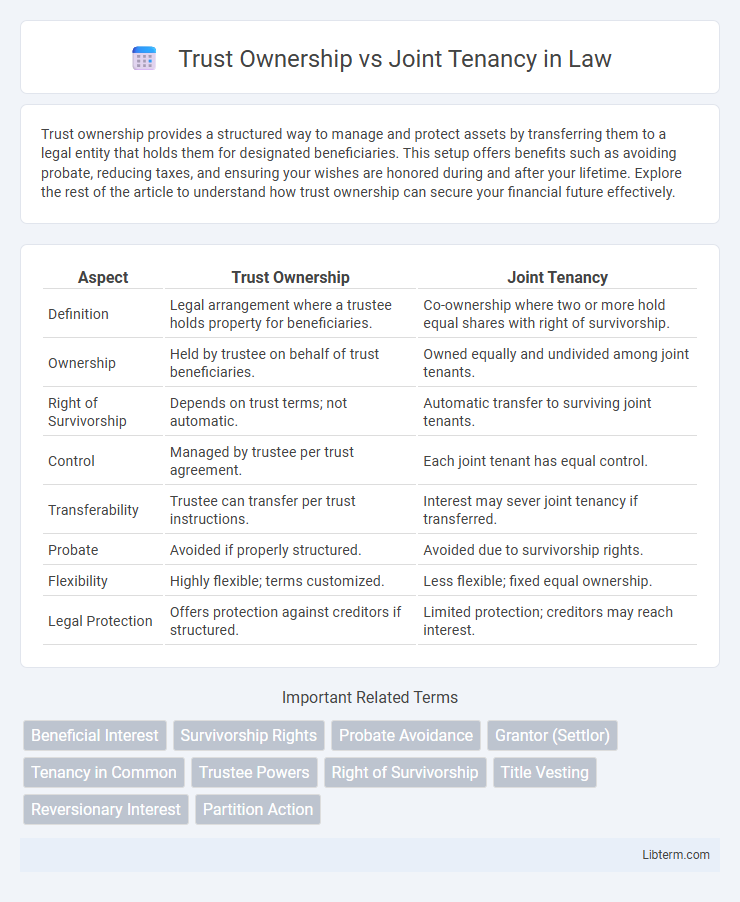

Trust ownership provides a structured way to manage and protect assets by transferring them to a legal entity that holds them for designated beneficiaries. This setup offers benefits such as avoiding probate, reducing taxes, and ensuring your wishes are honored during and after your lifetime. Explore the rest of the article to understand how trust ownership can secure your financial future effectively.

Table of Comparison

| Aspect | Trust Ownership | Joint Tenancy |

|---|---|---|

| Definition | Legal arrangement where a trustee holds property for beneficiaries. | Co-ownership where two or more hold equal shares with right of survivorship. |

| Ownership | Held by trustee on behalf of trust beneficiaries. | Owned equally and undivided among joint tenants. |

| Right of Survivorship | Depends on trust terms; not automatic. | Automatic transfer to surviving joint tenants. |

| Control | Managed by trustee per trust agreement. | Each joint tenant has equal control. |

| Transferability | Trustee can transfer per trust instructions. | Interest may sever joint tenancy if transferred. |

| Probate | Avoided if properly structured. | Avoided due to survivorship rights. |

| Flexibility | Highly flexible; terms customized. | Less flexible; fixed equal ownership. |

| Legal Protection | Offers protection against creditors if structured. | Limited protection; creditors may reach interest. |

Understanding Trust Ownership: An Overview

Trust ownership involves a legal arrangement where a grantor transfers assets to a trustee, who manages them on behalf of beneficiaries according to the trust agreement. This structure provides control, asset protection, and potential tax benefits while keeping ownership separate from the beneficiaries' personal estates. Unlike joint tenancy, trust ownership avoids the automatic right of survivorship and allows customized distribution terms tailored to the grantor's intentions.

What Is Joint Tenancy? Key Concepts

Joint tenancy is a form of property co-ownership where two or more individuals hold equal shares with rights of survivorship, meaning the deceased owner's interest automatically passes to the surviving joint tenants. Key concepts include the four unities: time, title, interest, and possession, all of which must be present for a valid joint tenancy. This arrangement contrasts with trust ownership, where a trustee manages assets on behalf of beneficiaries according to the trust agreement.

Legal Framework: Trust Ownership vs Joint Tenancy

Trust ownership is governed by trust law, allowing a trustee to hold legal title for the benefit of designated beneficiaries, providing flexibility in asset management and protection against probate. Joint tenancy is established under property law, where co-owners hold equal shares with the right of survivorship, leading to automatic transfer of ownership upon a tenant's death. The legal framework for trusts emphasizes fiduciary duties and formal trust documentation, while joint tenancy relies on clear conveyance language and unity of possession, interest, title, and time.

Asset Protection: Trusts Compared to Joint Tenancy

Trust ownership offers enhanced asset protection by legally separating assets from personal liabilities, shielding them from creditors and lawsuits, unlike joint tenancy where assets can be vulnerable to claims against one owner. Trusts provide customizable control over asset distribution and protection through specific terms, which joint tenancy cannot accommodate since it automatically grants surviving co-owners full rights without protection mechanisms. This makes trusts a preferred vehicle for securing wealth against creditors, divorce, and unforeseen financial risks compared to the less protected joint tenancy arrangement.

Estate Planning Implications

Trust ownership offers greater control and flexibility in estate planning by allowing assets to be managed according to specific wishes and conditions beyond death. Joint tenancy provides the right of survivorship, which can simplify asset transfer but may limit individual control and expose assets to risks like creditors or unintended beneficiaries. Choosing between trust ownership and joint tenancy impacts tax treatment, probate avoidance, and creditor protection within an estate plan.

Probate Avoidance: Which Structure Wins?

Trust ownership effectively avoids probate by transferring assets directly to beneficiaries according to the trust terms, bypassing court intervention. Joint tenancy also provides probate avoidance through the right of survivorship, allowing assets to pass immediately to the surviving co-owner without probate. For more complex estates or specific distribution control, trusts generally offer superior probate avoidance benefits compared to joint tenancy.

Tax Considerations: Trusts vs Joint Tenancy

Trust ownership can offer significant tax advantages by allowing for detailed control over asset distribution and potential reduction of estate taxes through effective planning and use of trusts like revocable or irrevocable ones. Joint tenancy involves automatic right of survivorship, which may simplify transfers but often results in immediate inclusion of the deceased's share in the estate for tax purposes, potentially increasing estate tax liability. Trusts provide flexibility in managing income taxes and capital gains by separating asset ownership from beneficiaries, whereas joint tenancy usually attributes income and gains directly to the owners, impacting tax rates and strategies.

Creditor Risks and Liability

Trust ownership offers enhanced creditor protection by separating legal title from beneficiaries, limiting creditor claims to the trust assets rather than individual ownership interests. In contrast, joint tenancy exposes each tenant's entire interest to creditors, as each co-owner holds an undivided share with rights of survivorship, increasing the risk of creditor claims on the property. Understanding the nuances of liability and creditor risks in trust ownership versus joint tenancy is crucial for estate planning and asset protection strategies.

Flexibility and Control Over Assets

Trust ownership offers greater flexibility and control over asset distribution, allowing the grantor to specify detailed terms and conditions for beneficiaries and manage assets during incapacity or after death. Joint tenancy provides automatic survivorship rights, enabling seamless transfer of property to co-owners without probate but limits individual control once established. Trusts can be tailored to protect assets from creditors and set complex inheritance rules, unlike joint tenancy which focuses primarily on shared ownership and equal rights.

Choosing the Right Ownership Structure

Choosing between trust ownership and joint tenancy hinges on factors such as estate planning goals, control over assets, and avoiding probate. Trust ownership allows for detailed management and distribution of assets according to specific wishes, while joint tenancy provides automatic right of survivorship, simplifying property transfer upon death. Evaluating tax implications, creditor protection, and the need for flexibility helps determine the most suitable ownership structure for individual circumstances.

Trust Ownership Infographic

libterm.com

libterm.com