Efficient distribution in liquid assets ensures your portfolio remains flexible and ready to meet short-term financial needs without sacrificing growth potential. Prioritizing cash equivalents and easily marketable securities can safeguard liquidity while optimizing returns. Explore the rest of the article to learn strategic methods for balancing liquidity and profitability in your asset distribution.

Table of Comparison

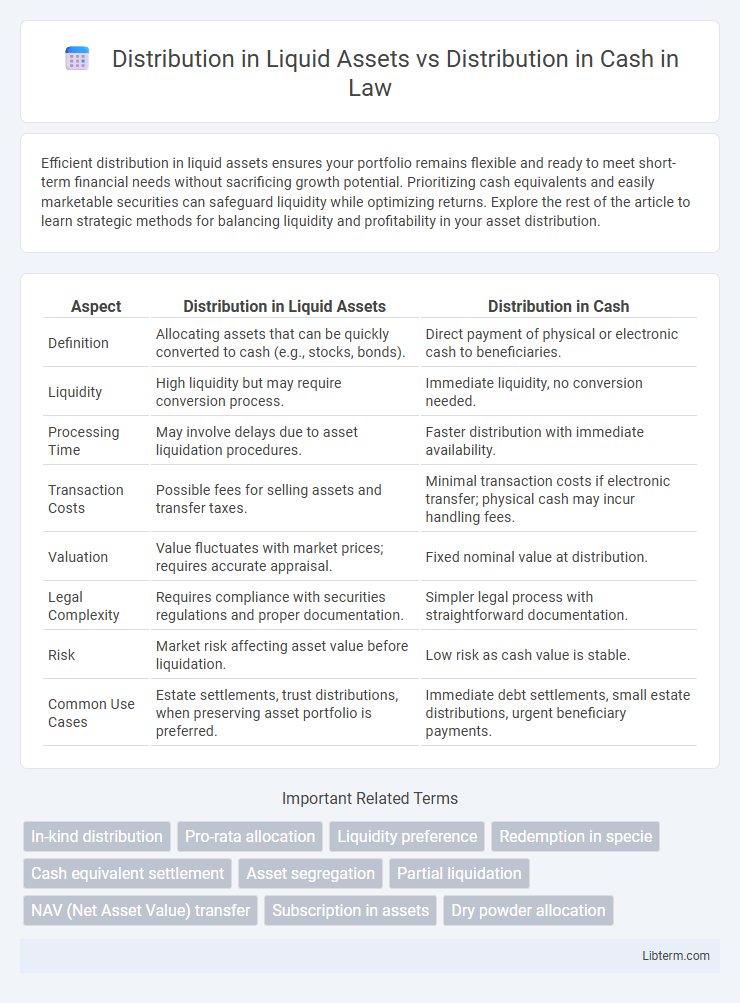

| Aspect | Distribution in Liquid Assets | Distribution in Cash |

|---|---|---|

| Definition | Allocating assets that can be quickly converted to cash (e.g., stocks, bonds). | Direct payment of physical or electronic cash to beneficiaries. |

| Liquidity | High liquidity but may require conversion process. | Immediate liquidity, no conversion needed. |

| Processing Time | May involve delays due to asset liquidation procedures. | Faster distribution with immediate availability. |

| Transaction Costs | Possible fees for selling assets and transfer taxes. | Minimal transaction costs if electronic transfer; physical cash may incur handling fees. |

| Valuation | Value fluctuates with market prices; requires accurate appraisal. | Fixed nominal value at distribution. |

| Legal Complexity | Requires compliance with securities regulations and proper documentation. | Simpler legal process with straightforward documentation. |

| Risk | Market risk affecting asset value before liquidation. | Low risk as cash value is stable. |

| Common Use Cases | Estate settlements, trust distributions, when preserving asset portfolio is preferred. | Immediate debt settlements, small estate distributions, urgent beneficiary payments. |

Understanding Liquid Assets Distribution

Distribution in liquid assets involves allocating investments or funds in assets easily convertible to cash, such as stocks, bonds, or money market instruments, ensuring swift access to capital for liquidity needs. Understanding liquid assets distribution is critical for balancing portfolio flexibility and minimizing transaction costs, as these assets provide a buffer during financial fluctuations without sacrificing potential returns. This contrasts with distribution in cash, which offers immediate availability but may result in lower yields, making liquid assets a strategic choice for maintaining both accessibility and growth potential.

What Constitutes a Cash Distribution?

Cash distribution constitutes the transfer of liquid funds directly to shareholders or investors, derived from company profits, dividends, or capital returns. It excludes non-cash assets such as stocks, property, or liquid assets that require conversion before use. Understanding cash distribution is crucial for assessing immediate financial liquidity and investor returns.

Key Differences: Liquid Assets vs Cash Distributions

Distribution in liquid assets involves transferring securities or investments that can be quickly converted to cash but retain some market risk, whereas cash distributions provide immediate liquidity with zero market risk. Liquid asset distributions may include stocks, bonds, or mutual funds, allowing recipients potential for appreciation, while cash distributions are fixed in value and usable immediately for expenses. The choice between liquid assets and cash distributions impacts tax treatment, liquidity timing, and investment flexibility for recipients.

Legal Implications of Asset Distributions

Distribution in liquid assets allows for non-cash transfers such as stocks, bonds, or other securities, which may involve complex valuation and regulatory compliance to ensure fair market value and proper disclosure. Distribution in cash provides straightforward transactions but can trigger immediate tax consequences and impact liquidity management within legal frameworks. Legal implications include adherence to fiduciary duties, accurate asset appraisal, and compliance with tax laws to avoid disputes and ensure equitable treatment of beneficiaries.

Tax Consequences for Liquid vs Cash Distributions

Distributions in liquid assets often trigger capital gains taxes if the asset's fair market value exceeds its basis, leading to immediate tax liabilities. Cash distributions are generally taxed as ordinary income or dividends, depending on the investment vehicle, often resulting in higher tax rates than long-term capital gains. Understanding the tax implications of liquid versus cash distributions is crucial for optimizing after-tax returns and effective financial planning.

Liquidity Considerations in Asset Distributions

Distribution in liquid assets provides quicker access to funds compared to distribution in cash, enhancing liquidity and reducing transaction delays. Liquid assets like stocks or bonds can be converted to cash rapidly, maintaining portfolio flexibility during asset distributions. Cash distributions eliminate conversion risk but may pose challenges in large transactions due to liquidity constraints and potential tax implications.

Timing and Process of Distributing Liquid Assets

Distribution in liquid assets involves transferring ownership of securities, stocks, or bonds directly to shareholders, ensuring the timing aligns with market liquidity to maximize value and minimize transaction costs. The process requires careful valuation, coordination with custodians, and legal compliance to facilitate smooth asset transfer without necessitating immediate liquidation. In contrast, distribution in cash provides immediate liquidity but may trigger taxable events and reduces the overall asset pool, making the timing of liquid asset distribution critical for tax efficiency and shareholder preference.

Risks Associated with Non-Cash Distributions

Distributions in liquid assets, such as stocks or bonds, pose risks including market volatility and valuation uncertainties, potentially leading to unexpected tax liabilities and reduced liquidity compared to cash distributions. Non-cash distributions may trigger capital gains taxes despite no immediate cash receipt, complicating financial planning for investors. The inability to immediately convert assets into cash can also limit an investor's capacity to meet short-term obligations or react to market changes.

Strategic Scenarios for Choosing Distribution Type

Distribution in liquid assets offers flexibility for investors seeking diversified portfolio exposure without immediate tax liabilities, ideal in strategic scenarios emphasizing long-term growth and asset retention. Distribution in cash provides immediate liquidity and certainty, preferred in situations requiring quick access to funds or in low-interest-rate environments where reinvestment options are limited. Selecting the optimal distribution type depends on factors like current market conditions, investor liquidity needs, tax implications, and portfolio strategy alignment.

Best Practices for Effective Asset Distribution

Effective asset distribution balances liquid assets and cash to optimize liquidity and financial flexibility. Best practices include prioritizing liquid assets like stocks and bonds for quick access during emergencies, while maintaining a cash reserve for immediate expenses and transactional needs. Regular portfolio assessments and alignment with financial goals ensure efficient distribution that minimizes tax impact and maximizes growth potential.

Distribution in Liquid Assets Infographic

libterm.com

libterm.com