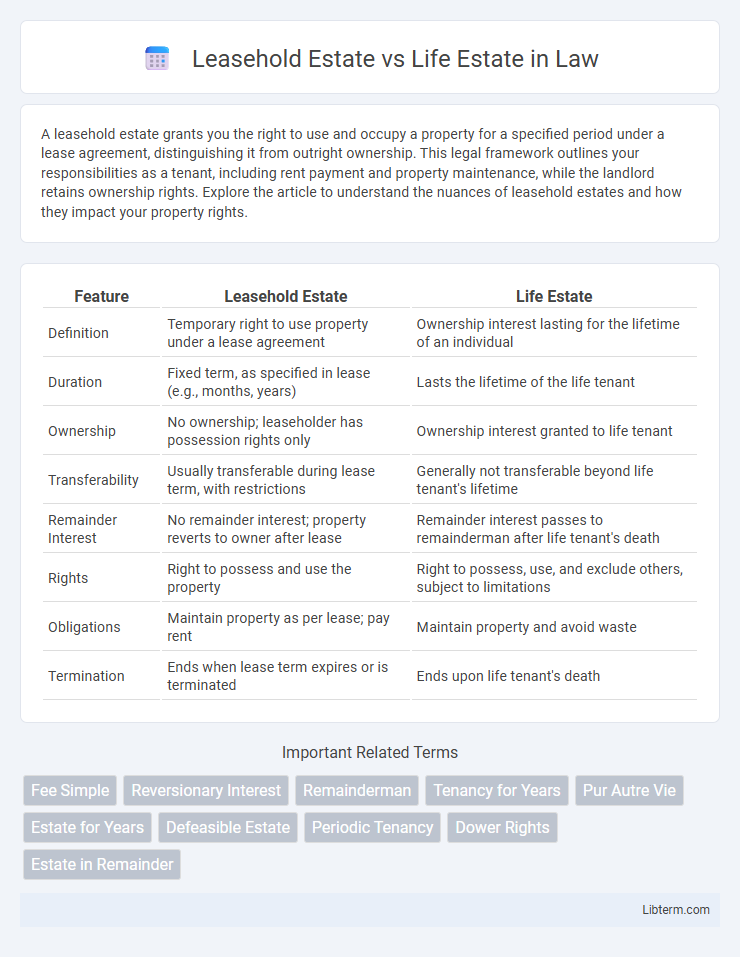

A leasehold estate grants you the right to use and occupy a property for a specified period under a lease agreement, distinguishing it from outright ownership. This legal framework outlines your responsibilities as a tenant, including rent payment and property maintenance, while the landlord retains ownership rights. Explore the article to understand the nuances of leasehold estates and how they impact your property rights.

Table of Comparison

| Feature | Leasehold Estate | Life Estate |

|---|---|---|

| Definition | Temporary right to use property under a lease agreement | Ownership interest lasting for the lifetime of an individual |

| Duration | Fixed term, as specified in lease (e.g., months, years) | Lasts the lifetime of the life tenant |

| Ownership | No ownership; leaseholder has possession rights only | Ownership interest granted to life tenant |

| Transferability | Usually transferable during lease term, with restrictions | Generally not transferable beyond life tenant's lifetime |

| Remainder Interest | No remainder interest; property reverts to owner after lease | Remainder interest passes to remainderman after life tenant's death |

| Rights | Right to possess and use the property | Right to possess, use, and exclude others, subject to limitations |

| Obligations | Maintain property as per lease; pay rent | Maintain property and avoid waste |

| Termination | Ends when lease term expires or is terminated | Ends upon life tenant's death |

Understanding Leasehold Estate: Definition and Key Features

Leasehold estate grants tenants the right to occupy property for a fixed term under a lease agreement, typically ranging from months to years, without owning the land. Key features include a defined lease duration, obligation to pay rent, and limited property rights compared to freehold ownership. Unlike life estates, which depend on the life span of an individual, leasehold estates terminate upon lease expiration, reverting possession to the landlord.

Life Estate Explained: Overview and Core Characteristics

A life estate grants an individual ownership rights for the duration of their lifetime, allowing them to use and benefit from the property without transferring full ownership. Upon the life tenant's death, the property automatically passes to the remainderman or reverts to the original grantor, ensuring clear succession. Key characteristics include limited transferability, no power to waste or damage the property, and the temporary nature tied exclusively to the life tenant's lifespan.

Legal Framework: How Leasehold and Life Estates Differ

Leasehold estates grant tenants possession and use of property for a fixed term based on a lease agreement, establishing a contractual relationship with the landlord, while ownership rights remain with the lessor. Life estates convey property interests measured by the lifetime of the life tenant, providing possessory rights until the tenant's death, after which the property reverts to the remainderman or grantor. Leasehold estates are governed primarily by landlord-tenant laws and lease contracts, whereas life estates are created and regulated under property and inheritance law, emphasizing duration linked to the life tenant's existence.

Duration of Interest: Temporary vs Lifetime Ownership

A leasehold estate grants tenants a temporary interest in property for a specified period, such as months or years, with no ownership rights beyond the lease term. In contrast, a life estate provides an individual with ownership rights lasting for the duration of their lifetime, after which the property typically reverts to a remainderman or grantor. This fundamental difference in duration distinguishes leasehold estates as limited-term interests and life estates as lifetime ownership interests.

Rights and Responsibilities of Leasehold Tenants

Leasehold tenants in a leasehold estate have the right to exclusive possession of the property for a specified term, while being responsible for paying rent and maintaining the premises according to the lease agreement. These tenants cannot alter the property's structure without the landlord's consent and must adhere to all terms stipulated in the lease. Life estate holders possess rights to use and benefit from the property for their lifetime but cannot transfer ownership, whereas leasehold tenants have limited duration rights defined by their lease contract.

Life Tenant Rights and Obligations

A life tenant holds the right to possess, use, and derive income from the property during their lifetime but must maintain the estate and avoid committing waste that diminishes its value. They are obligated to pay property taxes, insurance, and perform ordinary repairs to preserve the property for the remainderman or reversioner. Upon the life tenant's death, the property interest automatically transfers to the designated remainderman or reverts to the original grantor.

Transferability and Inheritance: What Happens at Termination?

A leasehold estate grants temporary possession of property with limited transferability and automatic termination upon lease expiry, reverting rights to the landlord. A life estate allows transfer during the owner's lifetime but terminates at death, passing ownership to the remainderman or reverting to the grantor. Leasehold interests are typically non-inheritable, whereas life estates involve inheritance provisions tied to the terms set at creation.

Financial Implications: Costs, Taxes, and Value Assessment

Leasehold estates typically involve fixed rental payments and potential lease-related fees, with expenses deducted as operational costs, while property taxes generally remain the responsibility of the landlord. Life estates transfer ownership interests that may affect property taxes based on the holder's usage rights and could complicate valuation due to contingent future interests. Financial assessment of leasehold estates often centers on lease terms and market rent, whereas life estates require consideration of actuarial life expectancy and reversionary interests impacting market value and tax liabilities.

Common Uses and Practical Applications in Real Estate

Leasehold estates are commonly used in commercial and residential real estate to grant tenants the right to occupy property for a specified term, facilitating rental agreements and property development without transferring ownership. Life estates are frequently applied in estate planning and elder care, allowing property owners to transfer ownership while retaining the right to use the property during their lifetime, thereby ensuring stability and control. Both estate types serve strategic roles in property management, investment, and inheritance planning by balancing possession rights and ownership interests.

Choosing Between Leasehold Estate and Life Estate: Key Considerations

Choosing between a leasehold estate and a life estate involves evaluating duration, control, and transferability of property rights. Leasehold estates grant tenants possession for a fixed term, offering predictable timeframes but limited ownership rights, whereas life estates provide ownership for the duration of an individual's life with reversion to heirs, making it ideal for estate planning. Consider tax implications, ability to mortgage, and intended use of the property to determine which estate aligns best with long-term goals and legal flexibility.

Leasehold Estate Infographic

libterm.com

libterm.com