liabilities is crucial in insurance claims and dispute resolution.

Legal Implications of Novation

Novation legally transfers both rights and obligations from one party to another, effectively extinguishing the original contract and creating a new one, which requires the consent of all involved parties. This process reduces liability risks for the original debtor, as the new party assumes all contractual responsibilities. In contrast to subrogation, novation alters the contractual relationship and can significantly impact enforceability and legal accountability.

Common Scenarios for Subrogation

Common scenarios for subrogation include insurance claims where an insurer seeks reimbursement from a third party responsible for causing damage or loss, such as car accidents or property damage. Subrogation often arises in healthcare when insurers pursue payment from liable parties after covering medical expenses. Another typical case is construction disputes, where a surety company pays claims and then subrogates against the contractor or subcontractor responsible for defects or delays.

Common Scenarios for Novation

Novation commonly occurs in business acquisitions where one company takes over another's contracts, transferring obligations and rights to the new party. In real estate transactions, novation facilitates the substitution of one tenant or buyer with another, ensuring all parties agree to the revised contractual terms. This mechanism also plays a crucial role in financial agreements, such as replacing a debtor with a new one to restructure debt or update lending arrangements.

Subrogation vs Novation: Pros and Cons

Subrogation allows an insurer to step into the shoes of the insured to recover costs from third parties, preserving the insured's rights while minimizing financial loss; its pros include cost recovery and reduced claim liabilities, but cons involve complex legal proceedings and delays. Novation replaces an original contract with a new one, transferring obligations and rights to a third party, offering clear transfer of responsibilities and release from liabilities, but risks include potential disputes over contract terms and the need for all parties' consent. Choosing between subrogation and novation depends on factors such as the nature of the claim, ease of enforcement, and the desired allocation of risks and responsibilities.

Choosing Between Subrogation and Novation

Choosing between subrogation and novation depends on the desired transfer of rights and obligations in a contract. Subrogation allows one party, typically an insurer, to step into the shoes of another to recover costs without altering the original contract terms. Novation replaces the original party with a new one, transferring both rights and obligations, often requiring consent from all involved parties.

Subrogation Infographic

libterm.com

libterm.com