A Trustee's Deed is a legal document used to transfer property ownership from a trustee to a beneficiary or third party, typically following a trust's terms or a foreclosure sale. It ensures that the property title is conveyed properly, protecting Your interests during the transaction. Explore the rest of the article to understand how Trustee's Deeds work and their implications for property transfers.

Table of Comparison

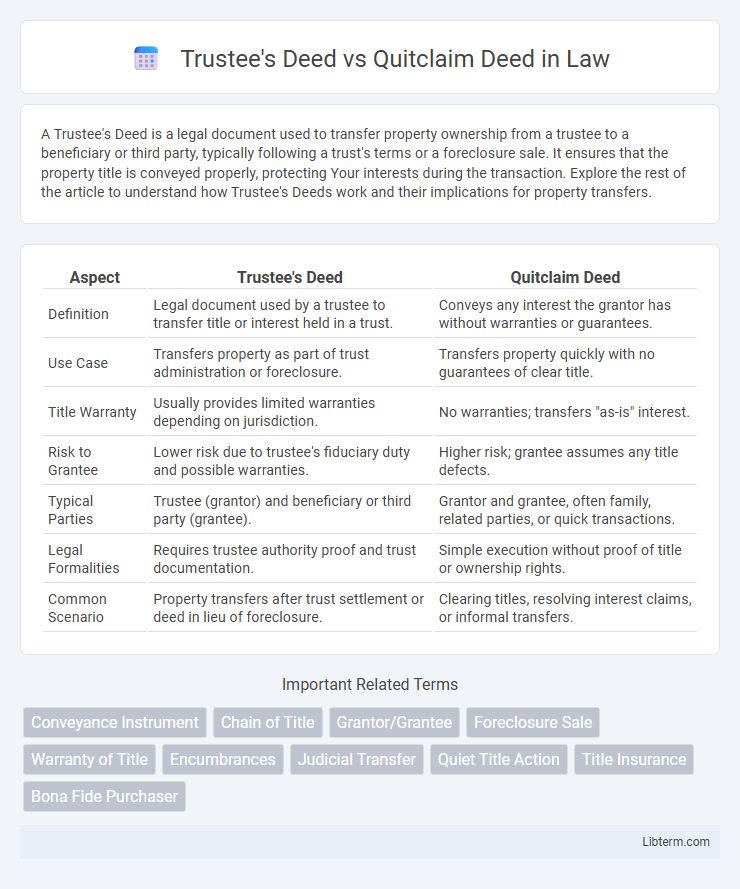

| Aspect | Trustee's Deed | Quitclaim Deed |

|---|---|---|

| Definition | Legal document used by a trustee to transfer title or interest held in a trust. | Conveys any interest the grantor has without warranties or guarantees. |

| Use Case | Transfers property as part of trust administration or foreclosure. | Transfers property quickly with no guarantees of clear title. |

| Title Warranty | Usually provides limited warranties depending on jurisdiction. | No warranties; transfers "as-is" interest. |

| Risk to Grantee | Lower risk due to trustee's fiduciary duty and possible warranties. | Higher risk; grantee assumes any title defects. |

| Typical Parties | Trustee (grantor) and beneficiary or third party (grantee). | Grantor and grantee, often family, related parties, or quick transactions. |

| Legal Formalities | Requires trustee authority proof and trust documentation. | Simple execution without proof of title or ownership rights. |

| Common Scenario | Property transfers after trust settlement or deed in lieu of foreclosure. | Clearing titles, resolving interest claims, or informal transfers. |

Understanding Trustee’s Deed: Definition and Purpose

A Trustee's Deed is a legal document used to transfer property ownership from a trustee to a buyer, typically following a foreclosure or a deed of trust sale. Its primary purpose is to convey clear title from the trustee, who holds the property as security, to the purchaser without warranties on title defects. This type of deed ensures a formal and enforceable transfer process within trust-related property transactions.

What Is a Quitclaim Deed? Key Features Explained

A quitclaim deed is a legal instrument used to transfer a grantor's interest in a property without guaranteeing clear title or ownership rights, often utilized between family members or in divorce settlements. Key features include the absence of warranties, meaning the grantee accepts the property "as-is," and the transfer of only whatever interest the grantor holds at the time of signing. Unlike a trustee's deed, which conveys property following a foreclosure or sale under a deed of trust with implied warranties of ownership, a quitclaim deed provides minimal protection to the receiver.

Legal Implications: Trustee’s Deed vs Quitclaim Deed

Trustee's deeds convey property ownership with warranties ensuring clear title, providing buyers protection from undisclosed liens or claims, while quitclaim deeds transfer whatever interest grantors hold without guarantees, increasing risk for buyers. Legal implications of a trustee's deed include potential remedies for breach of warranty, whereas quitclaim deeds offer no recourse if title defects arise. Understanding these distinctions is crucial for investors and parties involved in property transactions to minimize legal liabilities.

Use Cases: When to Use a Trustee’s Deed

A Trustee's Deed is commonly used in real estate transactions involving foreclosure sales, where the trustee conveys property rights to the buyer after a deed of trust sale. It is ideal for transferring property in trust-related scenarios, such as between trust beneficiaries or when executing a court-ordered sale. Unlike a Quitclaim Deed, which transfers only the grantor's interest without warranties, a Trustee's Deed often provides more specific assurances about the title's status connected to the trust or foreclosure context.

Situations Suited to Quitclaim Deeds

Quitclaim deeds are best suited for transferring property between family members, clearing up title issues, or relinquishing any possible interest in a property without warranties. They are commonly used in divorce settlements, intra-family transfers, or when the grantor's interest is uncertain. Unlike trustee's deeds, quitclaim deeds offer no guarantees about the title's validity, making them ideal for low-risk, straightforward transactions.

Transfer of Ownership: Process Differences

A Trustee's Deed transfers ownership through a formal foreclosure or trustee sale process, ensuring clear title conveyance backed by court or trustee authority. A Quitclaim Deed transfers ownership without warranties, simply releasing any interest the grantor holds, often used in non-foreclosure situations or among family members. The Trustee's Deed typically involves third-party oversight, while the Quitclaim Deed is a direct grantor-to-grantee transfer with minimal procedural requirements.

Protection for Buyers: Trustee’s Deed vs Quitclaim Deed

A Trustee's Deed provides stronger protection for buyers by conveying title through a trustee, often associated with foreclosure sales, ensuring the buyer receives valid ownership free of prior claims. Quitclaim Deeds offer minimal protection as they transfer only the grantor's interest without warranties, risking hidden liens or title defects. Buyers seeking secure title transfer typically prefer a Trustee's Deed for its greater legal assurances and reduced exposure to title disputes.

Title Warranty: What’s Guaranteed?

A Trustee's Deed generally includes limited warranties, ensuring the grantor acted properly within the trust's scope but not guaranteeing clear title against all claims. A Quitclaim Deed offers no title warranty, transferring only whatever interest the grantor holds without any assurances of ownership or lien status. Understanding these distinctions is crucial for buyers assessing the risk of undisclosed encumbrances or title defects.

Common Risks and Pitfalls to Avoid

Trustee's Deeds and Quitclaim Deeds carry distinct risks, primarily related to the level of title guarantee provided. Trustee's Deeds typically offer a stronger warranty of title, but risks include potential undisclosed liens or claims that can arise from trustee's failure to clear title defects. Quitclaim Deeds transfer ownership without warranties, increasing the risk of acquiring properties with unresolved title issues, making thorough title searches and due diligence essential to avoid future legal disputes.

Which Deed Is Right for Your Real Estate Transaction?

Trustee's deeds transfer property ownership from a trustee to a beneficiary, commonly used in foreclosure or trust sales, ensuring clear title with warranties included. Quitclaim deeds convey whatever interest the grantor has without guarantees, ideal for quick transfers between family members or resolving title issues without liability. Choosing the right deed depends on the transaction's need for title assurance--trustee's deeds offer protection and clear title, while quitclaim deeds provide simplicity and speed without title warranties.

Trustee's Deed Infographic

libterm.com

libterm.com