A creditor is an individual or institution that extends credit by lending money or providing goods and services with the expectation of future payment. Understanding the role and rights of creditors is essential for managing debt and financial relationships effectively. Explore the rest of the article to learn how creditors operate and what this means for your financial decisions.

Table of Comparison

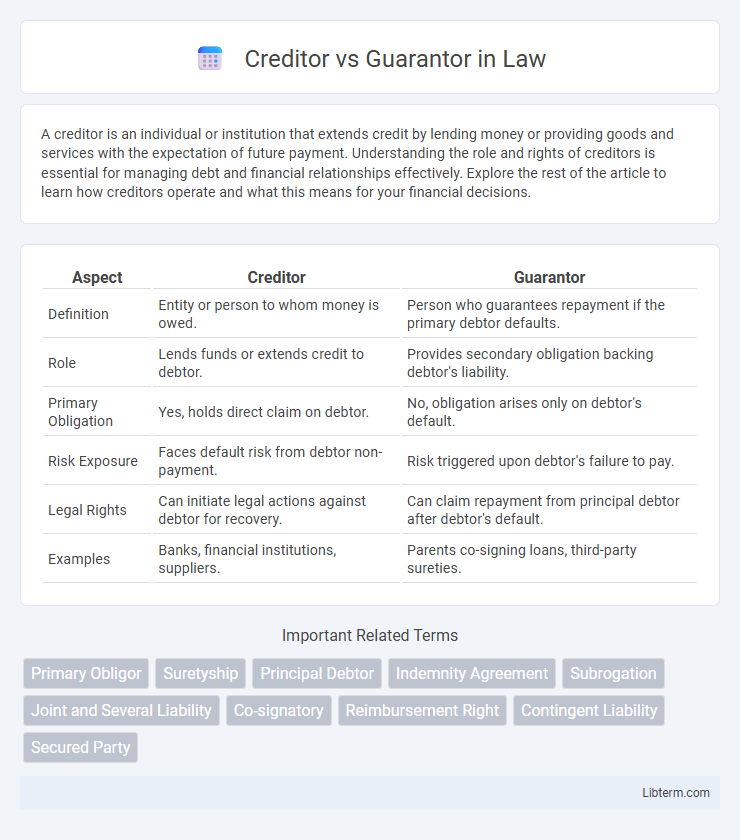

| Aspect | Creditor | Guarantor |

|---|---|---|

| Definition | Entity or person to whom money is owed. | Person who guarantees repayment if the primary debtor defaults. |

| Role | Lends funds or extends credit to debtor. | Provides secondary obligation backing debtor's liability. |

| Primary Obligation | Yes, holds direct claim on debtor. | No, obligation arises only on debtor's default. |

| Risk Exposure | Faces default risk from debtor non-payment. | Risk triggered upon debtor's failure to pay. |

| Legal Rights | Can initiate legal actions against debtor for recovery. | Can claim repayment from principal debtor after debtor's default. |

| Examples | Banks, financial institutions, suppliers. | Parents co-signing loans, third-party sureties. |

Understanding the Roles: Creditor vs Guarantor

A creditor is an individual or institution that extends credit or lends money to a borrower, holding the primary right to demand repayment. A guarantor acts as a secondary party who promises to fulfill the borrower's debt obligations if the borrower defaults, providing an added layer of security for the creditor. Understanding these distinct roles is essential for assessing risk allocation and legal responsibilities in lending agreements.

Definition of a Creditor

A creditor is an individual or institution that extends credit by lending money or providing goods and services with the expectation of future repayment, often formalized through agreements or contracts. Creditors hold a legal claim over the borrower's assets or income until the debt is settled, influencing financial rights and obligations. Understanding the role of a creditor is essential in financial transactions, distinguishing them from guarantors who provide secondary assurance without directly lending funds.

Definition of a Guarantor

A guarantor is a third party who agrees to fulfill the obligations of a borrower if the primary debtor defaults on a loan or debt. Unlike the creditor, who provides the loan or credit, the guarantor's role is to ensure repayment by legally committing to cover the liabilities if the borrower fails to do so. This arrangement enhances the lender's security by adding an additional layer of financial responsibility beyond the original debtor.

Key Legal Differences

A creditor holds the primary right to claim payment or performance under a contract, directly enforcing obligations against the debtor, while a guarantor provides a secondary obligation, agreeing to fulfill the debtor's obligations only upon the debtor's default. Legally, creditors possess immediate enforceable claims whereas guarantors' liabilities are contingent and typically require proof of default and creditor's attempt to collect from the debtor first. The creditor-debtor relationship is foundational in contract law, whereas guarantor liability is governed by suretyship principles, necessitating clear disclosure and sometimes formal requirements for enforceability.

Responsibilities and Obligations

A creditor holds the primary responsibility to provide the agreed-upon funds or credit to the borrower under the terms of the contract, ensuring timely disbursement and record-keeping. The guarantor assumes a secondary obligation to fulfill the debt repayment if the borrower defaults, acting as a financial backup without initially receiving the loan proceeds. Guarantors must fully understand their contingent liabilities and potential legal consequences, while creditors must enforce agreements and pursue repayment through contractual remedies.

Rights of Creditors

Creditors hold the primary right to demand full repayment of the principal debt and any accrued interest from the debtor under the loan agreement. They possess the legal authority to enforce payment through debt recovery processes, including seizing collateral or initiating litigation if the debtor defaults. Creditor rights include priority over guarantors in claims, ensuring direct access to the debtor's assets before guarantors are pursued for debt satisfaction.

Rights of Guarantors

Guarantors possess the right to be indemnified by the principal debtor, ensuring reimbursement for any payments made under the guarantee. They have the right to require the creditor to first exhaust remedies against the principal debtor before enforcing the guarantee. Guarantors can also claim contribution from co-guarantors and access all defenses available to the principal debtor against the creditor.

Common Scenarios in Lending Agreements

In lending agreements, creditors are the parties who extend credit or loans, holding the primary right to receive repayment from the borrower. Guarantors provide a secondary promise to fulfill the debtor's obligations if the borrower defaults, serving as an additional layer of security for lenders. Common scenarios include personal loans where guarantors assure repayment, and commercial loans where creditors require guarantor backing to mitigate risk and enhance loan approval chances.

Risks Involved for Creditors and Guarantors

Creditors face the risk of non-payment or default by the primary debtor, potentially resulting in financial loss and the need to initiate legal proceedings to recover funds. Guarantors assume the financial burden if the debtor defaults, exposing them to liability for the entire debt amount and impacting their creditworthiness. Both parties carry risks related to inadequate credit assessment, but guarantors have an added risk of unlimited liability depending on the guarantee terms.

Choosing Between a Creditor and a Guarantor in Financial Agreements

Choosing between a creditor and a guarantor in financial agreements depends on the risk tolerance and control preferences of the lender. Creditors directly extend credit and assume full repayment responsibility, while guarantors provide a backup promise to repay if the primary borrower defaults, reducing lender risk without immediate credit exposure. Assessing creditworthiness, collateral availability, and potential default scenarios is crucial for structuring agreements that balance security and flexibility.

Creditor Infographic

libterm.com

libterm.com