Joint and Several Liability holds multiple parties responsible for the full amount of a debt or damages, regardless of their individual share of fault. This legal principle ensures that the injured party can recover compensation from any one of the liable parties, granting stronger protection for victims. Discover how Joint and Several Liability impacts your rights and legal obligations in the detailed article ahead.

Table of Comparison

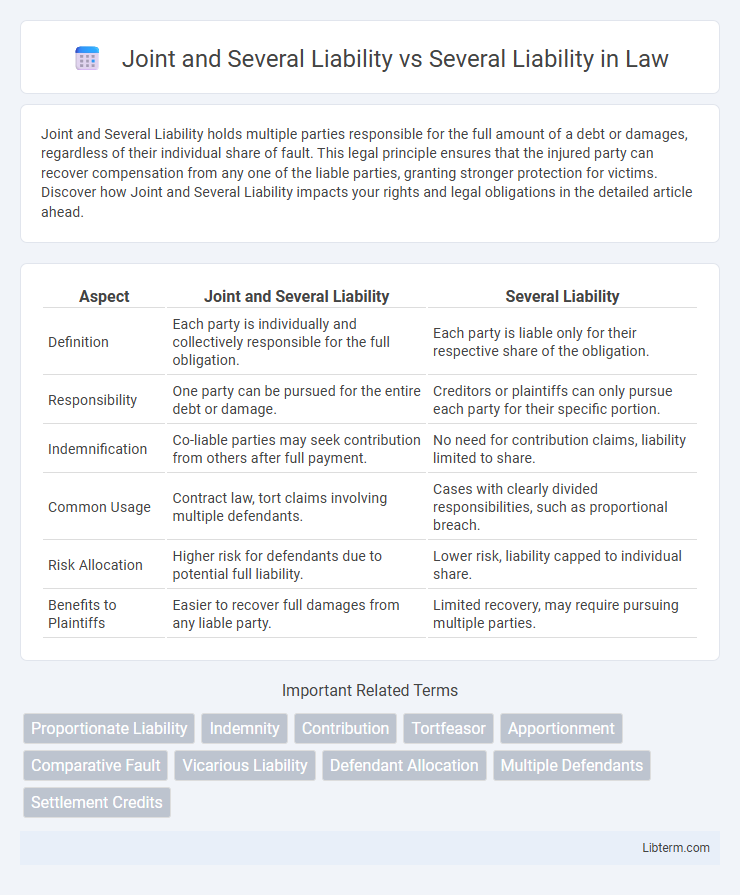

| Aspect | Joint and Several Liability | Several Liability |

|---|---|---|

| Definition | Each party is individually and collectively responsible for the full obligation. | Each party is liable only for their respective share of the obligation. |

| Responsibility | One party can be pursued for the entire debt or damage. | Creditors or plaintiffs can only pursue each party for their specific portion. |

| Indemnification | Co-liable parties may seek contribution from others after full payment. | No need for contribution claims, liability limited to share. |

| Common Usage | Contract law, tort claims involving multiple defendants. | Cases with clearly divided responsibilities, such as proportional breach. |

| Risk Allocation | Higher risk for defendants due to potential full liability. | Lower risk, liability capped to individual share. |

| Benefits to Plaintiffs | Easier to recover full damages from any liable party. | Limited recovery, may require pursuing multiple parties. |

Introduction to Liability in Legal Contexts

Joint and several liability holds multiple parties individually and collectively responsible for the full extent of a damage award, ensuring that a plaintiff can recover the total amount from any or all defendants regardless of their respective share of fault. Several liability limits each defendant's responsibility to their proportionate share of the damages, preventing one party from paying more than their assigned fault. Understanding these liability principles is crucial in legal contexts, as they directly impact the allocation of financial responsibility in tort and contract cases.

Definition of Joint and Several Liability

Joint and several liability is a legal concept where two or more parties are collectively and individually responsible for the entire obligation, allowing a claimant to pursue any one party for full compensation. This contrasts with several liability, where each party is only responsible for their specific share of the obligation, limiting claims to individual amounts owed. Joint and several liability ensures claimants can recover complete damages even if one party cannot pay.

Explanation of Several Liability

Several liability assigns each defendant responsibility solely for their proportion of the damages in a lawsuit, ensuring individuals are only accountable for their share of the loss. This legal principle limits financial exposure by preventing defendants from being held liable for the entire judgment if other parties cannot pay. Several liability promotes fairness by distributing damages based strictly on each party's degree of fault or involvement.

Key Differences Between Joint and Several Liability

Joint and several liability means multiple parties are each individually responsible for the entire amount of a judgment, allowing a plaintiff to recover the full amount from any one defendant, while several liability limits each party's responsibility to their specific share of the loss. In joint and several liability, if one defendant cannot pay, others must cover the unpaid portion, whereas in several liability, each defendant pays only their proportionate share regardless of others' ability to pay. This key distinction affects risk allocation, financial exposure, and strategic considerations in lawsuits involving multiple defendants.

Legal Implications for Plaintiffs and Defendants

Joint and several liability allows plaintiffs to recover the full amount of damages from any defendant regardless of their individual share of fault, enhancing plaintiff protection but increasing risk for defendants who may pay more than their proportionate liability. Several liability limits each defendant's financial responsibility to their specific percentage of fault, reducing the risk of disproportionate payment but potentially complicating full compensation for plaintiffs if some defendants cannot pay. Understanding these distinctions is crucial for plaintiffs seeking full recovery and defendants assessing potential financial exposure in multi-party litigation.

Impact on Risk and Financial Responsibility

Joint and several liability significantly increases financial responsibility by holding each party individually liable for the entire obligation, amplifying risk exposure for defendants who may have to pay more than their share if others cannot contribute. Several liability limits each party's financial responsibility strictly to their proportionate fault, reducing individual risk but potentially complicating recovery for plaintiffs if some defendants are insolvent. This distinction impacts risk management strategies, as joint liability may encourage settlements to avoid disproportionate payouts, whereas several liability promotes precise allocation of damages based on fault.

Real-World Examples and Case Studies

Joint and several liability holds multiple parties individually responsible for the entire obligation, as seen in the landmark case of *Indemnity Insurance Co. v. Global Construction Inc.*, where a subcontractor and contractor were both held liable for damages despite the contractor's greater role. Several liability allocates responsibility proportionally, demonstrated in *Smith v. Metro Developers*, where three developers were each liable only for their percentage of fault in a property dispute. These distinctions critically impact settlement negotiations and risk management strategies in construction and tort litigation.

Advantages and Disadvantages of Each Approach

Joint and several liability ensures that each defendant can be responsible for the entire amount of a judgment, which benefits plaintiffs by increasing the likelihood of full recovery but may unfairly burden a single defendant with disproportionate financial responsibility. Several liability limits each defendant's responsibility to their specific share of fault, providing fairness and proportionate accountability but potentially leaving plaintiffs with incomplete compensation if some defendants are insolvent. The joint approach promotes plaintiff protection and defendant risk but creates complexity in apportioning damages, while the several approach enhances equitable liability distribution yet may diminish plaintiff remedies.

Jurisdictions and Legal Systems: Where Each Applies

Joint and several liability primarily applies in common law jurisdictions such as the United States and the United Kingdom, where multiple parties can be held collectively and individually responsible for the full amount of damages. Several liability, by contrast, is more common in civil law jurisdictions like France and Germany, limiting each defendant's financial responsibility strictly to their proportionate share of fault. These distinctions impact how courts allocate compensation among liable parties, influencing litigation strategies and risk assessments within each legal system.

Choosing the Right Liability Structure for Your Case

Selecting the appropriate liability structure depends on the nature of the case and the financial responsibility each party can bear. Joint and several liability holds each defendant individually responsible for the entire judgment, allowing plaintiffs to recover full damages from any party, whereas several liability limits each defendant's responsibility to their specific share of fault. Understanding how courts allocate fault and the potential impact on recovery can help tailor the strategy for maximizing compensation and managing risk effectively.

Joint and Several Liability Infographic

libterm.com

libterm.com