The Commerce Clause grants Congress the authority to regulate trade and commercial activities across state lines, shaping the scope of federal power. This constitutional provision has been pivotal in numerous Supreme Court decisions that define the balance between state and federal regulation. Explore the article to understand how the Commerce Clause impacts your rights and business operations today.

Table of Comparison

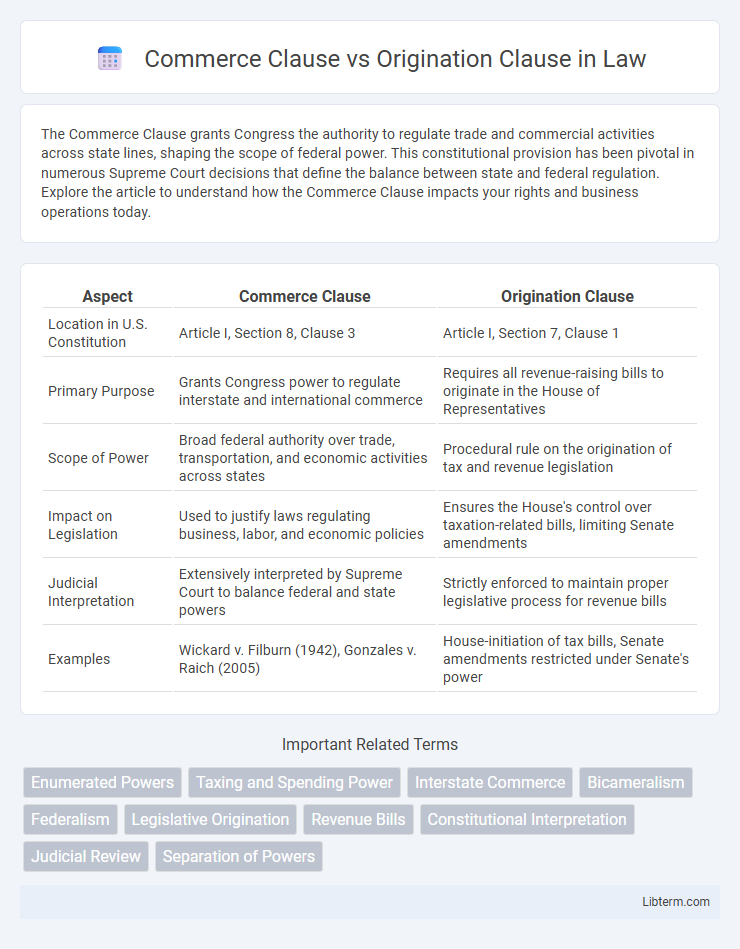

| Aspect | Commerce Clause | Origination Clause |

|---|---|---|

| Location in U.S. Constitution | Article I, Section 8, Clause 3 | Article I, Section 7, Clause 1 |

| Primary Purpose | Grants Congress power to regulate interstate and international commerce | Requires all revenue-raising bills to originate in the House of Representatives |

| Scope of Power | Broad federal authority over trade, transportation, and economic activities across states | Procedural rule on the origination of tax and revenue legislation |

| Impact on Legislation | Used to justify laws regulating business, labor, and economic policies | Ensures the House's control over taxation-related bills, limiting Senate amendments |

| Judicial Interpretation | Extensively interpreted by Supreme Court to balance federal and state powers | Strictly enforced to maintain proper legislative process for revenue bills |

| Examples | Wickard v. Filburn (1942), Gonzales v. Raich (2005) | House-initiation of tax bills, Senate amendments restricted under Senate's power |

Introduction to the Commerce Clause and Origination Clause

The Commerce Clause, found in Article I, Section 8, Clause 3 of the U.S. Constitution, grants Congress the power to regulate commerce with foreign nations, among the several states, and with Native American tribes. The Origination Clause, located in Article I, Section 7, Clause 1, mandates that all bills for raising revenue must originate in the House of Representatives. These clauses establish foundational principles for legislative authority over economic regulation and taxation in the federal government.

Constitutional Foundations: Article I, Sections 8 and 7

The Commerce Clause, found in Article I, Section 8 of the U.S. Constitution, grants Congress the power to regulate commerce with foreign nations, among the several states, and with Indian tribes, establishing a broad federal authority over economic activity. The Origination Clause, located in Article I, Section 7, mandates that all revenue-raising bills must originate in the House of Representatives, ensuring that taxation powers begin with the people's directly elected representatives. These clauses collectively shape the constitutional framework for legislative power over commerce and taxation, balancing federal control and representative governance.

Historical Context: Evolution of the Commerce Clause

The Commerce Clause, established in Article I, Section 8 of the U.S. Constitution, initially aimed to grant Congress power to regulate trade among states and with foreign nations, reflecting economic challenges of the late 18th century. Over time, its interpretation expanded significantly through key Supreme Court cases such as Gibbons v. Ogden (1824) and Wickard v. Filburn (1942), enabling broader federal regulatory authority. In contrast, the Origination Clause, found in Article I, Section 7, requires all revenue-raising bills to start in the House of Representatives, emphasizing the constitutional balance between popular representation and legislative power over taxation.

Historical Context: Evolution of the Origination Clause

The Origination Clause, rooted in Article I, Section 7 of the U.S. Constitution, reflects early American concerns about fair taxation and legislative control, mandating that all revenue-raising bills originate in the House of Representatives, the chamber closest to the people. Emerging from colonial experiences with taxation and representation, it aimed to prevent taxation without local consent, contrasting with the Commerce Clause, which grants Congress broad power to regulate interstate commerce, evolving through landmark cases like Gibbons v. Ogden (1824). The Origination Clause's historical evolution underscores the Founders' intent to balance federal taxation authority with representative accountability, shaping congressional procedures to this day.

Key Differences: Scope and Purpose

The Commerce Clause grants Congress broad authority to regulate interstate commerce, allowing for extensive federal control over economic activities crossing state lines. In contrast, the Origination Clause restricts Congress by requiring that all revenue-raising bills originate in the House of Representatives, ensuring a check on federal taxation powers. These clauses differ fundamentally in scope, with the Commerce Clause emphasizing regulatory power and the Origination Clause focusing on legislative procedure and taxation authority.

Notable Supreme Court Cases: Commerce Clause

The Commerce Clause has been central to several landmark Supreme Court cases, including *Wickard v. Filburn* (1942), which expanded federal regulatory power by allowing control of even local activities that substantially affect interstate commerce. In *Gonzales v. Raich* (2005), the Court upheld federal authority to prohibit locally grown marijuana under the Commerce Clause, emphasizing federal power over intrastate activities with national implications. *United States v. Lopez* (1995) marked a significant limitation on Commerce Clause power, ruling that the Gun-Free School Zones Act exceeded Congress's commerce authority.

Landmark Judgments: Origination Clause

The Origination Clause, found in Article I, Section 7, mandates that all revenue-raising bills must originate in the House of Representatives, ensuring fiscal accountability. Landmark judgments such as *Flint v. Stone Tracy Co.* (1911) upheld the Clause's requirement by invalidating bills that originated in the Senate without proper House initiation. The Supreme Court has consistently enforced this clause to preserve the constitutional balance of power in federal taxation and revenue legislation.

Interpretive Conflicts and Overlaps

The Commerce Clause grants Congress broad authority to regulate interstate commerce, often leading to expansive federal power over economic activities, while the Origination Clause requires all revenue-raising bills to originate in the House of Representatives, emphasizing the House's fiscal prerogative. Interpretive conflicts arise when Congress attaches revenue provisions to commerce regulations, blurring the line between commerce power and appropriations processes. Overlaps occur as courts navigate the balance between legislative procedures mandated by the Origination Clause and the substantive regulatory scope under the Commerce Clause, creating ongoing debates over congressional authority and procedural legitimacy.

Impact on Congressional Power and Legislation

The Commerce Clause empowers Congress to regulate interstate commerce, significantly expanding federal authority over economic activities and enabling broad legislative actions affecting trade, labor, and business practices nationwide. In contrast, the Origination Clause restricts Congress by mandating that all revenue-raising bills must originate in the House of Representatives, thereby limiting procedural power over taxation and budget legislation. This balance shapes the legislative process by combining expansive regulatory reach with constitutionally imposed procedural checks on fiscal lawmaking.

Contemporary Debates and Future Implications

Contemporary debates surrounding the Commerce Clause focus on its scope in regulating interstate economic activities, with courts assessing federal versus state powers amid evolving digital markets and gig economies. The Origination Clause raises questions about the procedural legitimacy of revenue bills, especially as Congress utilizes complex budget reconciliation processes that may circumvent traditional origination rules. Future implications involve balancing federal authority to address national economic challenges with preserving procedural safeguards in legislation, influencing constitutional interpretations and policymaking strategies.

Commerce Clause Infographic

libterm.com

libterm.com