Building trust is essential for successful relationships, fostering reliability and open communication. It enhances collaboration and creates a sense of security in both personal and professional environments. Explore the article to learn how you can effectively establish and maintain trust in various aspects of life.

Table of Comparison

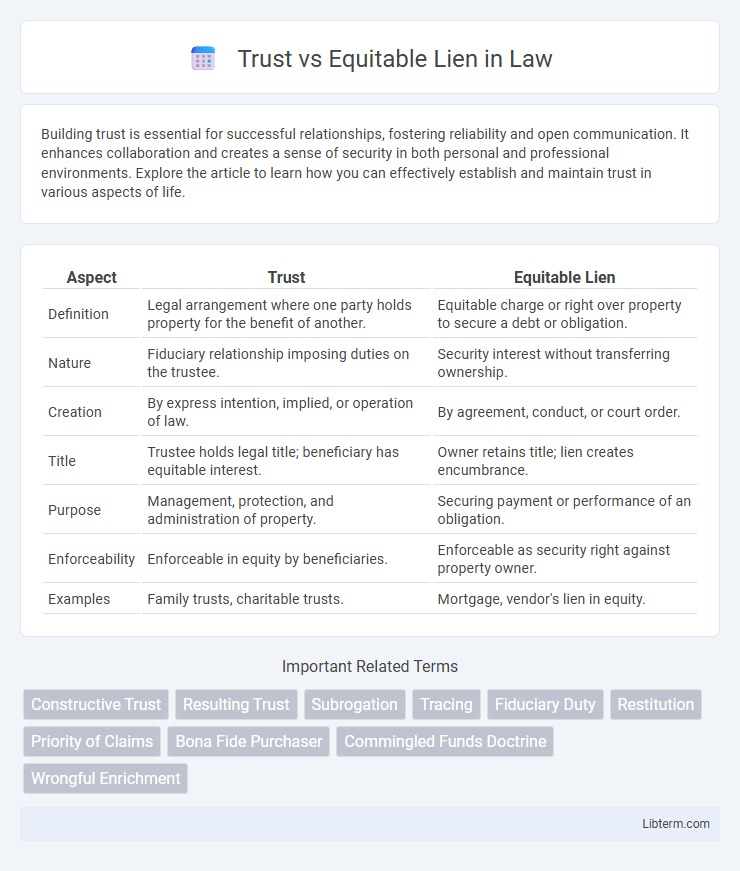

| Aspect | Trust | Equitable Lien |

|---|---|---|

| Definition | Legal arrangement where one party holds property for the benefit of another. | Equitable charge or right over property to secure a debt or obligation. |

| Nature | Fiduciary relationship imposing duties on the trustee. | Security interest without transferring ownership. |

| Creation | By express intention, implied, or operation of law. | By agreement, conduct, or court order. |

| Title | Trustee holds legal title; beneficiary has equitable interest. | Owner retains title; lien creates encumbrance. |

| Purpose | Management, protection, and administration of property. | Securing payment or performance of an obligation. |

| Enforceability | Enforceable in equity by beneficiaries. | Enforceable as security right against property owner. |

| Examples | Family trusts, charitable trusts. | Mortgage, vendor's lien in equity. |

Understanding Trusts: Definition and Key Features

A trust is a legal arrangement where a trustee holds and manages assets on behalf of beneficiaries, governed by the terms set out in a trust deed. Key features include fiduciary duty, where the trustee must act in the best interest of beneficiaries, and the separation of legal and beneficial ownership, allowing asset protection and estate planning advantages. Trusts differ from equitable liens, which are security interests without transfer of legal title, emphasizing the trustee's active role in managing trust property.

What is an Equitable Lien? Core Principles Explained

An equitable lien is a legal right or interest a person has in another's property, providing security for a debt or obligation without transferring title ownership. It arises by operation of equity to prevent unjust enrichment when a party has contributed value or relied on an agreement related to the property. Core principles include the lien attaching to the specific property, enforceability through equitable remedies, and prioritization over later claims absent contrary legal provisions.

Legal Foundations: Trusts vs Equitable Liens

Trusts arise from express or implied agreements where a trustee holds legal title to property for the benefit of a beneficiary, establishing fiduciary duties and recognized equitable interests. Equitable liens are non-possessory security interests created by operation of law to satisfy a debt or obligation, imposing a charge on specific property without transferring title. The legal foundation of trusts is rooted in intent and formalities, while equitable liens depend on fairness principles and the circumstances warranting an equitable remedy.

Creation and Establishment: Trusts Compared to Equitable Liens

Trusts are created through explicit intention by the settlor, evidenced by a clear declaration or transfer of property to a trustee with a fiduciary duty to manage assets for beneficiaries. Equitable liens arise by operation of law or equitable principle, established to secure an obligation or prevent unjust enrichment, often without the parties' formal agreement. The creation of a trust hinges on voluntariness and property segregation, while equitable liens depend on specific facts demonstrating fairness and security interests.

Rights of Beneficiaries: Trust vs Equitable Lien

Beneficiaries under a trust hold specific proprietary rights, including the right to enforce the trust and demand that trustees act in their best interests, often supported by clear statutory frameworks such as the Trustee Act. In contrast, beneficiaries of an equitable lien possess a security interest over property without transfer of title, granting them rights to enforce payment or performance but limited to the lien's scope rather than broader asset management. The trust confers fiduciary duties on trustees, enhancing beneficiary protections, while equitable liens primarily secure debts or obligations, reflecting a narrower, remedial right.

Remedies for Breach: Trusts and Equitable Liens Compared

Remedies for breach in trusts typically involve specific performance or equitable compensation, ensuring fiduciaries restore misappropriated trust property or account for profits gained. Equitable liens provide remedies by imposing a charge on the breaching party's property, allowing the claimant to recover the value owed through enforced sale or priority over other creditors. Trusts emphasize asset protection and beneficiary restitution, while equitable liens focus on securing debt repayment or equitable claims against particular assets.

Priority and Enforcement: Trusts vs Equitable Liens

Trusts hold a higher priority than equitable liens due to their status as proprietary interests, granting beneficiaries the right to enforce trust assets directly against trustees. Equitable liens function as security interests arising from specific circumstances, allowing claimants to enforce their rights only against particular property but typically ranking below trusts in priority. Enforcement of trusts involves compelling trustees to transfer or manage assets per the trust deed, whereas equitable lien enforcement necessitates court intervention to recognize the lien and authorize property sale or charge satisfaction.

Key Differences in Legal Proceedings

Trust involves a fiduciary relationship where the trustee holds legal title for the beneficiary's benefit, while an equitable lien is a non-possessory security interest that arises by operation of equity to secure payment or performance. Legal proceedings for a trust typically require proving fiduciary duties and breach of trust, whereas enforcing an equitable lien centers on demonstrating the existence of an underlying obligation and the lien's attachment to specific property. Trust litigation often involves detailed accounting and management of trust assets, whereas equitable lien cases focus on priority and enforcement against encumbered property.

Practical Examples: Trusts and Equitable Lien Applications

Trusts often involve a trustee managing assets on behalf of beneficiaries, such as a family trust distributing income to heirs. Equitable liens arise when a court recognizes a right to secure payment or satisfaction of a debt, for example, a contractor obtaining an equitable lien on a property to ensure payment for improvements made. Practical applications include using trusts to protect assets from creditors while equitable liens enforce claims on property without transferring ownership.

Choosing the Right Remedy: Trust or Equitable Lien?

Choosing the right remedy between a trust and an equitable lien hinges on the specific circumstances of property ownership and the intentions of the parties involved. A trust imposes fiduciary duties and transfers legal title to a trustee for the benefit of beneficiaries, making it suitable when clear intent to create such a relationship exists. An equitable lien provides a security interest on property without transferring ownership, ideal for situations requiring a charge to satisfy a debt or obligation without establishing a full trust relationship.

Trust Infographic

libterm.com

libterm.com