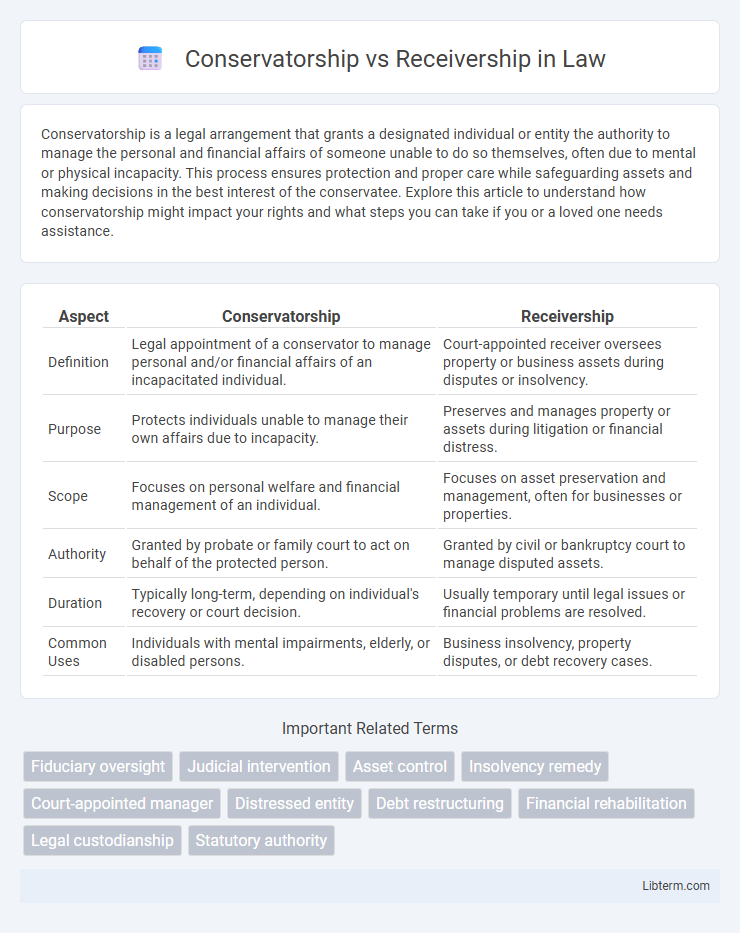

Conservatorship is a legal arrangement that grants a designated individual or entity the authority to manage the personal and financial affairs of someone unable to do so themselves, often due to mental or physical incapacity. This process ensures protection and proper care while safeguarding assets and making decisions in the best interest of the conservatee. Explore this article to understand how conservatorship might impact your rights and what steps you can take if you or a loved one needs assistance.

Table of Comparison

| Aspect | Conservatorship | Receivership |

|---|---|---|

| Definition | Legal appointment of a conservator to manage personal and/or financial affairs of an incapacitated individual. | Court-appointed receiver oversees property or business assets during disputes or insolvency. |

| Purpose | Protects individuals unable to manage their own affairs due to incapacity. | Preserves and manages property or assets during litigation or financial distress. |

| Scope | Focuses on personal welfare and financial management of an individual. | Focuses on asset preservation and management, often for businesses or properties. |

| Authority | Granted by probate or family court to act on behalf of the protected person. | Granted by civil or bankruptcy court to manage disputed assets. |

| Duration | Typically long-term, depending on individual's recovery or court decision. | Usually temporary until legal issues or financial problems are resolved. |

| Common Uses | Individuals with mental impairments, elderly, or disabled persons. | Business insolvency, property disputes, or debt recovery cases. |

Introduction: Defining Conservatorship and Receivership

Conservatorship and receivership are legal frameworks designed to manage the affairs of individuals or entities unable to do so themselves. Conservatorship generally applies to individuals who require protection due to physical or mental incapacity, granting a conservator authority over personal and financial decisions. Receivership, often used in corporate or financial contexts, involves appointing a receiver to oversee and preserve assets during legal disputes or insolvency proceedings.

Key Differences Between Conservatorship and Receivership

Conservatorship involves court-appointed management of an individual's personal and financial affairs when they are unable to do so, often due to incapacity, whereas receivership is a court-ordered process primarily focused on managing and protecting assets during legal disputes or insolvency. In conservatorship, the conservator has fiduciary duties to the conservatee, managing daily living needs and finances, while a receiver acts as a neutral custodian overseeing property or business operations to preserve value for creditors or stakeholders. Key distinctions include the scope of authority--personal vs. business asset management--and the underlying purpose: protecting an individual's welfare versus resolving financial or legal claims.

Legal Frameworks Guiding Each Process

Conservatorship is governed by state-specific statutes that establish the appointment of a conservator to manage the personal and financial affairs of an incapacitated individual, emphasizing fiduciary duty and court supervision. Receivership operates under both state and federal laws, involving a court-appointed receiver to take control of property or business assets primarily to resolve insolvency, enforce judgments, or protect creditors' interests. Distinct legal frameworks dictate procedural requirements, scope of authority, and duration for each process, ensuring safeguards for affected parties within judicial oversight.

Common Scenarios for Conservatorship Use

Conservatorships are commonly used in cases where individuals are unable to manage their personal affairs or finances due to mental or physical impairments, such as elderly adults with dementia or incapacitated minors. Courts assign conservators to protect and manage the well-being and estate of the conservatee, ensuring essential decisions are made in their best interest. This legal arrangement is frequently applied in scenarios involving elder care, disability, and mental health where ongoing supervision is necessary.

Typical Circumstances Triggering Receivership

Receivership is typically triggered when a company faces severe financial distress, such as bankruptcy, insolvency, or significant mismanagement leading to asset depletion. Courts appoint a receiver to take control of the company's assets to protect creditors' interests and maximize recovery value. This contrasts with conservatorship, which often involves regulatory intervention to oversee and stabilize a financially troubled institution without transferring asset ownership.

Roles and Responsibilities of Conservators vs. Receivers

Conservators oversee the personal and financial affairs of individuals unable to manage their own due to incapacitation or disability, ensuring their well-being and asset protection. Receivers are appointed by courts to manage, preserve, or liquidate assets, often in business disputes or insolvencies, to safeguard creditors' interests. While conservators prioritize holistic care and asset management for a person, receivers concentrate on asset control and recovery within legal contexts.

Impact on Businesses and Stakeholders

Conservatorship involves court-appointed management where the conservator takes control of a company's operations to restore financial stability, often preserving stakeholder interests by actively managing assets and liabilities. Receivership, by contrast, typically entails the liquidation or restructuring of the entity under a receiver's supervision, prioritizing creditor claims and potentially resulting in significant operational disruptions. Both mechanisms directly impact business continuity, stakeholder confidence, and asset valuation, with conservatorships tending to maintain ongoing business operations, while receiverships often lead to asset sale or dissolution.

Court Involvement and Oversight in Both Structures

Conservatorship involves a court-appointed individual or entity managing the personal and financial affairs of an incapacitated person under close judicial supervision. Receivership entails a court-appointed receiver taking control of a company's assets to preserve value and manage disputes, with ongoing court oversight to ensure proper administration. Both structures rely heavily on court involvement to authorize actions, enforce compliance, and provide remedies in cases of mismanagement or abuse.

Termination and Resolution of Conservatorship and Receivership

Termination of conservatorship occurs when the court determines the conservatee has regained capacity or no longer requires supervision, resulting in the restoration of their legal rights and control over personal and financial matters. Receivership ends when the court finds that the receiver has fulfilled their duties, typically involving the resolution of outstanding liabilities, liquidation of assets, or stabilization of the entity under receivership. Both processes require formal court orders to discharge the conservator or receiver and return management or ownership back to the appropriate parties.

Choosing the Right Option: Factors to Consider

Choosing between conservatorship and receivership depends on the nature of the asset or entity involved, the extent of control needed, and the legal framework governing the situation. Conservatorship is typically suited for managing personal affairs or finances of individuals unable to do so themselves, while receivership is often applied in corporate or financial distress scenarios to protect creditors or stakeholders. Evaluating the specific circumstances, such as the asset type, stakeholder interests, and court jurisdiction, is essential for selecting the appropriate legal mechanism.

Conservatorship Infographic

libterm.com

libterm.com