The Origination Clause, found in Article I, Section 7 of the U.S. Constitution, requires that all revenue-raising bills must begin in the House of Representatives, ensuring that taxation originates with the people's elected body. This provision safeguards your representation by giving the House primary control over fiscal legislation, while the Senate may propose amendments. Explore the rest of the article to understand how the Origination Clause shapes legislative processes and protects democratic principles.

Table of Comparison

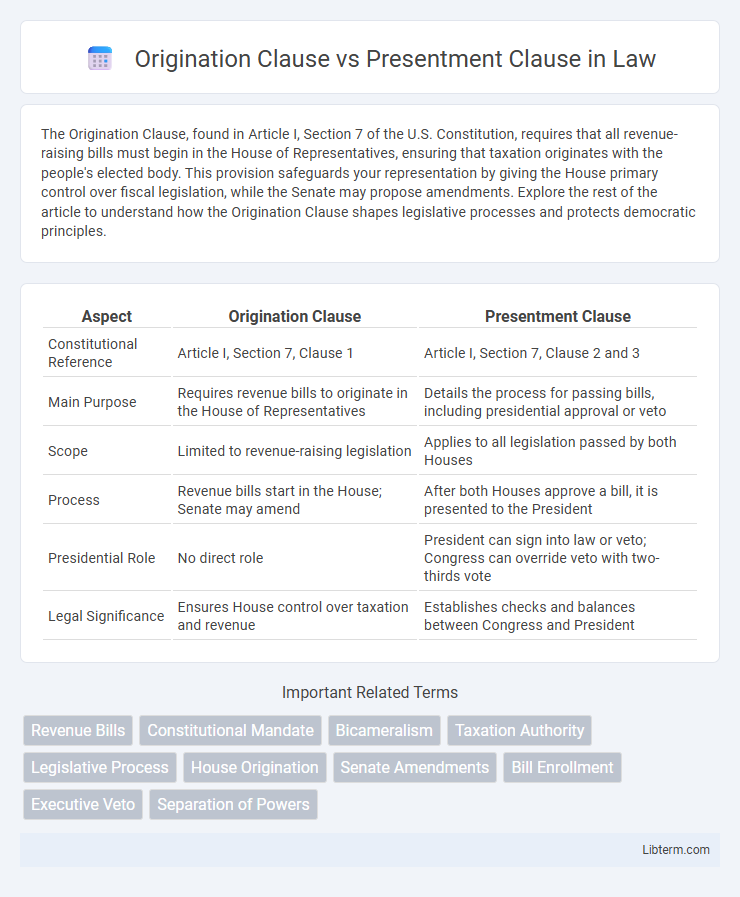

| Aspect | Origination Clause | Presentment Clause |

|---|---|---|

| Constitutional Reference | Article I, Section 7, Clause 1 | Article I, Section 7, Clause 2 and 3 |

| Main Purpose | Requires revenue bills to originate in the House of Representatives | Details the process for passing bills, including presidential approval or veto |

| Scope | Limited to revenue-raising legislation | Applies to all legislation passed by both Houses |

| Process | Revenue bills start in the House; Senate may amend | After both Houses approve a bill, it is presented to the President |

| Presidential Role | No direct role | President can sign into law or veto; Congress can override veto with two-thirds vote |

| Legal Significance | Ensures House control over taxation and revenue | Establishes checks and balances between Congress and President |

Introduction to Constitutional Clauses

The Origination Clause, found in Article I, Section 7 of the U.S. Constitution, mandates that all revenue-raising bills must originate in the House of Representatives, emphasizing the House's role in taxation and public finance. The Presentment Clause, also in Article I, Section 7, outlines the process for how a bill becomes law, requiring it to be presented to the President for approval or veto after passage by both the House and Senate. Together, these clauses establish fundamental legislative procedures to ensure checks and balances within the federal lawmaking process.

Understanding the Origination Clause

The Origination Clause, found in Article I, Section 7 of the U.S. Constitution, mandates that all revenue-raising bills must originate in the House of Representatives, ensuring the chamber closest to the people holds primary control over taxation and financial legislation. This clause emphasizes the distinct roles of the House and Senate in the legislative process, as the Senate can propose or concur with amendments but cannot initiate revenue bills. Understanding the Origination Clause is crucial for grasping the constitutional balance of powers in fiscal policymaking and the procedural requirements for passing tax laws.

Overview of the Presentment Clause

The Presentment Clause, found in Article I, Section 7 of the U.S. Constitution, outlines the process by which a bill, once passed by both the House of Representatives and the Senate, must be presented to the President for approval or veto. This clause establishes the formal legislative procedure ensuring executive review before a bill becomes law, preventing unilateral congressional enactment. The Presentment Clause balances legislative and executive powers by mandating presidential assent or return with objections, reinforcing the system of checks and balances integral to U.S. governance.

Historical Background of Both Clauses

The Origination Clause, rooted in Article I, Section 7 of the U.S. Constitution, was established to ensure that all revenue-raising bills originate in the House of Representatives, reflecting the framers' intent to give the people's directly elected representatives control over taxation. The Presentment Clause, also in Article I, Section 7, mandates that every bill passed by Congress be presented to the President for approval or veto, a mechanism designed to balance legislative power with executive oversight. Both clauses emerged during the Constitutional Convention of 1787, embodying a deliberate structure to promote checks and balances within the federal legislative process.

Key Differences Between Origination and Presentment Clauses

The Origination Clause requires all revenue-raising bills to start in the House of Representatives, ensuring taxation proposals originate from the people's directly elected body. The Presentment Clause mandates that every bill passed by both the House and Senate be presented to the President for approval or veto, establishing executive oversight in lawmaking. These clauses differ fundamentally in their roles: the Origination Clause governs where tax legislation begins, while the Presentment Clause governs the approval process for all legislation.

Constitutional Text and Legal Language

The Origination Clause, found in Article I, Section 7, Clause 1 of the U.S. Constitution, mandates that all revenue bills originate in the House of Representatives, ensuring fiscal control is vested in the legislative body closest to the people. The Presentment Clause, located in Article I, Section 7, Clauses 2 and 3, prescribes the process by which a bill, after passage by both the House and Senate, must be presented to the President for approval or veto, defining the executive role in legislative enactment. The distinct constitutional text of each clause emphasizes separate but complementary functions in the lawmaking process, with precise legal language delineating procedural steps for origination and presidential presentment.

Role in the Legislative Process

The Origination Clause mandates that all revenue-raising bills must originate in the House of Representatives, ensuring that taxation proposals start with the legislative branch closest to the people. The Presentment Clause requires that any bill passed by both the House and Senate be presented to the President for approval or veto, serving as a critical check in the legislative process. Together, these clauses define the procedural framework for how federal laws involving revenue are initiated, reviewed, and enacted into law.

Supreme Court Interpretations

The Origination Clause mandates that all revenue bills must originate in the House of Representatives, ensuring initial legislative control over taxation and appropriations. Supreme Court interpretations, such as in *United States v. Munoz-Flores* (1990), reinforce that while the Senate may amend these bills, the initiation must be by the House, preserving bicameral balance. The Presentment Clause requires that all bills passed by both chambers be presented to the President for approval or veto, a procedural safeguard upheld by cases like *INS v. Chadha* (1983), emphasizing executive review as a critical step in the legislative process.

Impact on Bill Passage and Veto Process

The Origination Clause mandates that all revenue-raising bills must originate in the House of Representatives, influencing the initial stages of the legislative process by ensuring that taxation proposals are rooted in the chamber closest to the electorate. The Presentment Clause requires that every bill passed by both the House and Senate be presented to the President for approval or veto, shaping the final stage of bill enactment by granting the executive branch the power to reject legislation. Together, these clauses balance congressional authority in lawmaking with presidential oversight, affecting the trajectory and outcome of legislative proposals related to revenue and beyond.

Modern Debates and Legal Controversies

The Origination Clause, mandating that revenue bills originate in the House of Representatives, often sparks debate over its scope and applicability in modern legislation, especially concerning complex appropriations and tax laws. The Presentment Clause requires all bills passed by Congress to be presented to the President for approval or veto, raising legal controversies when Congress attempts to bypass this process through mechanisms like joint resolutions or concurrent resolutions. Courts continue to navigate conflicts between these clauses amid evolving legislative practices, impacting separation of powers and the balance of federal authority.

Origination Clause Infographic

libterm.com

libterm.com