Trusteeship involves the management and oversight of assets or responsibilities entrusted to an individual or organization, ensuring they act in the best interest of beneficiaries. It requires a deep understanding of fiduciary duties, legal obligations, and ethical standards to safeguard and grow the entrusted resources effectively. Discover how trusteeship can impact your financial future and the responsibilities it entails by reading the full article.

Table of Comparison

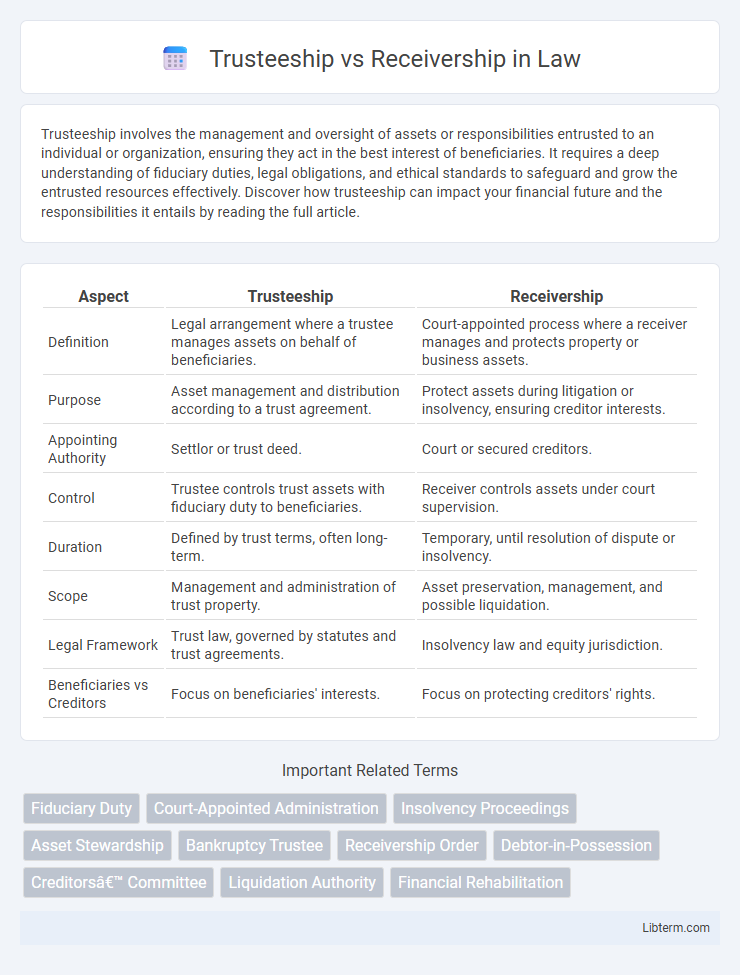

| Aspect | Trusteeship | Receivership |

|---|---|---|

| Definition | Legal arrangement where a trustee manages assets on behalf of beneficiaries. | Court-appointed process where a receiver manages and protects property or business assets. |

| Purpose | Asset management and distribution according to a trust agreement. | Protect assets during litigation or insolvency, ensuring creditor interests. |

| Appointing Authority | Settlor or trust deed. | Court or secured creditors. |

| Control | Trustee controls trust assets with fiduciary duty to beneficiaries. | Receiver controls assets under court supervision. |

| Duration | Defined by trust terms, often long-term. | Temporary, until resolution of dispute or insolvency. |

| Scope | Management and administration of trust property. | Asset preservation, management, and possible liquidation. |

| Legal Framework | Trust law, governed by statutes and trust agreements. | Insolvency law and equity jurisdiction. |

| Beneficiaries vs Creditors | Focus on beneficiaries' interests. | Focus on protecting creditors' rights. |

Introduction to Trusteeship and Receivership

Trusteeship involves the appointment of a trustee to manage assets or property on behalf of beneficiaries, ensuring fiduciary duties and legal responsibilities are upheld. Receivership refers to the legal process where a receiver is appointed by a court to take custody and control of property or business operations, typically during insolvency or dispute resolution. Both roles serve to protect stakeholders' interests but differ in scope, authority, and purpose within financial and legal frameworks.

Key Definitions: Trusteeship vs Receivership

Trusteeship refers to the legal arrangement where a trustee manages assets or property on behalf of beneficiaries, ensuring fiduciary duties and compliance with the trust's terms. Receivership involves the appointment of a receiver by a court to take control of a company's assets during litigation or insolvency to protect creditors' interests. While trusteeship emphasizes ongoing management and distribution within a trust structure, receivership focuses on preserving and administering assets during financial distress or legal disputes.

Legal Framework Governing Trusteeship

The legal framework governing trusteeship is primarily derived from trust law, which establishes fiduciary duties, the scope of authority, and beneficiary rights to ensure assets are managed responsibly and transparently. Trustees must adhere to statutory regulations, such as the Uniform Trust Code (UTC) in the United States, which codifies duties of loyalty, prudence, and impartiality in administering the trust. Unlike receivership, which involves court-appointed management during insolvency and operates under bankruptcy law, trusteeship functions within private or statutory trust agreements to oversee asset preservation and distribution.

Legal Framework Governing Receivership

Receivership is governed by a specific legal framework that allows a court to appoint a receiver to manage and preserve the assets of a financially distressed entity, often under insolvency or foreclosure laws. This framework outlines the receiver's authority, duties, and the process for asset management or liquidation to protect creditor interests. In contrast, trusteeship, typically seen in bankruptcy cases, operates under a different set of bankruptcy laws where a trustee administers the debtor's estate for equitable distribution to creditors.

Roles and Responsibilities of a Trustee

A trustee manages and protects assets on behalf of beneficiaries with fiduciary duty, ensuring they act in the best interest of the trust according to legal and ethical standards. Trustees oversee asset distribution, maintain accurate records, file necessary tax returns, and may make investment decisions aligned with the trust's terms. Unlike receivers who manage distressed assets primarily for creditors, trustees focus on preserving trust value and fulfilling the grantor's intentions.

Duties and Powers of a Receiver

A receiver is appointed by a court or creditor to take control of and manage a debtor's assets during insolvency or dispute resolution, with duties including preserving property value, collecting income, and paying expenses. The powers of a receiver typically involve operating the business, selling assets to satisfy creditors, and enforcing security interests, all under court supervision. Unlike trustees, receivers primarily focus on asset management and recovery rather than overall estate administration or distribution.

Appointment Process: Trustee vs Receiver

The appointment process of a trustee involves formal court approval based on insolvency proceedings, where the trustee is selected to manage and liquidate assets under bankruptcy laws. Receivers are typically appointed by secured creditors or by court order to take control of specific property or assets, with a focus on preserving value or enforcing security interests. Trustees act under statutory authority with fiduciary duties to creditors, while receivers operate under contractual or judicial mandates limited to particular assets.

Advantages and Disadvantages of Trusteeship

Trusteeship offers advantages such as professional management of assets, enhanced creditor confidence, and structured debt repayment plans, which facilitate business rehabilitation. However, it also presents disadvantages including potential loss of control for original owners, lengthy processes, and significant administrative costs that may burden the debtor. The balance between these factors determines the effectiveness of trusteeship in resolving financial distress compared to receivership.

Pros and Cons of Receivership

Receivership provides court-appointed control over troubled assets, enabling efficient management and protection of creditor interests during insolvency or legal disputes. Its pros include swift asset preservation and potential for maximizing recovery value, while cons involve loss of owner control, possible conflicts of interest, and high administrative costs. This process is especially useful in complex financial distress but may prolong resolution and impact business reputation negatively.

Choosing Between Trusteeship and Receivership

Choosing between trusteeship and receivership depends on the nature of the financial or legal issue at hand, the desired level of control, and the objectives for asset management or debt resolution. Trusteeship typically involves a fiduciary appointed to manage assets or a trust with a focus on maximizing value for beneficiaries, while receivership assigns a receiver to take control of property or operations often during litigation or insolvency to preserve assets and satisfy creditors. Evaluating factors such as court involvement, creditor priorities, and long-term goals is critical for selecting the most appropriate mechanism for asset administration or business restructuring.

Trusteeship Infographic

libterm.com

libterm.com