The Necessary and Proper Clause grants Congress the authority to make laws required for executing its enumerated powers, ensuring legislative flexibility within the U.S. Constitution. This clause serves as a foundation for expansive federal power, allowing lawmakers to adapt to changing circumstances while maintaining constitutional balance. Explore the full article to understand how the Necessary and Proper Clause shapes your government's legislative capabilities.

Table of Comparison

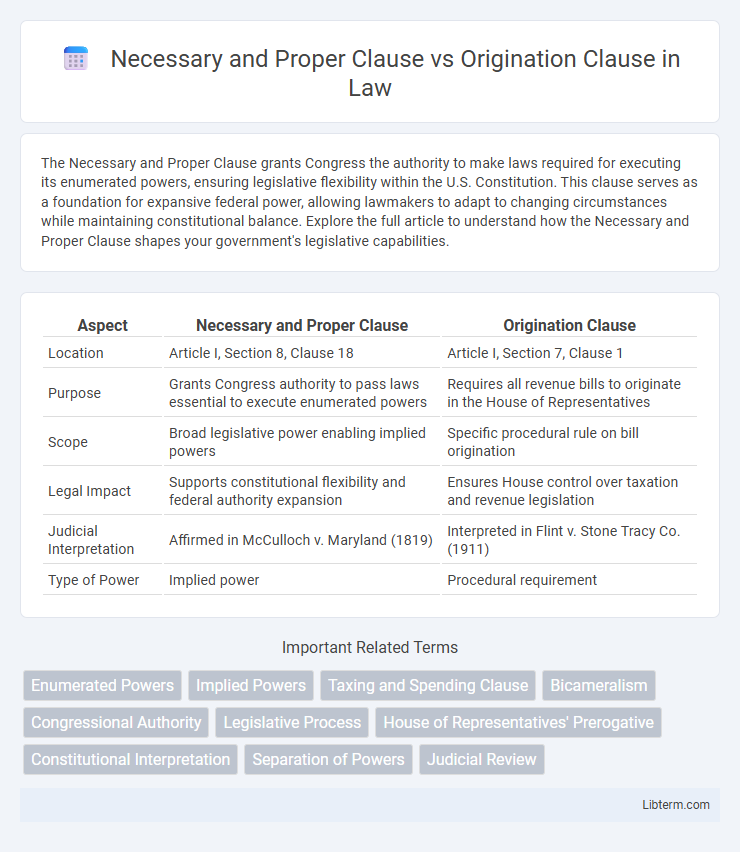

| Aspect | Necessary and Proper Clause | Origination Clause |

|---|---|---|

| Location | Article I, Section 8, Clause 18 | Article I, Section 7, Clause 1 |

| Purpose | Grants Congress authority to pass laws essential to execute enumerated powers | Requires all revenue bills to originate in the House of Representatives |

| Scope | Broad legislative power enabling implied powers | Specific procedural rule on bill origination |

| Legal Impact | Supports constitutional flexibility and federal authority expansion | Ensures House control over taxation and revenue legislation |

| Judicial Interpretation | Affirmed in McCulloch v. Maryland (1819) | Interpreted in Flint v. Stone Tracy Co. (1911) |

| Type of Power | Implied power | Procedural requirement |

Introduction to Constitutional Clauses

The Necessary and Proper Clause grants Congress the authority to make laws essential for executing its enumerated powers, establishing flexibility in legislative processes under Article I, Section 8. The Origination Clause mandates that all revenue-raising bills must originate in the House of Representatives, ensuring the chamber closest to the people controls tax legislation under Article I, Section 7. These constitutional clauses balance congressional powers by defining legislative scope and procedural requirements critical to federal lawmaking.

Overview of the Necessary and Proper Clause

The Necessary and Proper Clause, found in Article I, Section 8, Clause 18 of the U.S. Constitution, grants Congress the authority to enact laws essential for executing its enumerated powers effectively. This clause enables legislative flexibility by allowing Congress to adopt measures not explicitly listed in the Constitution but deemed necessary to fulfill its constitutional responsibilities. It contrasts with the Origination Clause, which mandates that all revenue-raising bills must begin in the House of Representatives, strictly regulating the legislative process related to taxation.

Purpose and Significance of the Origination Clause

The Origination Clause mandates that all revenue-raising bills originate in the House of Representatives, ensuring that taxation authority begins with the chamber closest to the people, reflecting democratic accountability. This clause serves as a critical check on fiscal legislation by requiring the Senate to only amend rather than initiate revenue bills, preserving the House's constitutional "power of the purse." Its purpose is to maintain a clear separation of fiscal responsibilities and reinforce the foundational principle that taxation authority should reside with directly elected representatives.

Historical Background of Both Clauses

The Necessary and Proper Clause, also known as the Elastic Clause, was established in Article I, Section 8, Clause 18 of the U.S. Constitution in 1787 to grant Congress the authority to pass laws needed to execute its enumerated powers. The Origination Clause, found in Article I, Section 7, Clause 1, mandates that all revenue-raising bills must originate in the House of Representatives, reflecting the framers' intent to give the more populace-based chamber control over taxation. Both clauses emerged from debates during the Constitutional Convention aimed at balancing federal power and representative control over fiscal matters.

Key Differences Between Necessary and Proper vs Origination Clauses

The Necessary and Proper Clause grants Congress the authority to make all laws necessary to execute its enumerated powers, providing flexibility in legislative actions. In contrast, the Origination Clause mandates that all revenue-raising bills must originate in the House of Representatives, ensuring control over taxation begins in the popularly elected chamber. These clauses differ fundamentally in purpose and function: the Necessary and Proper Clause expands legislative power scope, while the Origination Clause imposes procedural restrictions on revenue legislation origination.

Legal Interpretations and Supreme Court Cases

The Necessary and Proper Clause, pivotal in cases like McCulloch v. Maryland (1819), grants Congress implied powers essential for executing enumerated powers, emphasizing federal authority expansion. In contrast, the Origination Clause mandates that all revenue-raising bills originate in the House of Representatives, as upheld in United States v. Munoz-Flores (1990), reinforcing the House's budgetary control. Supreme Court interpretations consistently balance these clauses to delineate congressional power scope, maintaining constitutional checks and balances in legislative processes.

Impact on Congressional Powers

The Necessary and Proper Clause grants Congress the flexibility to enact laws essential for executing its enumerated powers, significantly expanding legislative authority over diverse policy areas. In contrast, the Origination Clause restricts the initiation of revenue-raising bills to the House of Representatives, limiting procedural routes and influencing the balance of power between congressional chambers. Together, these clauses shape the scope and limitations of congressional powers by defining both functional capabilities and procedural constraints.

Checks and Balances: Clauses in Practice

The Necessary and Proper Clause grants Congress the authority to enact laws essential for executing its enumerated powers, enabling legislative flexibility and adaptation over time. In contrast, the Origination Clause mandates that all revenue-raising bills must originate in the House of Representatives, ensuring fiscal oversight and direct representation in tax legislation. These clauses exemplify checks and balances by distributing legislative powers and responsibilities, preventing governmental overreach and maintaining accountability between branches.

Modern Debates and Controversies

The Necessary and Proper Clause, granting Congress the authority to enact laws essential for executing enumerated powers, faces ongoing debate over its scope, especially regarding federal overreach into states' rights. The Origination Clause, requiring all revenue bills to originate in the House of Representatives, prompts controversies around legislative procedures and executive manipulation through budget reconciliation. Modern disputes often center on balancing federal power expansion under the Necessary and Proper Clause against constitutional safeguards protecting legislative origination and state sovereignty under the Origination Clause.

Conclusion: Implications for Constitutional Law

The Necessary and Proper Clause grants Congress flexibility to enact laws essential for executing enumerated powers, reinforcing federal legislative authority. In contrast, the Origination Clause restricts the procedural origin of revenue bills, preserving the House's exclusive prerogative to initiate taxation measures. Together, these clauses balance expansive federal power with procedural safeguards, shaping constitutional interpretations of legislative scope and process.

Necessary and Proper Clause Infographic

libterm.com

libterm.com