Distribution in specie involves the transfer of specific assets rather than cash to shareholders during liquidation or dividend payment. This method ensures shareholders receive tangible property or securities directly, preserving asset value without liquidation costs. Explore the rest of the article to understand how distribution in specie can impact your investment strategy and tax implications.

Table of Comparison

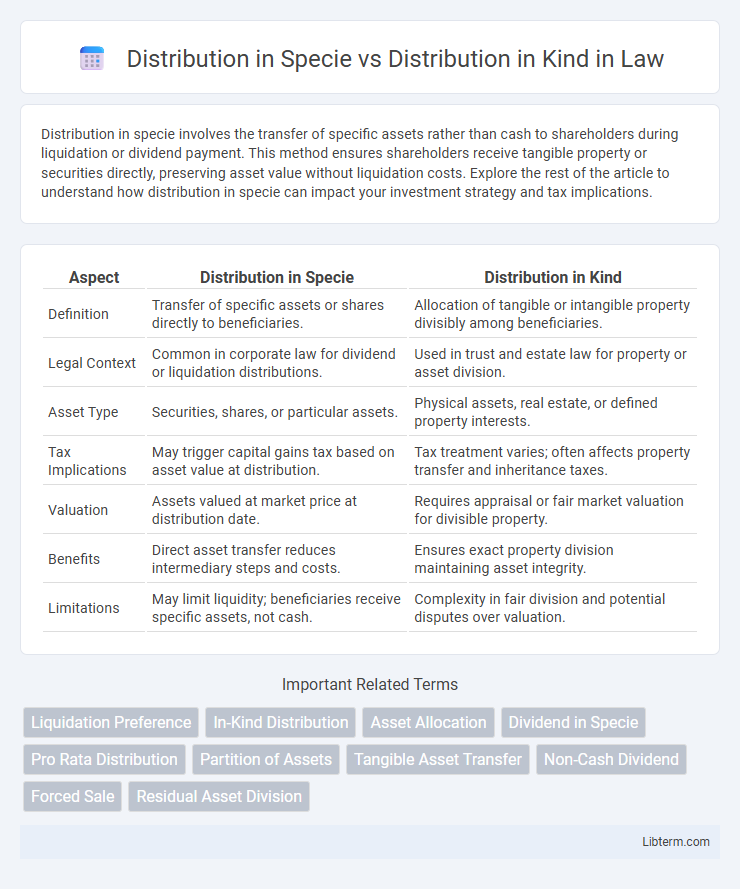

| Aspect | Distribution in Specie | Distribution in Kind |

|---|---|---|

| Definition | Transfer of specific assets or shares directly to beneficiaries. | Allocation of tangible or intangible property divisibly among beneficiaries. |

| Legal Context | Common in corporate law for dividend or liquidation distributions. | Used in trust and estate law for property or asset division. |

| Asset Type | Securities, shares, or particular assets. | Physical assets, real estate, or defined property interests. |

| Tax Implications | May trigger capital gains tax based on asset value at distribution. | Tax treatment varies; often affects property transfer and inheritance taxes. |

| Valuation | Assets valued at market price at distribution date. | Requires appraisal or fair market valuation for divisible property. |

| Benefits | Direct asset transfer reduces intermediary steps and costs. | Ensures exact property division maintaining asset integrity. |

| Limitations | May limit liquidity; beneficiaries receive specific assets, not cash. | Complexity in fair division and potential disputes over valuation. |

Introduction to Distribution in Specie and Distribution in Kind

Distribution in specie refers to the transfer of assets to shareholders in their existing form, such as property, shares, or other tangible assets, rather than converting them into cash. Distribution in kind generally involves giving shareholders assets that are not cash, often tailored to specific types of property or investments, and can include securities, real estate, or physical goods. Both methods require precise valuation and legal compliance to ensure fair treatment of shareholders and proper documentation during corporate restructurings or liquidation processes.

Definition of Distribution in Specie

Distribution in specie refers to the transfer of assets to shareholders in their original physical form rather than cash, typically involving shares, property, or other tangible assets. This method allows shareholders to receive a portion of the company's holdings directly, often used in corporate reorganizations or liquidations. It differs from distribution in kind by emphasizing the direct allocation of specific non-cash assets without conversion or sale.

Definition of Distribution in Kind

Distribution in kind refers to the process of allocating assets or property to shareholders, creditors, or beneficiaries in their actual form rather than converting them into cash. This method involves the direct transfer of specific assets such as real estate, securities, or inventory, preserving the original nature and value of the assets. It differs from distribution in specie, which often implies the distribution of shares or securities rather than tangible assets.

Key Differences Between Distribution in Specie and Distribution in Kind

Distribution in specie refers to the transfer of assets to shareholders or partners in their original form, such as property or shares, without converting them to cash. Distribution in kind involves distributing non-cash assets, often tangible goods or securities, directly to stakeholders instead of money. Key differences include the nature of assets transferred--specifically original assets versus varied forms of non-cash assets--and the legal and tax implications associated with each distribution method.

Legal Framework and Regulatory Considerations

Distribution in specie and distribution in kind involve transferring assets directly to shareholders without liquidation, governed by specific legal frameworks varying by jurisdiction. Regulatory considerations focus on compliance with securities laws, tax implications, and accurate asset valuation to protect shareholder interests and ensure transparency. Companies must adhere to corporate statutes and regulatory bodies' requirements, such as disclosure obligations and approval protocols, to mitigate legal risks during these distributions.

Practical Examples of Distribution in Specie

Distribution in specie involves transferring assets directly to shareholders rather than cash, commonly seen in corporate actions such as stock dividends or property transfers. For example, a company might distribute shares of a subsidiary to its existing shareholders, enabling them to gain ownership without selling the shares. Another practical case is when a trust distributes specific real estate properties to beneficiaries instead of liquidating assets and distributing cash proceeds.

Practical Examples of Distribution in Kind

Distribution in kind involves the transfer of specific assets or property to shareholders instead of cash, commonly used in corporate reorganizations or liquidations. Practical examples include a company distributing shares of a subsidiary or tangible assets like real estate directly to its investors. This method helps align asset allocation with shareholder preferences and can offer tax advantages compared to cash distributions.

Advantages and Disadvantages of Each Distribution Method

Distribution in specie offers shareholders direct ownership of specific assets, preserving asset value and avoiding liquidation costs, but it may lead to complexity in valuation and unequal share allocation. Distribution in kind simplifies administrative processes by transferring easily divisible assets like cash or securities, enhancing liquidity and uniformity while potentially triggering tax events and reducing shareholder control over specific asset choices. Choosing between these methods depends on balancing tax efficiency, fairness, and operational simplicity aligned with shareholder preferences.

Factors Influencing the Type of Distribution

Factors influencing the choice between Distribution in Specie and Distribution in Kind include the nature of the assets, regulatory requirements, and shareholder preferences. Distribution in Specie involves transferring specific assets directly to shareholders, often favored when assets are easily divisible and valued, while Distribution in Kind allocates shares or securities corresponding to the underlying assets, preferred for complex or illiquid holdings. Tax implications and administrative costs also play critical roles in determining the most efficient distribution method.

Conclusion: Choosing the Appropriate Distribution Method

Distribution in specie allocates assets directly, preserving the original form without liquidation, ideal for shareholders seeking specific holdings or tax efficiency. Distribution in kind involves transferring asset ownership, often requiring valuation and potentially triggering tax events, suitable when liquidation costs or market conditions make cash distributions unfavorable. Selecting the appropriate method depends on legal, tax, and shareholder considerations to maximize value and compliance.

Distribution in Specie Infographic

libterm.com

libterm.com