A waiver is a legal document that voluntarily relinquishes a known right, claim, or privilege. It is crucial to understand the terms and consequences of signing a waiver to protect your interests effectively. Explore the rest of the article to learn how waivers function and when you might need one.

Table of Comparison

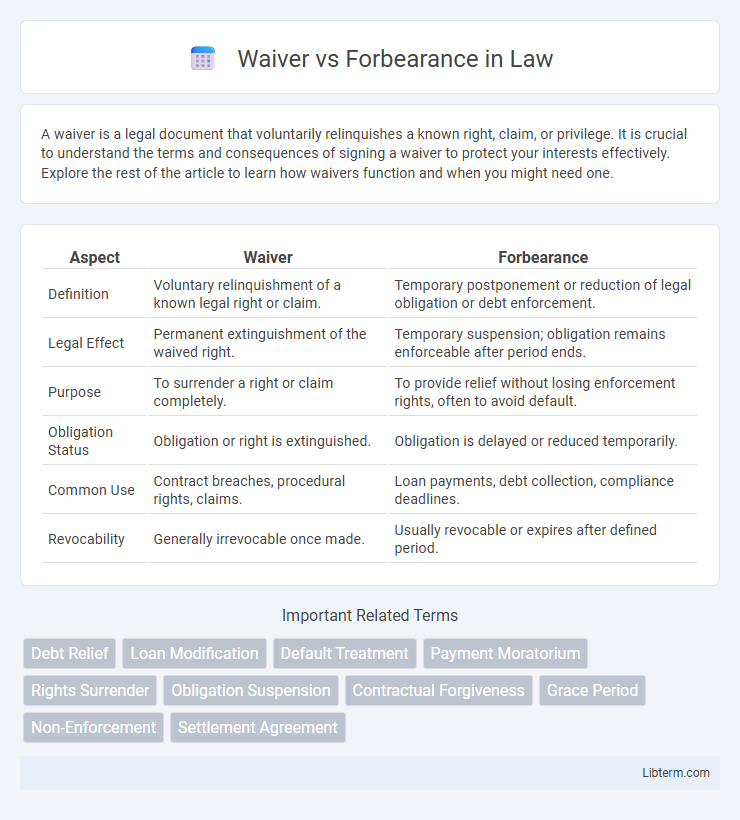

| Aspect | Waiver | Forbearance |

|---|---|---|

| Definition | Voluntary relinquishment of a known legal right or claim. | Temporary postponement or reduction of legal obligation or debt enforcement. |

| Legal Effect | Permanent extinguishment of the waived right. | Temporary suspension; obligation remains enforceable after period ends. |

| Purpose | To surrender a right or claim completely. | To provide relief without losing enforcement rights, often to avoid default. |

| Obligation Status | Obligation or right is extinguished. | Obligation is delayed or reduced temporarily. |

| Common Use | Contract breaches, procedural rights, claims. | Loan payments, debt collection, compliance deadlines. |

| Revocability | Generally irrevocable once made. | Usually revocable or expires after defined period. |

Understanding Waiver and Forbearance

Waiver is a voluntary relinquishment of a known right or claim, often used in legal or contractual contexts to permanently forgive a breach or obligation, while forbearance is a temporary postponement or reduction of payments granted by a lender to ease financial hardship without erasing the debt. Waiver results in the extinguishment of the right waived, whereas forbearance merely delays enforcement or collection, maintaining the validity of the original obligation. Understanding these distinctions is crucial for borrowers and creditors when negotiating debt relief or contractual adjustments.

Definition of Waiver

Waiver refers to the voluntary relinquishment or abandonment of a known right, claim, or privilege by a party, often documented in legal or contractual contexts to avoid defaults or penalties. It involves a clear intent to forgo specific rights, such as the right to enforce a contract term or collect a debt, without altering the underlying obligation. Unlike forbearance, which temporarily postpones enforcement, a waiver permanently surrenders the right in question.

Definition of Forbearance

Forbearance is a temporary postponement or reduction of loan payments granted by a lender to help borrowers avoid default during financial hardship. Unlike a waiver, which permanently releases the borrower from the obligation to repay certain amounts, forbearance allows the borrower to resume regular payments after the agreed period, often with accrued interest. This arrangement is common in mortgages, student loans, and other credit agreements to provide short-term relief without erasing the debt.

Key Differences Between Waiver and Forbearance

Waiver involves the voluntary relinquishment of a known right, often permanently eliminating an obligation, whereas forbearance is a temporary postponement or reduction of an obligation, typically used in loan repayments. A waiver legally cancels the right or claim, while forbearance modifies the terms without erasing the underlying debt or duty. Forbearance agreements usually include specific conditions and timelines, whereas waivers operate as a definitive legal surrender of rights.

Common Scenarios for Using a Waiver

Common scenarios for using a waiver include situations where a party voluntarily relinquishes a legal right or claim, such as waiving a breach of contract to maintain business relations or accepting late payment without penalties. Waivers are often employed in sports and recreational activities to release liability for potential injuries, and in employment agreements to forgo certain rights like non-compete clauses. These scenarios highlight the strategic use of waivers to avoid disputes and foster cooperation without resorting to forbearance or more formal legal remedies.

Situations Where Forbearance Applies

Forbearance applies primarily in situations where borrowers face temporary financial difficulties but intend to resume regular payments, such as during job loss, medical emergencies, or natural disasters. Lenders agree to reduce or pause payments for a limited period without charging penalties, allowing borrowers time to stabilize their finances. This differs from a waiver, which typically involves a permanent relinquishment of certain payment obligations or fees.

Legal Implications of Waiver

Waiver involves the voluntary relinquishment of a known legal right, which can lead to the permanent loss of that right and affect the enforceability of a contract or claim. Courts typically require clear and unequivocal evidence of waiver to prevent unintended forfeiture of rights. Unlike forbearance, which is a temporary suspension of enforcement, waiver permanently removes the right to take future legal action concerning the waived issue.

Legal Implications of Forbearance

Forbearance involves a lender's legal agreement to temporarily suspend or reduce loan payments without forgiving the debt, thereby preserving the borrower's obligation to repay according to modified terms. This arrangement often modifies the contract to include specific conditions, such as increased interest accrual or extended loan duration, which can have lasting legal consequences if the borrower defaults. Unlike waivers, forbearance does not eliminate the debtor's liability, maintaining the lender's right to enforce the original loan terms once the forbearance period ends.

Pros and Cons of Waiver vs Forbearance

Waiver offers the advantage of permanently releasing the borrower from specific loan obligations, providing immediate financial relief and eliminating future liability on the waived amount, but it may have tax implications and can negatively affect credit if reported. Forbearance allows temporary suspension or reduction of loan payments without penalty, preserving the borrower's credit and offering a chance to improve finances, yet it only postpones payments, potentially increasing the total loan cost due to accruing interest. Choosing between waiver and forbearance depends on the borrower's financial situation, long-term repayment capability, and the lender's policies on loan modification.

Choosing the Right Option: Waiver or Forbearance

Choosing between waiver and forbearance depends on financial circumstances and long-term loan goals. A waiver permanently removes a portion of debt, ideal for borrowers facing severe financial hardship and seeking debt relief. Forbearance temporarily halts or reduces payments, offering short-term relief while maintaining loan obligations for future repayment.

Waiver Infographic

libterm.com

libterm.com