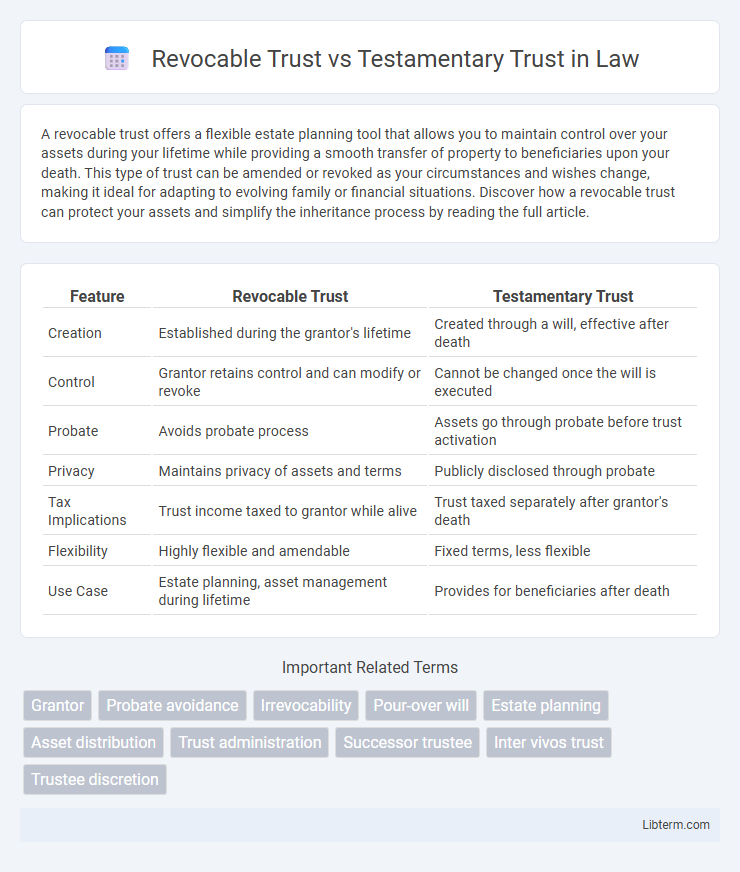

A revocable trust offers a flexible estate planning tool that allows you to maintain control over your assets during your lifetime while providing a smooth transfer of property to beneficiaries upon your death. This type of trust can be amended or revoked as your circumstances and wishes change, making it ideal for adapting to evolving family or financial situations. Discover how a revocable trust can protect your assets and simplify the inheritance process by reading the full article.

Table of Comparison

| Feature | Revocable Trust | Testamentary Trust |

|---|---|---|

| Creation | Established during the grantor's lifetime | Created through a will, effective after death |

| Control | Grantor retains control and can modify or revoke | Cannot be changed once the will is executed |

| Probate | Avoids probate process | Assets go through probate before trust activation |

| Privacy | Maintains privacy of assets and terms | Publicly disclosed through probate |

| Tax Implications | Trust income taxed to grantor while alive | Trust taxed separately after grantor's death |

| Flexibility | Highly flexible and amendable | Fixed terms, less flexible |

| Use Case | Estate planning, asset management during lifetime | Provides for beneficiaries after death |

Introduction to Revocable and Testamentary Trusts

Revocable trusts are legal arrangements created during a grantor's lifetime, allowing them to retain control over assets and modify or revoke the trust as needed. Testamentary trusts are established through a will and only take effect after the grantor's death, providing structured asset management according to the will's terms. Both trust types serve estate planning purposes but differ primarily in timing and flexibility of asset control.

Definition of Revocable Trust

A revocable trust is a legal arrangement where the grantor retains control over the trust assets and can modify or revoke the trust during their lifetime. This type of trust allows for flexible management of property and helps avoid probate upon the grantor's death. Unlike testamentary trusts, which are established through a will and become effective only after death, revocable trusts operate immediately upon creation.

Definition of Testamentary Trust

A testamentary trust is a legal arrangement created through a will that only becomes effective upon the death of the trustor. Unlike a revocable trust, which is established and operational during the trustor's lifetime, a testamentary trust operates under the terms specified in the will to manage and distribute assets according to the trustor's wishes after passing. This type of trust is often used to provide ongoing financial support to beneficiaries while ensuring proper estate management through probate.

Key Differences Between Revocable and Testamentary Trusts

Revocable trusts provide flexible asset management during the grantor's lifetime and can be amended or revoked at any time, whereas testamentary trusts are created through a will and only take effect after the grantor's death. Revocable trusts avoid probate, enabling quicker distribution to beneficiaries, while testamentary trusts require probate, potentially causing delays. Tax implications differ as well: revocable trusts offer limited tax benefits during life, whereas testamentary trusts may offer estate tax planning advantages after death.

Advantages of Revocable Trusts

Revocable trusts offer the advantage of maintaining flexibility by allowing the grantor to modify or revoke the trust during their lifetime, which ensures control over assets and adaptability to changing circumstances. They enable seamless probate avoidance, leading to faster and more private asset distribution compared to testamentary trusts that only take effect after death. Furthermore, revocable trusts provide greater privacy since they do not become part of the public probate record, enhancing confidentiality for beneficiaries.

Benefits of Testamentary Trusts

Testamentary trusts provide significant benefits such as controlling asset distribution after death, protecting beneficiaries from creditors, and offering tax advantages by allocating income to beneficiaries in lower tax brackets. They are established through a will and become effective only after the grantor's death, allowing flexibility in managing estate tax implications and safeguarding assets for minors or individuals with special needs. This type of trust also ensures that the trust terms can adapt to changes in family circumstances without requiring immediate trust creation during the grantor's lifetime.

Tax Implications: Revocable vs Testamentary Trust

Revocable trusts provide minimal tax benefits during the grantor's lifetime as income is typically reported on the grantor's personal tax return, whereas testamentary trusts are separate tax entities subject to their own tax rates once established after the grantor's death. Testamentary trusts may offer potential income tax advantages by allocating income among beneficiaries, potentially lowering overall tax liability. Estate taxes can differ significantly; assets in a revocable trust remain part of the taxable estate, while testamentary trusts allow for more strategic estate tax planning and creditor protection.

Probate Process and Trusts

Revocable trusts allow assets to bypass the probate process, enabling quicker distribution to beneficiaries and maintaining privacy, whereas testamentary trusts are established through a will and require probate, often resulting in longer delays and public scrutiny. The probate court supervises the administration of testamentary trusts, ensuring legal compliance but potentially increasing costs and timeframes. Opting for a revocable trust streamlines estate settlement by avoiding probate, making it a preferred choice for minimizing estate administration complexities.

Choosing the Right Trust for Your Estate Plan

Choosing the right trust for your estate plan depends on your goals and timeline; a revocable trust offers flexibility and immediate control over assets during your lifetime, while a testamentary trust takes effect only after your death as specified in your will. Revocable trusts help avoid probate and provide privacy, making them ideal for managing assets and incapacity planning. Testamentary trusts suit those who want to establish conditions for asset distribution to beneficiaries, such as minors or individuals requiring oversight.

Conclusion: Which Trust Is Best for You?

A revocable trust offers flexibility and privacy by allowing changes during your lifetime without court involvement, making it ideal for those seeking control and efficient estate management. Testamentary trusts, created through a will and effective only after death, provide more oversight and creditor protection, often benefiting individuals with complex family or tax situations. Choosing between the two depends on your need for control, privacy, and asset protection, with revocable trusts favoring adaptability and testamentary trusts emphasizing post-mortem management and protection.

Revocable Trust Infographic

libterm.com

libterm.com