Repossession occurs when a lender takes back an asset, typically a vehicle or property, due to your failure to meet loan repayment terms. This process impacts your credit score and can result in additional financial challenges if the asset's resale value doesn't cover the outstanding debt. Explore the rest of this article to understand how repossession affects you and what steps you can take to protect your finances.

Table of Comparison

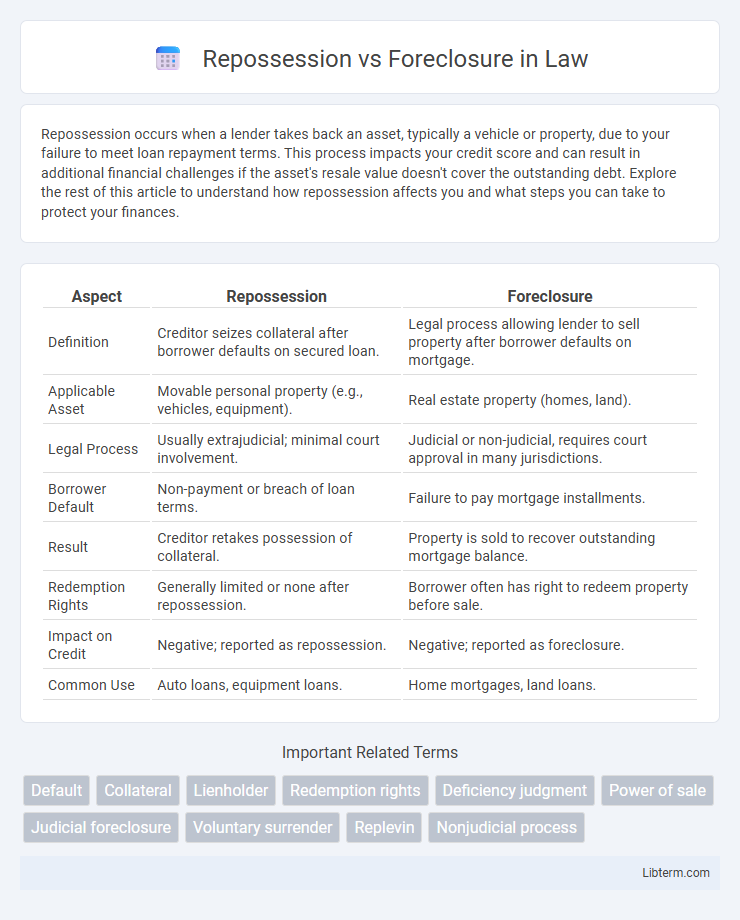

| Aspect | Repossession | Foreclosure |

|---|---|---|

| Definition | Creditor seizes collateral after borrower defaults on secured loan. | Legal process allowing lender to sell property after borrower defaults on mortgage. |

| Applicable Asset | Movable personal property (e.g., vehicles, equipment). | Real estate property (homes, land). |

| Legal Process | Usually extrajudicial; minimal court involvement. | Judicial or non-judicial, requires court approval in many jurisdictions. |

| Borrower Default | Non-payment or breach of loan terms. | Failure to pay mortgage installments. |

| Result | Creditor retakes possession of collateral. | Property is sold to recover outstanding mortgage balance. |

| Redemption Rights | Generally limited or none after repossession. | Borrower often has right to redeem property before sale. |

| Impact on Credit | Negative; reported as repossession. | Negative; reported as foreclosure. |

| Common Use | Auto loans, equipment loans. | Home mortgages, land loans. |

Understanding Repossession and Foreclosure

Repossession occurs when a lender takes back personal property, such as a vehicle, due to missed loan payments, without involving the court system. Foreclosure involves the legal process by which a lender takes control of real estate property after the borrower defaults on a mortgage, often resulting in a public auction. Both processes affect credit scores, but foreclosure typically has a more severe and long-lasting impact on credit history.

Key Differences Between Repossession and Foreclosure

Repossession involves the lender reclaiming personal property, such as a vehicle, when the borrower defaults on a secured loan, whereas foreclosure pertains to the process of taking ownership of real estate due to mortgage default. Repossession typically occurs faster, with fewer legal procedures, while foreclosure is a lengthy court-driven process requiring public notice, auction, and legal documentation. Key differences also include the type of collateral--repossession applies to movable assets, whereas foreclosure applies exclusively to real property.

Common Causes of Repossession

Repossession commonly occurs when borrowers default on secured loans, such as auto or equipment loans, due to missed payments or breach of contract terms. Lenders typically initiate repossession after multiple payment delinquencies or failure to maintain insurance on the collateral. Economic hardship, job loss, and unexpected expenses frequently contribute to borrowers' inability to meet financial obligations, leading to repossession actions.

Common Causes of Foreclosure

Common causes of foreclosure include missed mortgage payments due to financial hardship, unemployment, or unexpected expenses leading to default on loan agreements. Foreclosure often occurs when homeowners fail to meet their repayment schedules, causing lenders to initiate legal proceedings to recover the loan balance. Unlike repossession, which typically involves personal property, foreclosure specifically relates to the loss of real estate collateral securing the mortgage loan.

The Repossession Process Explained

Repossession involves a lender reclaiming property, typically vehicles or personal items, after missed payments without court intervention, whereas foreclosure applies to real estate, requiring legal proceedings. The repossession process begins when a borrower defaults, prompting the creditor to notify them and repossess the asset, often through a third-party agent. Unlike foreclosure, repossession is faster and less costly, but both severely impact credit scores and financial stability.

The Foreclosure Process Explained

The foreclosure process involves a legal procedure where a lender seeks to recover the balance of a loan from a borrower who has stopped making payments by forcing the sale of the property used as collateral. Typically, the process begins with a notice of default issued after missed payments, followed by a waiting period during which the borrower can pay off the debt or negotiate terms. If unresolved, the property is auctioned or repossessed by the lender, transferring ownership and removing the borrower's rights to the home.

Legal Rights of Borrowers in Repossession

Borrowers retain specific legal rights during repossession, including the right to receive proper notice and the opportunity to cure the default under the Uniform Commercial Code (UCC) for secured personal property. Lenders must repossess property without breaching the peace, ensuring repossession occurs peacefully without force or illegal entry. Courts often require lenders to provide an accounting and may mandate surplus funds from the sale of repossessed property be returned to borrowers, protecting their financial interests.

Legal Rights of Homeowners in Foreclosure

Homeowners facing foreclosure retain the legal right to receive clear notice of default and an opportunity to cure the debt before the property is sold. Foreclosure laws require lenders to follow strict procedural guidelines, including providing homeowners with timelines for repayment or loan modification options. Unlike repossession, which often applies to personal property, foreclosure involves judicial or non-judicial processes that protect homeowners' rights during home loss.

Preventing Repossession and Foreclosure

Preventing repossession and foreclosure requires proactive financial management and timely communication with lenders to explore options like loan modification, repayment plans, or refinancing. Borrowers should seek assistance from credit counseling agencies or legal advisors to understand their rights and negotiate terms that avoid asset loss. Maintaining consistent payments and addressing financial hardships early significantly reduces the risk of losing homes or personal property through repossession or foreclosure.

Long-term Impacts on Credit and Financial Health

Repossession and foreclosure both drastically damage credit scores, but foreclosure typically has a longer-lasting effect, remaining on credit reports for up to seven years compared to repossession's three to seven years. Foreclosure often results in greater financial loss and can hinder future loan approvals due to its association with mortgage debt, while repossession, tied to personal property loans like vehicles, can limit access to auto financing. Recovery from either requires strategic credit rebuilding efforts, including timely payments and reducing overall debt, to restore long-term financial health.

Repossession Infographic

libterm.com

libterm.com