A breach occurs when unauthorized access compromises the security of sensitive data or systems, potentially leading to significant financial and reputational damage. Organizations must understand the causes and consequences of breaches to develop effective prevention and response strategies. Discover how to protect your information and mitigate risks by reading the rest of the article.

Table of Comparison

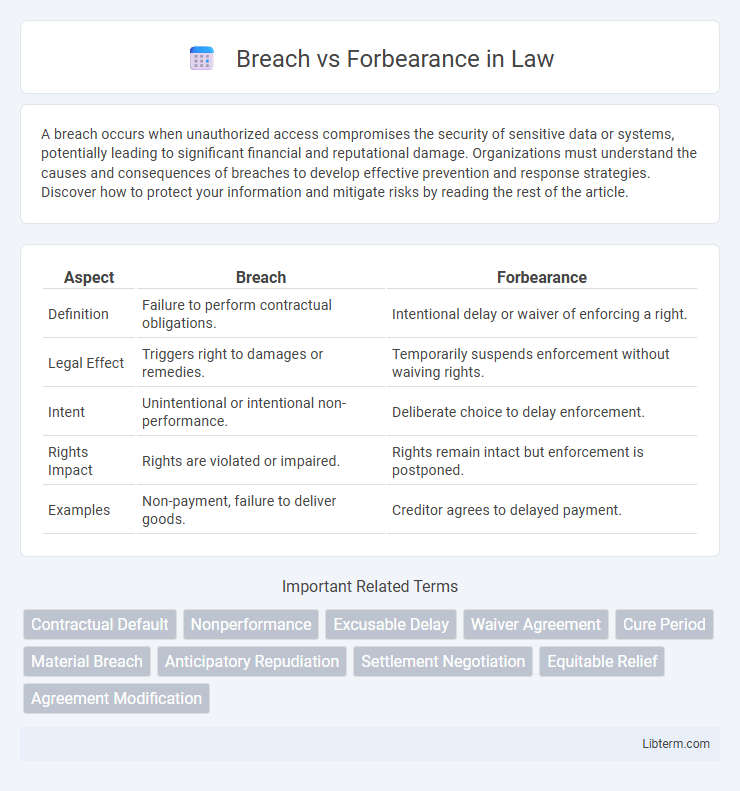

| Aspect | Breach | Forbearance |

|---|---|---|

| Definition | Failure to perform contractual obligations. | Intentional delay or waiver of enforcing a right. |

| Legal Effect | Triggers right to damages or remedies. | Temporarily suspends enforcement without waiving rights. |

| Intent | Unintentional or intentional non-performance. | Deliberate choice to delay enforcement. |

| Rights Impact | Rights are violated or impaired. | Rights remain intact but enforcement is postponed. |

| Examples | Non-payment, failure to deliver goods. | Creditor agrees to delayed payment. |

Understanding Breach and Forbearance: Key Definitions

Breach refers to the failure to fulfill a contractual obligation, resulting in a violation of agreed-upon terms. Forbearance involves a creditor's voluntary refraining from enforcing their legal right to collect a debt or demand performance, often to provide temporary relief to the debtor. Understanding these key definitions highlights the distinction between a party's nonperformance (breach) and the lender's intentional decision to delay action (forbearance) to manage contractual relationships.

Legal Foundations: Breach vs Forbearance

Breach refers to the violation or failure to perform a contractual duty as agreed, grounded in contract law principles that impose liability for non-performance or defective performance. Forbearance involves the intentional refraining from exercising a legal right, such as the right to sue or demand payment, and is often recognized as valid consideration in forming new contracts or modifying existing obligations. Legal foundations distinguish these concepts through doctrines of damages for breach and enforceability of forbearance agreements under the Uniform Commercial Code and common law.

Common Scenarios of Breach in Contracts

Common scenarios of breach in contracts include failure to deliver goods or services on time, non-payment or partial payment by the buyer, and violation of specific contractual terms such as confidentiality or performance standards. These breaches can be categorized as material or minor depending on the extent to which they affect the contract's overall purpose. Identifying the type of breach is critical in determining the appropriate legal remedy or whether forbearance, which involves delaying enforcement or waiving a breach, is a suitable response.

When Is Forbearance Applied?

Forbearance is applied when a borrower faces temporary financial hardship, allowing them to pause or reduce loan payments without triggering default or breach consequences. It is typically granted after demonstrating an inability to meet original loan terms, often during crises like job loss or medical emergencies. Lenders use forbearance to avoid foreclosure or legal action, providing a structured period for recovery while maintaining loan obligations.

Consequences of Breach of Agreement

A breach of agreement results in legal consequences such as damages, specific performance, or contract rescission, primarily aimed at compensating the non-breaching party. Courts may impose monetary penalties, restitution, or injunctions to enforce compliance and prevent further harm. Forbearance, by contrast, involves a voluntary delay or waiver of enforcement, which preserves contractual relationships but does not eliminate the right to seek remedies for future breaches.

Benefits and Risks of Forbearance

Forbearance allows borrowers to temporarily pause or reduce mortgage payments during financial hardship, helping avoid foreclosure and maintain credit standing. The primary benefit of forbearance is providing financial relief without immediate penalty, though interest may still accrue, increasing total repayment cost. Risks include potential loan modification refusal after forbearance ends, and the accumulation of owed payments leading to larger future balances or default if not managed properly.

Comparing Remedies: Breach vs Forbearance

Breach and forbearance represent contrasting legal remedies for contract disputes, where breach involves the violation of contractual obligations, triggering damages or specific performance claims. Forbearance, by contrast, is a voluntary agreement to refrain from enforcing a right or claim, often used to negotiate settlements or prevent litigation. Courts typically award damages for breach to compensate losses, whereas forbearance serves as a strategic tool to delay or modify enforcement without immediate financial penalties.

Practical Examples: Breach vs Forbearance

A breach occurs when a party fails to fulfill a contractual obligation, such as not delivering goods on the agreed date, leading to potential legal action or damages. Forbearance involves one party voluntarily refraining from enforcing a right, like a lender allowing delayed loan payments without penalty during financial hardship. Practical distinctions include a landlord suing for unpaid rent (breach) versus accepting late payment without eviction (forbearance).

Preventing Breach: Tips for Contract Compliance

Preventing breach of contract requires diligent monitoring of obligations and clear communication between parties to ensure mutual understanding and timely performance. Implementing regular reviews of contract terms and deadlines helps identify potential compliance issues early, allowing for prompt corrective action or negotiated forbearance agreements to avoid litigation. Utilizing legal counsel to draft precise clauses and manage modifications reduces ambiguity, thereby minimizing the risk of breach and fostering long-term contractual relationships.

Navigating Breach and Forbearance in Negotiations

Navigating breach and forbearance in negotiations requires a clear understanding of contractual obligations and the implications of non-performance. Effective negotiation hinges on distinguishing between a material breach that justifies termination and a forbearance agreement that temporarily permits delay or non-performance without penalty. Leveraging precise legal definitions and documented communication ensures mutual agreement on remedial actions or extensions, minimizing disputes and fostering constructive resolution.

Breach Infographic

libterm.com

libterm.com