Derivative action allows shareholders to sue on behalf of the corporation to address wrongs done to the company when management fails to act. This legal tool protects your investment by holding directors and officers accountable for breaches of fiduciary duty or misconduct. Explore the rest of the article to understand how derivative actions work and when you can bring one.

Table of Comparison

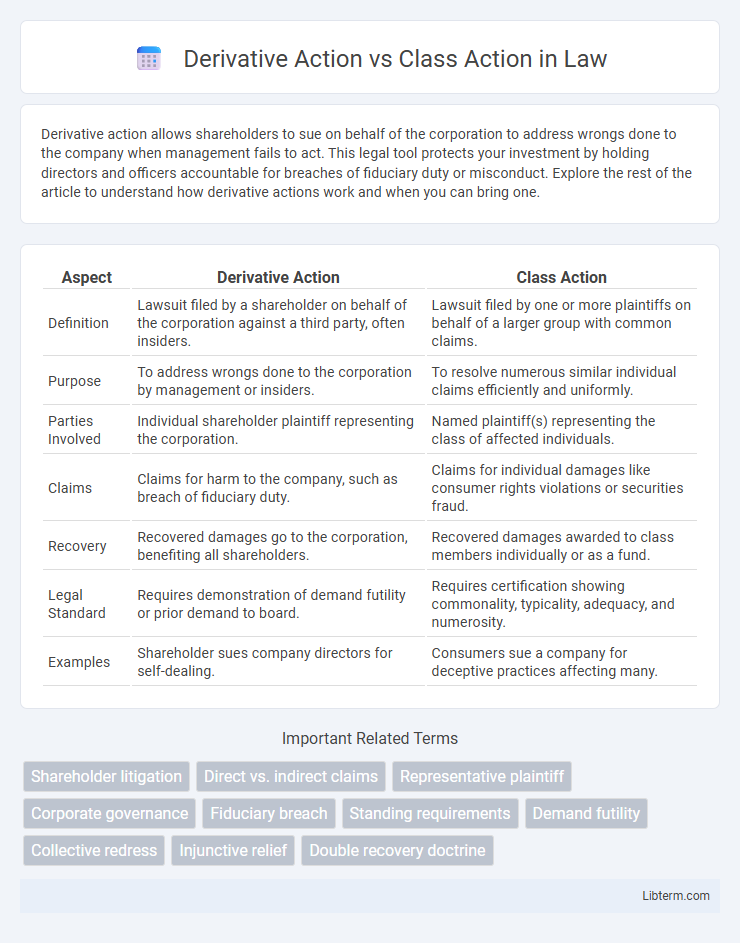

| Aspect | Derivative Action | Class Action |

|---|---|---|

| Definition | Lawsuit filed by a shareholder on behalf of the corporation against a third party, often insiders. | Lawsuit filed by one or more plaintiffs on behalf of a larger group with common claims. |

| Purpose | To address wrongs done to the corporation by management or insiders. | To resolve numerous similar individual claims efficiently and uniformly. |

| Parties Involved | Individual shareholder plaintiff representing the corporation. | Named plaintiff(s) representing the class of affected individuals. |

| Claims | Claims for harm to the company, such as breach of fiduciary duty. | Claims for individual damages like consumer rights violations or securities fraud. |

| Recovery | Recovered damages go to the corporation, benefiting all shareholders. | Recovered damages awarded to class members individually or as a fund. |

| Legal Standard | Requires demonstration of demand futility or prior demand to board. | Requires certification showing commonality, typicality, adequacy, and numerosity. |

| Examples | Shareholder sues company directors for self-dealing. | Consumers sue a company for deceptive practices affecting many. |

Introduction to Derivative and Class Actions

Derivative actions enable shareholders to sue on behalf of the corporation, addressing wrongs committed against the company, typically involving breaches of fiduciary duty by directors or officers. Class actions allow multiple plaintiffs with similar claims to band together to seek collective redress, commonly used in consumer protection, securities fraud, or employment disputes. Both legal mechanisms provide distinct pathways for group litigation, with derivative suits focusing on corporate governance issues and class actions addressing widespread individual harm.

Definition of Derivative Action

A derivative action is a legal lawsuit initiated by a shareholder on behalf of a corporation against third parties, often insiders like directors or officers, who are alleged to have harmed the company. Unlike a class action, which represents individual claims of numerous plaintiffs against a defendant, a derivative action seeks to address wrongs done to the corporation itself. This mechanism enforces fiduciary duties and protects corporate interests by allowing shareholders to step into the corporation's shoes when its management fails to act.

Definition of Class Action

Class action is a legal mechanism that allows a group of individuals with similar claims against a defendant to file a single lawsuit collectively. This method streamlines the litigation process by consolidating numerous individual claims into one representative case, often involving large-scale disputes such as consumer rights, securities fraud, or product liability. Unlike derivative action, which is brought by shareholders on behalf of a corporation for wrongs against the company, class action focuses on compensating plaintiffs directly for personal injuries or losses.

Key Differences Between Derivative and Class Actions

Derivative actions are lawsuits initiated by shareholders on behalf of the corporation to address wrongs done to the company, targeting breaches of fiduciary duty by executives or directors. Class actions involve a group of plaintiffs collectively suing a defendant for similar harm, primarily focusing on individual damages affecting all members, such as consumer fraud or product liability. The key difference lies in the beneficiary of the lawsuit: derivative actions benefit the corporation, while class actions compensate the individual plaintiffs.

Legal Requirements for Derivative Actions

Derivative actions require the plaintiff to be a shareholder who sues on behalf of the corporation to address wrongs against the company, mandating that the shareholder first demand the board to take action unless such demand would be futile. Legal requirements include proving the board's failure to act, demonstrating shareholder standing, and adhering to procedural rules like the demand requirement and notice to the corporation. Unlike class actions that focus on individual claims for damages, derivative actions must show harm to the corporation and seek remedies that benefit the corporate entity.

Legal Requirements for Class Actions

Class actions require plaintiffs to demonstrate numerosity, commonality, typicality, and adequacy of representation under Rule 23 of the Federal Rules of Civil Procedure. Certification by the court ensures these prerequisites are met before proceeding to collective litigation. This legal framework differentiates class actions from derivative actions, which involve shareholders suing on behalf of a corporation for harm to the company.

Typical Scenarios for Derivative Actions

Derivative actions typically arise when shareholders bring lawsuits on behalf of the corporation against insiders such as directors or officers for breach of fiduciary duties, fraud, or mismanagement that harm the company. These actions are common in closely held corporations where minority shareholders seek to address wrongs after the board fails to act. Derivative suits often occur in scenarios involving corporate waste, self-dealing, or conflicts of interest that damage the company's value or reputation.

Typical Scenarios for Class Actions

Class actions typically arise in scenarios involving widespread consumer fraud, product liability, or employment discrimination affecting large groups of individuals. These lawsuits consolidate numerous similar claims into a single case to efficiently address common legal issues and provide uniform relief. This approach is cost-effective and fosters judicial economy by minimizing repetitive litigation over identical matters.

Advantages and Disadvantages of Each Action

Derivative actions allow shareholders to sue on behalf of the corporation, providing a means to address wrongs against the company while maintaining corporate control, but they often involve complex procedural requirements and may result in limited personal recovery. Class actions combine multiple plaintiffs with similar claims into one lawsuit, offering efficiency and cost-effectiveness while increasing leverage against defendants, yet they can face challenges such as certification hurdles and less tailored remedies for individual members. Both legal mechanisms aim to enforce rights and achieve compensation but vary significantly in scope, procedural complexity, and potential benefits or drawbacks for plaintiffs.

Choosing the Right Legal Action

Choosing the right legal action depends on the dispute's nature and the parties involved. Derivative actions allow shareholders to sue on behalf of the corporation for wrongs against the company, ideal when internal management fails to act, while class actions enable a group of individuals with common claims to collectively seek relief, maximizing efficiency in consumer or employment cases. Evaluating factors such as the plaintiff's relationship to the defendant, the objective of the lawsuit, and potential remedies ensures the most effective strategy for achieving legal and financial outcomes.

Derivative Action Infographic

libterm.com

libterm.com