A well-organized drawer maximizes storage efficiency and reduces clutter in any space, making it easier to find your essentials quickly. Choosing the right drawer organizers and maintenance tips can prolong the life of your furniture and enhance your daily routine. Explore the rest of the article to discover practical solutions for transforming your drawer into a model of order and functionality.

Table of Comparison

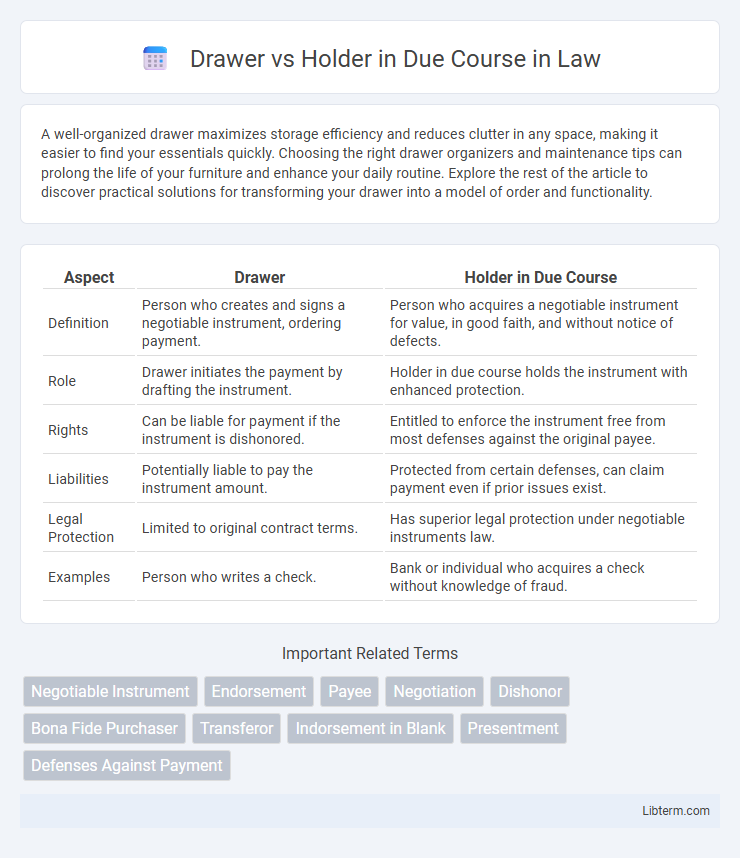

| Aspect | Drawer | Holder in Due Course |

|---|---|---|

| Definition | Person who creates and signs a negotiable instrument, ordering payment. | Person who acquires a negotiable instrument for value, in good faith, and without notice of defects. |

| Role | Drawer initiates the payment by drafting the instrument. | Holder in due course holds the instrument with enhanced protection. |

| Rights | Can be liable for payment if the instrument is dishonored. | Entitled to enforce the instrument free from most defenses against the original payee. |

| Liabilities | Potentially liable to pay the instrument amount. | Protected from certain defenses, can claim payment even if prior issues exist. |

| Legal Protection | Limited to original contract terms. | Has superior legal protection under negotiable instruments law. |

| Examples | Person who writes a check. | Bank or individual who acquires a check without knowledge of fraud. |

Understanding the Concept of a Drawer

A drawer in the context of due course is the party who creates and signs a negotiable instrument, such as a check or bill of exchange, ordering payment to be made to the holder. Understanding the drawer's role is crucial because they initiate the transaction and assume liability for payment if the instrument is dishonored. The drawer's ability to transfer the instrument to a holder in due course ensures the instrument's negotiability and protects the holder's rights against certain defenses.

Definition and Role of a Holder in Due Course

A Drawer is the party that creates and signs a negotiable instrument, such as a check or draft, ordering payment to be made. A Holder in Due Course (HIDC) is an individual or entity that has obtained the instrument for value, in good faith, and without notice of any defects or claims against it. The role of a Holder in Due Course is to acquire enhanced legal protection, enabling them to enforce the instrument free from certain defenses and claims that could be raised by prior parties.

Key Legal Differences: Drawer vs Holder in Due Course

The drawer is the party that creates and signs a negotiable instrument, such as a check or bill of exchange, thereby ordering the payment of a specified amount. The holder in due course, however, is a person who acquires the instrument in good faith, for value, and without notice of any defects or claims against it, thereby gaining certain legal protections. Key legal differences include that the drawer initiates the instrument's obligation, while the holder in due course enjoys enhanced rights to enforce payment free from many defenses that could be raised against the drawer.

Rights and Liabilities of a Drawer

The drawer in a negotiable instrument holds the primary liability to pay the instrument when it is accepted or presented for payment, ensuring the holder in due course can enforce payment free from most defenses. Rights of the drawer include the ability to stop payment before the instrument is dishonored, but liabilities arise if the instrument is dishonored and the drawer has endorsed or transferred it improperly. The drawer's financial responsibility persists unless the instrument is duly discharged or payment is made by the drawee or acceptor.

Entitlements and Protections of a Holder in Due Course

A Holder in Due Course (HDC) holds a negotiable instrument free from many defenses that could be asserted against the Drawer or prior holders, granting greater security and certainty in payment. Unlike a mere Drawer, the HDC is entitled to payment even if there are defects or claims against the underlying transaction, provided the instrument was acquired in good faith, for value, and without notice of any defects. This protection encourages the free transferability of negotiable instruments by shielding the HDC from most personal defenses and claims, enhancing the instrument's reliability in commercial dealings.

Essential Conditions for Holder in Due Course Status

A Holder in Due Course must acquire the instrument for value, in good faith, and without notice of any defects or claims against it. The drawer, as the party who writes or creates the negotiable instrument, does not automatically become a Holder in Due Course unless these conditions are met upon transfer. Essential conditions include timely acquisition, legitimate consideration, and absence of knowledge regarding any dishonor, fraud, or infirmities affecting the instrument's validity.

Comparative Legal Cases: Drawer vs Holder in Due Course

Comparative legal cases involving Drawer vs Holder in Due Course often analyze the drawer's obligation to honor the negotiable instrument versus the holder's right to enforce payment free from personal defenses. Courts typically emphasize that holders in due course acquire the instrument in good faith, granting them protection against certain claims that could be asserted against the drawer. Legal precedents demonstrate that while the drawer remains liable, the holder's status as a holder in due course shields their enforcement rights, influencing rulings on negotiable instruments across jurisdictions.

Common Misconceptions in Negotiable Instruments Law

Many mistakenly believe the drawer of a negotiable instrument automatically qualifies as a holder in due course, but only the party who takes the instrument for value, in good faith, and without notice of defects can be a holder in due course. The drawer typically creates the instrument but does not acquire rights superior to those of the payee or indorser. Misunderstandings arise from confusing the roles and protections afforded under the Uniform Commercial Code, which distinctly separates the drawer's liability from the holder in due course's enhanced rights.

Practical Examples: Drawer and Holder in Due Course Situations

A drawer is the party who creates and signs a negotiable instrument, such as a check or promissory note, instructing the bank or payer to pay a specified amount to the payee or holder. A holder in due course is an individual or entity that acquires a negotiable instrument in good faith, for value, and without notice of any defect or claim against it, thereby gaining protection from certain defenses. For example, if a drawer issues a check to a payee, and the payee transfers the check to a holder in due course who accepted it without knowledge of fraud, the holder in due course can enforce payment even if there are underlying disputes between the drawer and original payee.

Summary Table: Drawer vs Holder in Due Course

A Drawer in a negotiable instrument is the party who creates and signs the instrument, instructing payment to a payee, while the Holder in Due Course (HDC) is one who acquires the instrument for value, in good faith, and without notice of defects or claims. The summary table comparing Drawer vs Holder in Due Course highlights key distinctions: the Drawer primarily owes liability upon dishonor or non-payment, whereas the HDC enjoys enhanced protection by holding the instrument free from many defenses. The HDC's rights enable enforceability against prior parties, including the Drawer, ensuring secure transactions in commercial paper law.

Drawer Infographic

libterm.com

libterm.com