Charge refers to the fundamental property of matter that causes it to experience a force in an electromagnetic field, typically classified as positive or negative. Understanding charge is crucial for grasping how electrical circuits operate and how particles interact at both macroscopic and quantum levels. Discover how charge influences your everyday technology and natural phenomena by reading the rest of the article.

Table of Comparison

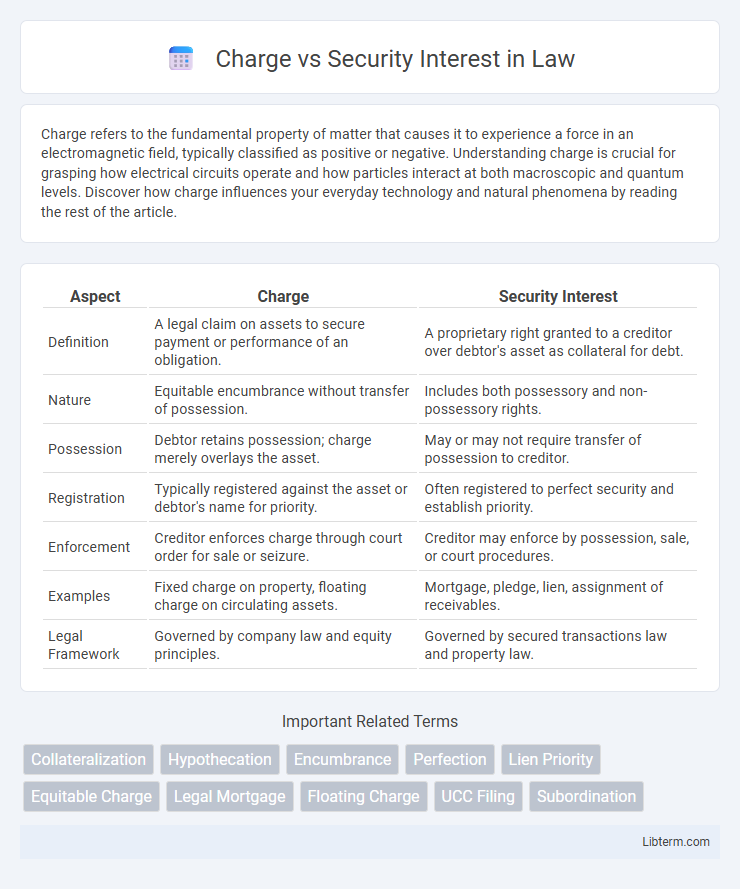

| Aspect | Charge | Security Interest |

|---|---|---|

| Definition | A legal claim on assets to secure payment or performance of an obligation. | A proprietary right granted to a creditor over debtor's asset as collateral for debt. |

| Nature | Equitable encumbrance without transfer of possession. | Includes both possessory and non-possessory rights. |

| Possession | Debtor retains possession; charge merely overlays the asset. | May or may not require transfer of possession to creditor. |

| Registration | Typically registered against the asset or debtor's name for priority. | Often registered to perfect security and establish priority. |

| Enforcement | Creditor enforces charge through court order for sale or seizure. | Creditor may enforce by possession, sale, or court procedures. |

| Examples | Fixed charge on property, floating charge on circulating assets. | Mortgage, pledge, lien, assignment of receivables. |

| Legal Framework | Governed by company law and equity principles. | Governed by secured transactions law and property law. |

Understanding Charge and Security Interest

A charge is a legal claim or lien created over an asset to secure the repayment of a debt or obligation without transferring ownership, commonly categorized as fixed or floating charges depending on asset control. A security interest grants a lender a right in specific collateral, allowing enforcement actions if the borrower defaults, typically governed by statutes like the Uniform Commercial Code (UCC) in the U.S. Differentiating between a charge and a security interest involves understanding the nature of control, enforcement rights, and jurisdictional legal frameworks influencing creditor remedies.

Key Differences Between Charge and Security Interest

A charge creates a financial claim or lien on an asset without transferring possession, whereas a security interest typically involves a contractual right to seize the collateral upon default. Charges can be fixed or floating, impacting asset management, while security interests are often governed by specific statutes like the Uniform Commercial Code (UCC) in the U.S. Enforcement of a charge generally requires registration and adherence to formalities, while security interests may require attachment and perfection processes to protect creditor rights.

Legal Framework Governing Charges

The legal framework governing charges is primarily established through statutory laws such as the Companies Act, which defines and regulates fixed and floating charges on company assets. Charges require proper registration with the relevant governmental authority to ensure enforceability and priority against third parties. Courts interpret these laws to distinguish charges from other security interests, emphasizing the necessity of compliance with formalities for the creation, perfection, and enforcement of charges.

Types of Security Interests

Types of security interests include fixed charges, floating charges, liens, pledges, and mortgages, each offering varying degrees of control over the secured asset. A fixed charge attaches to specific assets, restricting the asset's disposal without lender consent, while a floating charge hovers over changing assets, such as stock or receivables, allowing business flexibility until a default triggers crystallization. Liens grant possession-based security, pledges involve transferring possession while retaining ownership, and mortgages specifically secure real property through registration.

Creation and Registration of Charges

Creation of a charge involves a contractual agreement between a borrower and a lender, where specific assets are pledged as collateral to secure a debt. Security interests require precise documentation and typically must be registered with a relevant public registry, such as the Companies House in the UK or the UCC filing office in the US, to perfect the charge and establish priority over other creditors. Proper registration protects the lender's rights and ensures enforceability of the security interest against third parties.

Enforcement of Security Interests

Enforcement of security interests involves the legal steps a secured party takes to recover debt when a borrower defaults, including repossession, foreclosure, or sale of collateral. A security interest grants creditors rights over specific assets, whereas a charge generally encumbers the asset without transferring possession until enforcement. Secured parties must comply with jurisdiction-specific laws and contractual terms to ensure enforcement actions are valid and to protect the borrower's rights during the process.

Priority of Charges vs Security Interests

Priority of charges versus security interests is determined primarily by the date of creation and registration, where earlier perfected security interests generally have precedence over later charges. Equitable principles and specific jurisdictional rules can influence priority, especially in cases involving floating charges or subordination agreements. Lenders protect their rights by promptly registering security interests to establish priority over subsequent charges and unsecured claims.

Impact on Borrowers and Lenders

A charge provides lenders with a fixed or floating claim over a borrower's assets, allowing control without transfer of ownership, which can limit the borrower's ability to freely dispose of charged assets. Security interest grants lenders a legally enforceable right over specified collateral, often enabling swift repossession or sale upon default, increasing the borrower's risk of asset loss. Borrowers face varying restrictions on asset use under charges and security interests, while lenders benefit from differing degrees of protection and priority in insolvency scenarios.

Common Challenges in Charge and Security Interest

Common challenges in charge and security interest include identifying the correct classification between fixed and floating charges, which impacts priority and enforcement rights. The complexity of accurately registering and perfecting security interests under varying jurisdictional requirements often leads to disputes and loss of priority. Additionally, delineating the scope and extent of the security interest, particularly in dynamic assets such as inventory or receivables, poses significant legal and operational difficulties for creditors.

Recent Developments in Charge and Security Interest Law

Recent developments in charge and security interest law have focused on clarifying the priorities between fixed and floating charges, enhancing creditor protections, and streamlining registration processes for security interests. Courts have increasingly emphasized substance over form to prevent misuse of floating charges that undermine creditor rights. Legislative reforms in several jurisdictions have introduced more robust frameworks for the enforceability and perfection of security interests, improving transparency and reducing disputes.

Charge Infographic

libterm.com

libterm.com