A positive covenant requires one party to actively perform certain obligations, such as maintaining property or paying for specific services, ensuring ongoing responsibilities are met. These covenants are common in real estate contracts and play a crucial role in preserving the value and condition of properties. Discover how understanding positive covenants can protect your interests by reading the rest of the article.

Table of Comparison

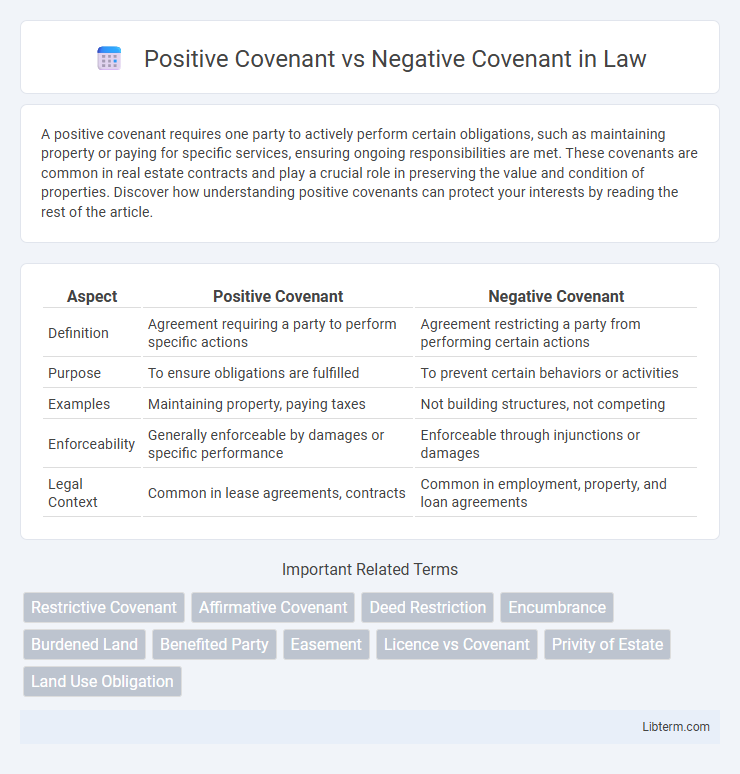

| Aspect | Positive Covenant | Negative Covenant |

|---|---|---|

| Definition | Agreement requiring a party to perform specific actions | Agreement restricting a party from performing certain actions |

| Purpose | To ensure obligations are fulfilled | To prevent certain behaviors or activities |

| Examples | Maintaining property, paying taxes | Not building structures, not competing |

| Enforceability | Generally enforceable by damages or specific performance | Enforceable through injunctions or damages |

| Legal Context | Common in lease agreements, contracts | Common in employment, property, and loan agreements |

Introduction to Covenants in Law

Positive covenants in law require a party to actively perform certain duties, such as maintaining a property or paying fees, whereas negative covenants restrict parties from engaging in specific actions, like prohibiting alterations or commercial use of land. These covenants are commonly used in property and contract law to regulate behavior and ensure compliance with agreed terms, enhancing the value and usability of assets. Understanding the distinction between positive and negative covenants is crucial for interpreting legal obligations and enforcing agreements effectively in real estate and commercial transactions.

Definition of Positive Covenant

A Positive Covenant is a legally binding obligation requiring a party to perform specific actions or duties, such as maintaining a property or paying insurance premiums. This contrasts with a Negative Covenant, which restricts a party from taking certain actions, like building above a specified height. Positive Covenants ensure active compliance with defined terms, often used in property law and contract agreements.

Definition of Negative Covenant

A Negative Covenant is a legally binding agreement that restricts a party from performing certain actions, ensuring limitations on behavior to protect the interests of the other party. In contrast, a Positive Covenant requires a party to perform specific duties or obligations, such as maintaining a property or providing services. Negative Covenants commonly appear in contracts like leases, loan agreements, and real estate transactions to prevent undesirable activities or changes.

Key Differences Between Positive and Negative Covenants

Positive covenants require a party to take specific actions or fulfill obligations, such as maintaining property or making regular payments, while negative covenants restrict certain activities, like prohibiting the sale of assets or incurring additional debt. Positive covenants ensure proactive compliance with agreed terms, whereas negative covenants prevent potential risks or detrimental behavior. Understanding these differences is essential for contract enforcement, risk management, and negotiation strategies in legal and financial agreements.

Legal Implications of Positive Covenants

Positive covenants impose specific obligations on a party to take certain actions, such as maintaining property or paying fees, which can create ongoing legal responsibilities enforceable by courts. Failure to comply with a positive covenant may result in injunctions or damages, highlighting the significant legal implications for property owners or businesses bound by such agreements. In contrast to negative covenants, which restrict actions, positive covenants require active performance, often complicating enforcement due to the need for continuous adherence to specified duties.

Legal Implications of Negative Covenants

Negative covenants impose restrictions on actions a party can take, legally binding them to refrain from specific activities such as incurring additional debt or altering property use without consent. Breach of a negative covenant can result in injunctive relief, damages, or contract termination, underscoring its enforceability in protecting the interests of the non-breaching party. Courts generally enforce negative covenants strictly to prevent harm and maintain contractual equilibrium, highlighting their critical role in governing obligations within agreements.

Examples of Positive Covenants

Positive covenants require a party to take specific actions, such as maintaining insurance policies, paying property taxes, or performing regular property maintenance. For example, a borrower might agree to keep a building in good repair or to provide financial statements regularly to the lender. These obligations ensure ongoing responsibilities that uphold the value or condition of the secured asset.

Examples of Negative Covenants

Negative covenants restrict specific activities to protect the lender's interests, such as prohibiting additional debt issuance, limiting asset sales, or restricting dividend distributions. For instance, a loan agreement may include a negative covenant preventing the borrower from incurring new liens or selling key collateral without lender approval. These restrictions ensure financial stability and reduce risk exposure for creditors during the loan term.

Enforcement of Covenants in Practice

Enforcement of positive covenants typically requires ongoing action or expenditure by the covenantor, making breaches easier to identify and remedy through specific performance or damages. Negative covenants eliminate certain actions or behaviors, with enforcement often relying on injunctions to prevent violations and ensure compliance. Courts favor clear evidence of breach and the practicality of enforcement when distinguishing between positive and negative covenant remedies.

Conclusion: Choosing the Right Covenant

Selecting the right covenant depends on the specific needs and risk management goals of the parties involved; positive covenants require proactive actions like maintaining insurance or regular reporting, while negative covenants restrict certain behaviors such as incurring additional debt or asset disposal. Lenders typically prefer negative covenants for tighter control over borrower risks, whereas positive covenants are advantageous for ensuring ongoing compliance and operational transparency. Evaluating the financial objectives, legal implications, and enforcement mechanisms is crucial to effectively balancing flexibility and protection in contractual agreements.

Positive Covenant Infographic

libterm.com

libterm.com