A beneficiary is an individual or entity designated to receive benefits or assets from a will, trust, insurance policy, or retirement plan. Understanding who qualifies as a beneficiary and the rights associated with that designation is essential for effective estate planning and asset management. Explore the rest of the article to learn how beneficiary designations impact your financial future.

Table of Comparison

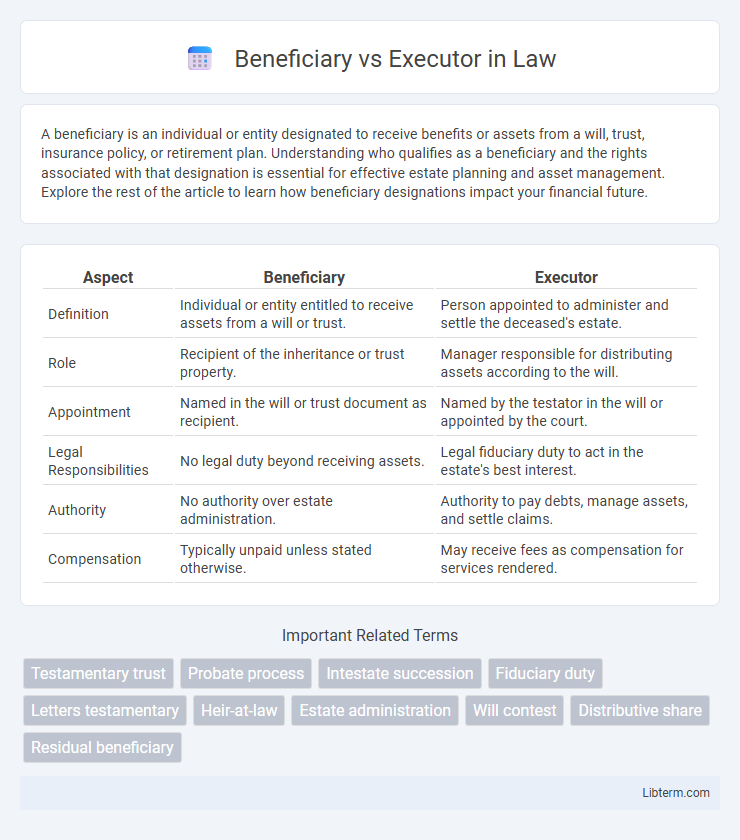

| Aspect | Beneficiary | Executor |

|---|---|---|

| Definition | Individual or entity entitled to receive assets from a will or trust. | Person appointed to administer and settle the deceased's estate. |

| Role | Recipient of the inheritance or trust property. | Manager responsible for distributing assets according to the will. |

| Appointment | Named in the will or trust document as recipient. | Named by the testator in the will or appointed by the court. |

| Legal Responsibilities | No legal duty beyond receiving assets. | Legal fiduciary duty to act in the estate's best interest. |

| Authority | No authority over estate administration. | Authority to pay debts, manage assets, and settle claims. |

| Compensation | Typically unpaid unless stated otherwise. | May receive fees as compensation for services rendered. |

Understanding Beneficiaries and Executors

Beneficiaries are individuals or entities designated to receive assets or benefits from a will or trust, while executors are appointed to manage and distribute the estate according to the deceased's wishes. Understanding beneficiaries involves recognizing their rights to receive specified inheritances, whereas comprehending the executor's role centers on their fiduciary duty to settle debts, manage estate assets, and ensure legal compliance. Clear differentiation between beneficiaries and executors is essential for effective estate planning and administration.

Key Roles and Responsibilities

A beneficiary is an individual or entity entitled to receive assets or benefits from a trust, will, or insurance policy, whereas an executor is appointed to administer the deceased's estate, ensuring debts are paid and assets are distributed according to the will. The executor handles legal responsibilities such as filing probate, managing estate taxes, and safeguarding assets until distribution. Beneficiaries primarily receive the inheritance but do not manage or oversee the estate's legal and financial processes.

Appointment and Selection Process

The appointment of an executor is typically specified in a will by the testator, who selects a trusted individual or institution to administer the estate according to legal requirements. Beneficiaries, on the other hand, are named recipients of assets or benefits within the will or trust, but they have no direct role in the estate administration process. Executors must often be formally appointed by a probate court to ensure they have the legal authority to manage and distribute the deceased's assets, whereas beneficiaries automatically receive their designated inheritance without a separate appointment process.

Legal Definitions and Distinctions

A beneficiary is a person or entity entitled to receive assets or benefits from a trust, will, or insurance policy, holding a legal right to the inheritance or proceeds. An executor is an individual appointed by a will or court to administer the estate, responsible for managing assets, paying debts, and distributing the estate to beneficiaries according to the decedent's wishes. The legal distinction lies in the beneficiary's right to receive assets versus the executor's duty to ensure proper estate administration and asset distribution.

Rights of a Beneficiary

A beneficiary has the legal right to receive assets or benefits as specified in a will or trust, while an executor is responsible for managing and distributing the estate according to those instructions. Beneficiaries can demand transparency and accountability from executors, including access to estate inventories and financial records. These rights ensure beneficiaries can protect their interests and verify that the executor fulfills their fiduciary duties properly.

Duties of an Executor

An executor is responsible for managing the deceased person's estate, including gathering assets, paying debts and taxes, and distributing the remaining property according to the will. Duties also involve filing necessary court documents, maintaining accurate records, and communicating with beneficiaries to ensure transparency. Unlike beneficiaries who receive assets, executors act as fiduciaries, legally obligated to act in the best interest of the estate and its heirs.

Common Misconceptions

Many people mistakenly believe that beneficiaries control how an estate is managed, but this responsibility lies with the executor, who legally administers the will and ensures assets are distributed according to its terms. Another common misconception is that executors always inherit from the estate; in reality, they may or may not be beneficiaries and serve primarily as fiduciaries. Confusion also arises because beneficiaries receive benefits from the estate, while executors have a duty to act impartially and in the best interest of all parties involved.

Challenges and Conflicts

Beneficiaries often face challenges when executors delay the distribution of assets or fail to communicate transparently, leading to mistrust and conflicts. Executors may encounter difficulties fulfilling fiduciary duties due to complex legal requirements, potentially causing disputes with beneficiaries over interpretation of wills. Conflicts frequently arise from perceived favoritism, unclear instructions, and disagreements over asset valuation or debt settlement.

Changing Beneficiaries or Executors

Changing beneficiaries or executors in a will requires understanding their distinct roles: beneficiaries receive assets, while executors manage estate administration. To update beneficiaries, one can typically file a beneficiary designation form or create a codicil to the will, ensuring the changes are legally recognized. Modifying an executor usually involves revising the will through a formal amendment or drafting a new will to appoint a different individual for estate management.

Frequently Asked Questions

A beneficiary is an individual or entity entitled to receive assets or benefits from a will or trust, while an executor is the person appointed to manage and distribute the deceased's estate according to the will. Frequently asked questions often address whether an executor can also be a beneficiary, the executor's responsibilities, and how beneficiaries can contest a will. Clarifying differences in roles and legal duties helps avoid conflicts and ensures proper estate administration.

Beneficiary Infographic

libterm.com

libterm.com