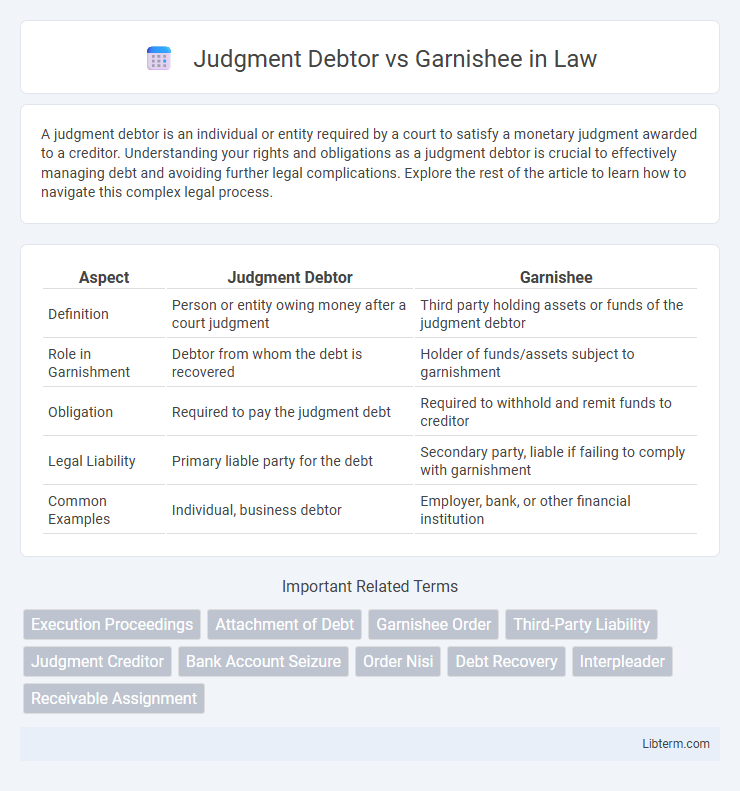

A judgment debtor is an individual or entity required by a court to satisfy a monetary judgment awarded to a creditor. Understanding your rights and obligations as a judgment debtor is crucial to effectively managing debt and avoiding further legal complications. Explore the rest of the article to learn how to navigate this complex legal process.

Table of Comparison

| Aspect | Judgment Debtor | Garnishee |

|---|---|---|

| Definition | Person or entity owing money after a court judgment | Third party holding assets or funds of the judgment debtor |

| Role in Garnishment | Debtor from whom the debt is recovered | Holder of funds/assets subject to garnishment |

| Obligation | Required to pay the judgment debt | Required to withhold and remit funds to creditor |

| Legal Liability | Primary liable party for the debt | Secondary party, liable if failing to comply with garnishment |

| Common Examples | Individual, business debtor | Employer, bank, or other financial institution |

Understanding Judgment Debtor: Definition and Role

A judgment debtor is the individual or entity ordered by a court to pay a specific debt or damages to the judgment creditor following a legal judgment. Their primary role involves satisfying the court's financial obligation, either through direct payment or by having assets seized. Understanding the judgment debtor's responsibilities is crucial in enforcing court orders and ensuring the creditor's rights are upheld.

Who is a Garnishee? Meaning and Legal Position

A garnishee is a third party, often a bank or employer, holding assets or wages of the judgment debtor, which are subject to a court order for seizure or garnishment to satisfy the creditor's claim. The legal position of a garnishee is neutral; they are obligated to comply with the garnishment order by withholding or turning over the specified funds but do not become liable for the debt itself. This role ensures enforcement of judgments by directing payment from the debtor's property in the hands of others without initiating a new legal claim against the garnishee.

Key Differences: Judgment Debtor vs Garnishee

A judgment debtor is the individual or entity ordered by the court to pay a monetary judgment, while the garnishee is a third party, typically a bank or employer, who holds the debtor's assets or wages subject to garnishment. The key difference lies in responsibility; the judgment debtor owes the debt, whereas the garnishee is legally obligated to comply with the court's order by withholding funds but does not owe the debt. Enforcement actions target the judgment debtor's liability, whereas garnishment procedures involve the garnishee's role in transferring or withholding assets pursuant to a court directive.

Legal Obligations of a Judgment Debtor

A Judgment Debtor has the legal obligation to satisfy the court-ordered debt, which may involve paying the creditor directly or fulfilling conditions set by the judgment. Failure to comply can result in enforcement actions such as wage garnishment, property liens, or asset seizure initiated against the debtor. This responsibility is distinct from the Garnishee, who is legally required only to withhold and transfer specified funds or property belonging to the Judgment Debtor upon court order.

Rights and Responsibilities of a Garnishee

A garnishee holds the legal responsibility to freeze and withhold the debtor's funds or assets once served with a garnishment order, ensuring compliance with court directives. The garnishee must accurately report and remit the specified amounts to the court or creditor, avoiding liability for wrongful withholding or payment. Rights include contesting the garnishment if it conflicts with existing obligations or exemptions, safeguarding their own interests while fulfilling the creditor's legal claim.

The Garnishee Order: Process and Procedural Steps

The garnishee order initiates when a judgment creditor secures a court directive to third parties holding funds or property of the judgment debtor. The court serves the garnishee with the order, requiring them to withhold and remit the specified assets to satisfy the debt. The garnishee must respond within a designated timeframe, either admitting or contesting liability, after which the court enforces compliance or resolves disputes through further hearings.

Impact of Garnishee Proceedings on Judgment Debtor

Garnishee proceedings directly affect the judgment debtor by allowing creditors to claim funds or assets held by a third party, limiting the debtor's access to those resources. This legal process can result in frozen bank accounts or withheld wages, significantly impacting the debtor's financial liquidity and ability to meet other obligations. The judgment debtor must navigate the garnishment carefully to avoid escalating penalties or further legal action.

Defenses Available to Garnishee in Court

The garnishee can assert defenses such as proving lack of possession or control over the debtor's assets, demonstrating that the funds or property are exempt from garnishment under applicable laws, or showing that the amount claimed exceeds what is legally owed. Courts also recognize defenses based on procedural errors in the garnishment process or that the garnishee has already fulfilled obligations to the judgment creditor through previous payments. Valid defenses protect the garnishee from liability while ensuring compliance with judgment enforcement mechanisms.

Common Challenges in Judgment Enforcement

Judgment debtors often evade payment by transferring assets or concealing income, complicating enforcement efforts. Garnishees, typically third parties holding the debtor's funds, may resist compliance due to misunderstandings or fear of legal consequences. These challenges prolong the collection process and necessitate precise legal procedures to secure judgment satisfaction.

Practical Tips for Navigating Garnishee and Debtor Disputes

Understanding the distinct roles of judgment debtors and garnishees is crucial for resolving garnishment disputes effectively. Judgment debtors are the individuals or entities owing the debt, while garnishees hold the debtor's funds or assets subject to court order. Clear communication, timely response to garnishment notices, and consulting legal expertise can help both parties navigate the legal obligations and protect their rights during garnishment proceedings.

Judgment Debtor Infographic

libterm.com

libterm.com