Liquidation is the process of winding up a company's operations by selling off assets to pay creditors and distribute any remaining funds to shareholders. Understanding the different types of liquidation, such as voluntary or compulsory, can help you navigate legal and financial complexities more effectively. Explore the rest of the article to learn how liquidation may impact your business and what steps you can take to manage it.

Table of Comparison

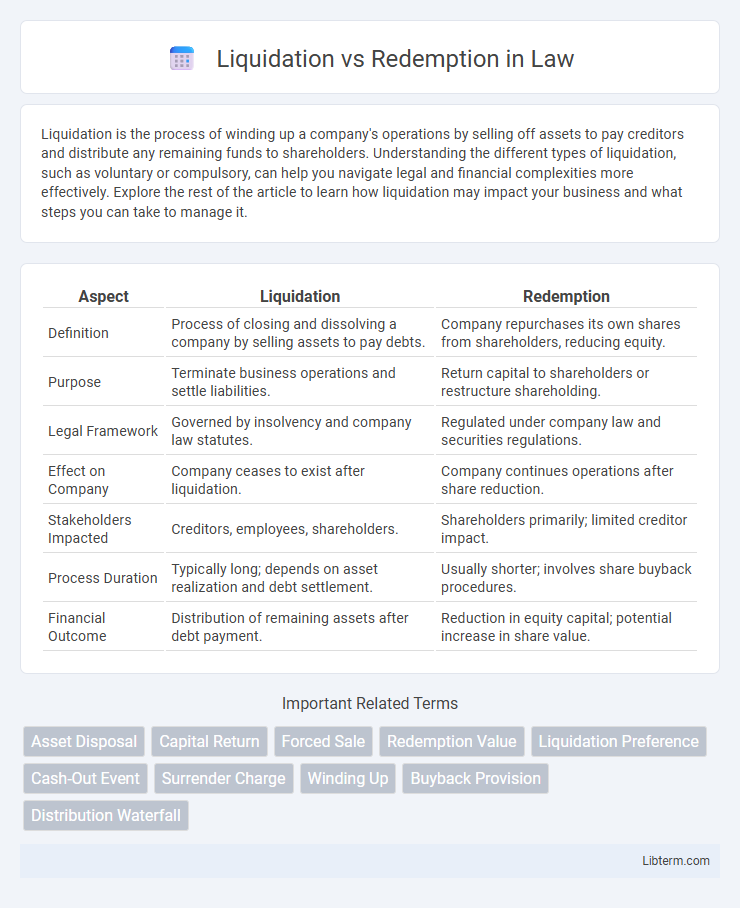

| Aspect | Liquidation | Redemption |

|---|---|---|

| Definition | Process of closing and dissolving a company by selling assets to pay debts. | Company repurchases its own shares from shareholders, reducing equity. |

| Purpose | Terminate business operations and settle liabilities. | Return capital to shareholders or restructure shareholding. |

| Legal Framework | Governed by insolvency and company law statutes. | Regulated under company law and securities regulations. |

| Effect on Company | Company ceases to exist after liquidation. | Company continues operations after share reduction. |

| Stakeholders Impacted | Creditors, employees, shareholders. | Shareholders primarily; limited creditor impact. |

| Process Duration | Typically long; depends on asset realization and debt settlement. | Usually shorter; involves share buyback procedures. |

| Financial Outcome | Distribution of remaining assets after debt payment. | Reduction in equity capital; potential increase in share value. |

Understanding Liquidation: Definition and Process

Liquidation involves winding up a company's operations by selling assets to pay off creditors before dissolving the business entity. The process typically includes appointing a liquidator who oversees asset valuation, debt settlement, and distribution of any remaining funds to shareholders. Understanding liquidation is crucial for stakeholders to grasp the legal and financial steps required to formally end a company's existence.

What is Redemption? Key Features Explained

Redemption is the process by which a company repurchases its outstanding shares or bonds from shareholders or bondholders, often at a predetermined price before maturity. Key features include the option for investors to sell securities back to the issuer, potential premium payments above face value, and a structured timeline for exercising redemption rights. Redemption differs from liquidation as it aims to retire specific securities without dissolving the company, maintaining ongoing operations and financial stability.

Liquidation vs Redemption: Core Differences

Liquidation involves selling a company's assets to settle debts and dissolve the business, while redemption refers to a corporation repurchasing its own shares from shareholders. Liquidation results in the complete termination of the company, whereas redemption allows the company to reduce outstanding shares without ending its operations. Key distinctions include the purpose--debt settlement in liquidation versus capital restructuring in redemption--and the impact on company continuity.

When to Choose Liquidation Over Redemption

Choose liquidation over redemption when a company faces insolvency or severe financial distress, making it impossible to continue operations or meet creditor obligations. Liquidation is preferable if winding up the business and selling assets can satisfy outstanding debts more effectively than redemption, especially when redemption is limited by statutory restrictions or insufficient retained earnings. Opt for liquidation when restructuring is not viable, and the goal is to maximize creditor recovery while ceasing all business activities.

Financial Implications of Liquidation

Liquidation involves selling a company's assets to pay off creditors, often resulting in lower recovery rates for shareholders compared to redemption, which typically entails repurchasing shares at a predetermined price. The financial implications of liquidation include potential losses due to asset devaluation, accelerated sales, and increased administrative costs, impacting overall creditor and investor returns. In contrast, redemption provides a more controlled financial outcome, preserving company value and shareholder equity.

Tax Consequences: Liquidation vs Redemption

Liquidation typically results in the distribution of corporate assets to shareholders, triggering capital gains tax on the difference between the liquidation proceeds and the shareholder's basis in the stock. Redemption involves the corporation buying back shares, which may be treated as either a sale or a dividend for tax purposes, depending on specific IRS criteria, potentially leading to preferential capital gains tax rates or ordinary income tax. Understanding the tax implications requires careful analysis of the transaction structure, shareholder basis, and applicable tax codes to minimize tax liability.

Impact on Shareholders: Liquidation and Redemption

Liquidation typically results in shareholders receiving a distribution of remaining assets after all debts are settled, often resulting in loss if liabilities exceed assets. Redemption involves the company repurchasing shares at a predetermined price, providing shareholders with a direct exit and potential profit without company dissolution. Both processes affect shareholder value but differ in timing, financial outcomes, and company continuity.

Legal Considerations in Liquidation and Redemption

Legal considerations in liquidation involve strict adherence to statutory procedures governing creditor settlements, asset distribution, and regulatory filings to ensure compliance with insolvency laws. Redemption requires careful evaluation of shareholder rights, contractual obligations, and approval mechanisms outlined in corporate charters to lawfully repurchase shares. Both processes demand meticulous documentation and compliance with jurisdiction-specific corporate and securities laws to mitigate legal risks and protect stakeholder interests.

Pros and Cons: Liquidation vs Redemption Strategies

Liquidation strategies enable companies to quickly convert assets into cash, providing immediate financial relief but often at reduced asset values and potential loss of business continuity. Redemption strategies allow shareholders to exit by selling shares back to the company, preserving ongoing operations and potentially offering higher value returns, though they can strain company cash flow and limit reinvestment capacity. Choosing between liquidation and redemption depends on factors like urgency of cash needs, long-term operational goals, and shareholder interests.

Choosing the Right Option: Factors to Consider

Choosing between liquidation and redemption hinges on factors such as the company's liquidity position, outstanding debt obligations, and shareholder interests. Liquidation is suitable when a business cannot sustain operations and aims to maximize asset value distribution to creditors, whereas redemption is appropriate when the company seeks to repurchase shares to restructure equity or return capital to shareholders without ceasing operations. Evaluating financial stability, long-term strategic goals, and legal implications ensures informed decision-making tailored to the company's specific circumstances.

Liquidation Infographic

libterm.com

libterm.com