Finding relevant information quickly is essential for making informed decisions in today's fast-paced world. Efficient search techniques and reliable sources can streamline your research process. Explore the rest of this article to uncover the best strategies for effective information finding.

Table of Comparison

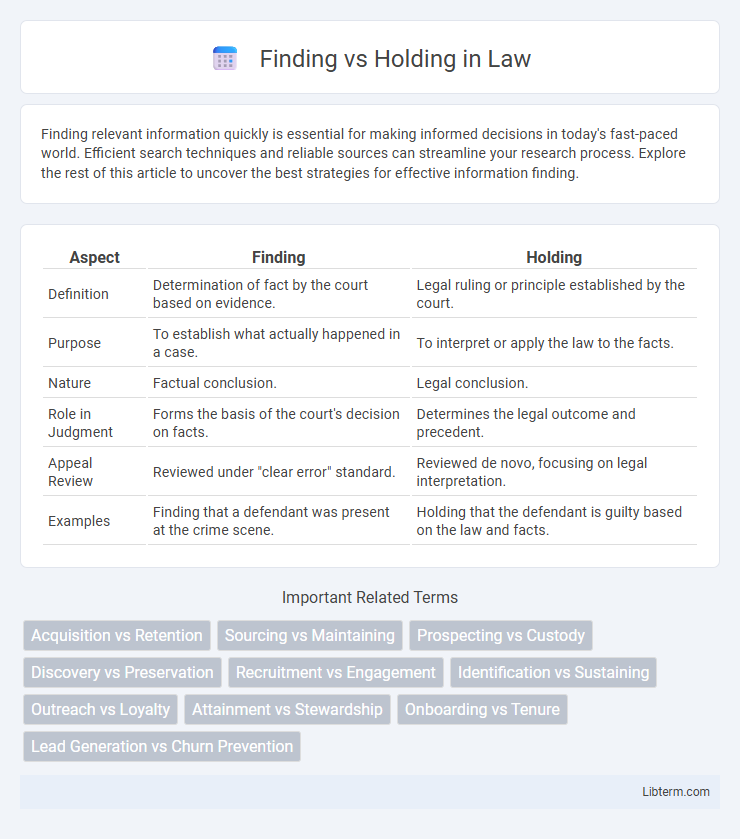

| Aspect | Finding | Holding |

|---|---|---|

| Definition | Determination of fact by the court based on evidence. | Legal ruling or principle established by the court. |

| Purpose | To establish what actually happened in a case. | To interpret or apply the law to the facts. |

| Nature | Factual conclusion. | Legal conclusion. |

| Role in Judgment | Forms the basis of the court's decision on facts. | Determines the legal outcome and precedent. |

| Appeal Review | Reviewed under "clear error" standard. | Reviewed de novo, focusing on legal interpretation. |

| Examples | Finding that a defendant was present at the crime scene. | Holding that the defendant is guilty based on the law and facts. |

Understanding the Difference: Finding vs Holding

Finding refers to the initial discovery or identification of valuable opportunities, assets, or information, whereas holding involves maintaining possession or control over these assets for a period of time. In investment contexts, finding signifies locating promising stocks or properties, while holding relates to the strategy of retaining them to realize potential growth or returns. Understanding the difference between finding and holding is crucial for optimizing decision-making and long-term success in asset management or investment portfolios.

The Psychology Behind Seeking and Retaining

The psychology behind seeking and retaining explores the cognitive and emotional mechanisms that drive individuals to pursue new experiences or goals (finding) versus the motivations to maintain and protect existing achievements or relationships (holding). Dopamine pathways in the brain incentivize the pursuit of novelty and reward, whereas oxytocin and attachment-related neural circuits promote bonding and long-term retention. Understanding these psychological dynamics reveals how balancing exploration with stability is crucial for mental well-being and adaptive decision-making.

Key Challenges in Finding vs Holding

Key challenges in finding involve accurately identifying valuable opportunities amidst vast, incomplete, or noisy data, requiring advanced analytical tools and precise criteria to avoid costly errors. In contrast, holding challenges center on maintaining long-term value through consistent performance, adapting to evolving market conditions, and managing risks like volatility or operational inefficiencies. Balancing timely decision-making in finding with sustained commitment in holding demands robust strategies integrating data-driven insights and dynamic resource allocation.

Strategies for Effective Finding

Effective finding strategies emphasize targeted research and the use of advanced tools such as AI-driven analytics and data mining to uncover relevant information quickly. Leveraging keyword optimization, semantic search techniques, and precise filtering enhances the accuracy and relevance of search results. Consistent evaluation and refinement of search parameters ensure sustained efficiency and improved decision-making outcomes.

Best Practices for Successful Holding

Successful holding requires implementing best practices such as maintaining proper storage conditions, regularly inspecting the holdings for quality, and employing accurate record-keeping systems. Ensuring optimal temperature, humidity, and light exposure helps preserve product integrity over time. Utilizing inventory management software enhances tracking and minimizes losses during the holding period.

When to Find and When to Hold: Decision-Making Tips

Finding the right investment opportunities requires market research, timing, and risk assessment, whereas holding focuses on patience and evaluating long-term potential. Investors should find new assets when market conditions signal growth potential or undervaluation, while holding applies during stable economic periods with consistent asset appreciation. Effective decision-making combines financial analysis, market trends, and personal risk tolerance to maximize returns.

Common Mistakes in Finding and Holding

Common mistakes in finding involve relying on inadequate lead qualification, resulting in wasted time on unpromising prospects and skewed sales pipelines. In holding, poor follow-up strategies and neglecting customer engagement lead to decreased retention rates and missed upselling opportunities. Effective finding requires targeted data analysis, while holding demands consistent, personalized communication to sustain long-term client relationships.

Tools and Techniques for Optimizing Both

Leveraging advanced data analytics tools and machine learning algorithms enhances decision-making in both finding and holding valuable assets, enabling more precise targeting and retention strategies. Techniques such as predictive modeling, customer segmentation, and real-time monitoring optimize acquisition processes while improving engagement and loyalty. Integrating CRM platforms with automation and AI-driven insights streamlines workflows, ensuring efficient resource allocation and sustained value capture.

Balancing Discovery and Retention

Finding strategies emphasize discovering new opportunities and assets, driving growth through exploration and innovation. Holding focuses on retention and maximizing value from existing resources, ensuring stability and long-term benefits. A balanced approach integrates both, optimizing resource allocation by continuously acquiring new prospects while maintaining and nurturing current holdings for sustainable success.

Real-World Examples: Finding vs Holding in Action

Finding skills are exemplified by investors identifying early-stage companies like Amazon in the 1990s, capitalizing on growth potential before market awareness peaks. Holding strategies shine in Warren Buffett's long-term investment approach with Coca-Cola, where sustained value appreciation and dividends reward patience. These real-world cases illustrate how finding uncovers growth opportunities while holding maximizes wealth through strategic endurance.

Finding Infographic

libterm.com

libterm.com