A settlor is a person who creates a trust by transferring assets into it for the benefit of beneficiaries, defining how the property should be managed and distributed. Understanding the role and responsibilities of a settlor is crucial for effective estate planning and ensuring your wishes are honored. Explore the rest of this article to learn how a settlor impacts trust structure and beneficiary rights.

Table of Comparison

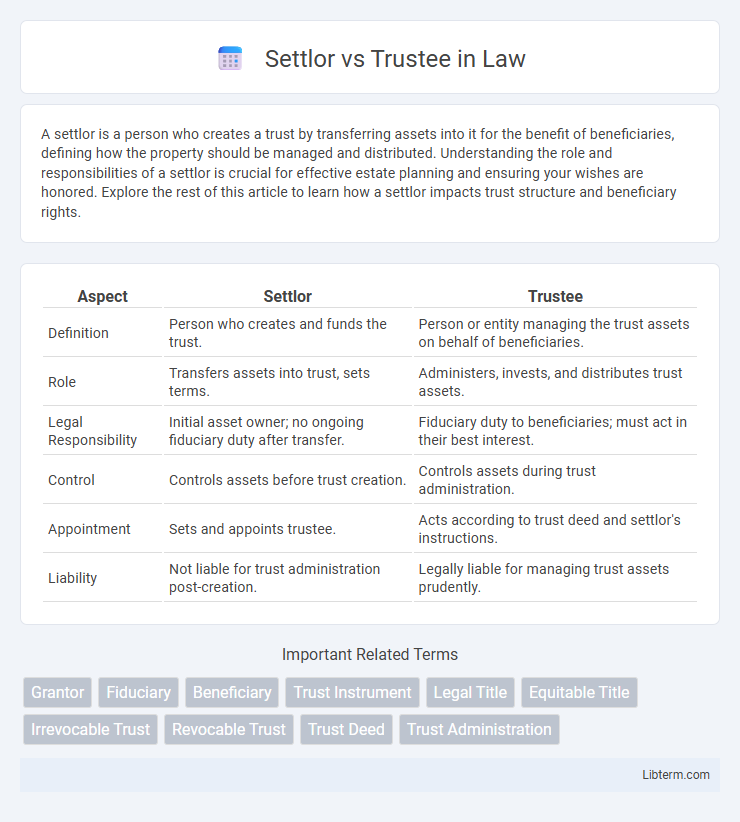

| Aspect | Settlor | Trustee |

|---|---|---|

| Definition | Person who creates and funds the trust. | Person or entity managing the trust assets on behalf of beneficiaries. |

| Role | Transfers assets into trust, sets terms. | Administers, invests, and distributes trust assets. |

| Legal Responsibility | Initial asset owner; no ongoing fiduciary duty after transfer. | Fiduciary duty to beneficiaries; must act in their best interest. |

| Control | Controls assets before trust creation. | Controls assets during trust administration. |

| Appointment | Sets and appoints trustee. | Acts according to trust deed and settlor's instructions. |

| Liability | Not liable for trust administration post-creation. | Legally liable for managing trust assets prudently. |

Understanding the Roles: Settlor vs Trustee

The settlor is the individual who creates and funds a trust, transferring assets to be managed according to the terms specified in the trust deed. The trustee, on the other hand, holds legal title to the trust property and is responsible for managing the assets in the best interest of the beneficiaries while adhering to fiduciary duties. Clear differentiation between the settlor's role in establishing the trust and the trustee's role in administering it is essential for effective trust management and legal compliance.

Key Definitions: Who is a Settlor?

A Settlor is an individual or entity that creates a trust by transferring assets or property to a trustee for the benefit of beneficiaries. The Settlor sets the terms and conditions of the trust through a trust deed or agreement, outlining how the trust assets should be managed and distributed. Unlike the trustee, the Settlor does not manage the trust after its creation but initiates the legal framework that governs the trust's operation.

Key Definitions: Who is a Trustee?

A trustee is an individual or entity legally appointed to manage and administer assets held in a trust for the benefit of beneficiaries, adhering to fiduciary duties and the terms set by the trust document. Unlike the settlor, who creates and funds the trust, the trustee controls and invests the trust assets, ensuring proper distribution according to the trust agreement. Trustees must act prudently, loyally, and in good faith, maintaining transparency and accountability throughout the trust's duration.

Primary Duties of a Settlor

The primary duties of a settlor involve creating and funding the trust by transferring assets and clearly defining the trust's terms and objectives. The settlor must ensure the trust document accurately reflects their intentions and complies with legal requirements. Unlike the trustee, who manages and administers the trust, the settlor's role is mainly establishing the trust framework and providing initial capital.

Primary Responsibilities of a Trustee

A trustee's primary responsibilities include managing trust assets prudently, adhering to the terms set by the settlor, and acting in the best interests of the beneficiaries. Trustees must ensure accurate record-keeping, timely distribution of income or principal, and compliance with relevant fiduciary laws. They also have a duty to avoid conflicts of interest and maintain transparency throughout trust administration.

Legal Powers: Settlor vs Trustee

The settlor holds the authority to establish the trust and define its terms but typically relinquishes control over trust assets once the trust is operational. Trustees possess legal powers to manage, invest, and distribute trust assets according to the trust document while adhering to fiduciary duties. Courts generally enforce trustees' discretionary power but may intervene if trustees breach their fiduciary responsibilities or act outside granted powers.

Rights and Limitations of Settlors

Settlors hold the primary right to establish a trust and define its terms, including the distribution of assets and the appointment of trustees. However, once the trust is established and assets are transferred, settlors typically lose direct control over the trust property, limiting their ability to alter or revoke the trust unless explicitly reserved in a revocable trust agreement. Trust law and jurisdiction-specific regulations impose limitations on settlors to prevent undue influence or conflicts of interest, ensuring that trustees administer the trust in the best interests of the beneficiaries.

Rights and Obligations of Trustees

Trustees hold fiduciary duties to administer the trust assets in accordance with the trust deed and applicable laws, ensuring the best interests of beneficiaries. They possess rights to manage, invest, and protect trust property while being obligated to maintain impartiality, avoid conflicts of interest, and provide transparent accounting. Failure to uphold these responsibilities can result in legal liabilities and removal from their trustee role.

Case Examples: Settlor and Trustee in Practice

In the landmark case of Saunders v Vautier (1841), the settlor's power was upheld when beneficiaries unanimously agreed to terminate a trust, illustrating the settlor's control in trust management. In contrast, in the case of Re Astor's Settlement Trusts (1952), the trustee's duty to ensure clarity and certainty of trust terms was emphasized, highlighting the trustee's obligation to administer the trust in accordance with legal principles. These cases demonstrate how settlors establish trust terms and trustees execute fiduciary responsibilities, balancing control and administration in practice.

Choosing Between Being a Settlor or a Trustee

Choosing between being a settlor or a trustee hinges on control versus responsibility; settlors establish the trust and define its terms, maintaining initial authority over the assets, while trustees manage and administer the trust according to those terms, bearing fiduciary duties and legal obligations. Settlor roles are typically suited for individuals seeking to dictate the future use of assets without ongoing management responsibilities, whereas trustee roles appeal to those willing to oversee the trust's operation and protect beneficiaries' interests. Understanding the legal implications, including liability exposure and administrative burdens, is crucial in making an informed decision.

Settlor Infographic

libterm.com

libterm.com