Unliquidated damages refer to compensation awarded by a court when the exact amount of loss resulting from a breach of contract is not predetermined or specified in the agreement. These damages are determined based on the actual harm or loss proven and must be reasonable, not punitive. Explore the rest of the article to understand how unliquidated damages affect your contractual rights and remedies.

Table of Comparison

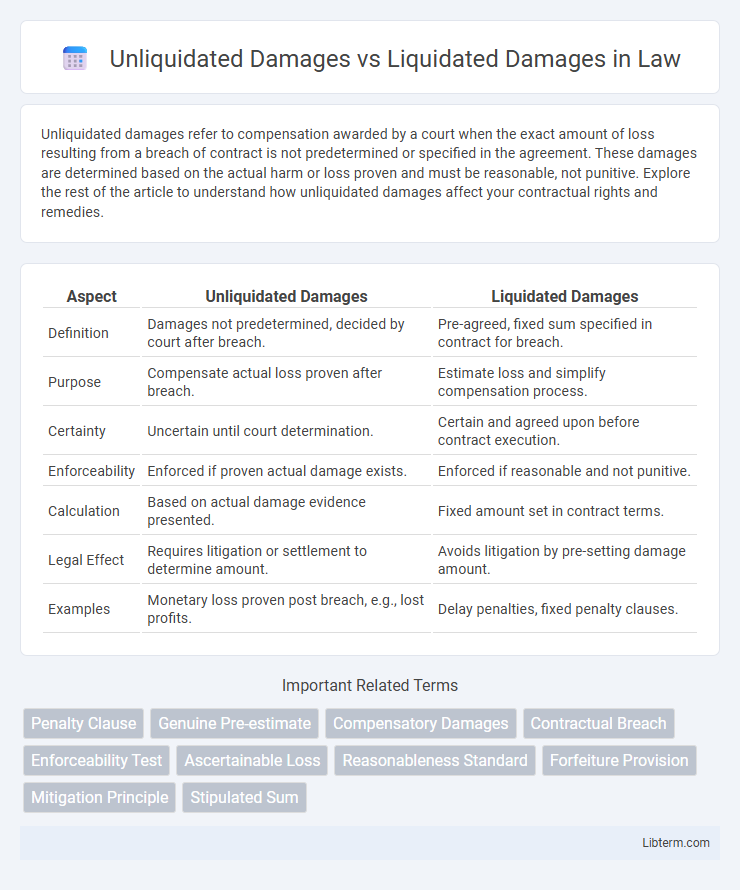

| Aspect | Unliquidated Damages | Liquidated Damages |

|---|---|---|

| Definition | Damages not predetermined, decided by court after breach. | Pre-agreed, fixed sum specified in contract for breach. |

| Purpose | Compensate actual loss proven after breach. | Estimate loss and simplify compensation process. |

| Certainty | Uncertain until court determination. | Certain and agreed upon before contract execution. |

| Enforceability | Enforced if proven actual damage exists. | Enforced if reasonable and not punitive. |

| Calculation | Based on actual damage evidence presented. | Fixed amount set in contract terms. |

| Legal Effect | Requires litigation or settlement to determine amount. | Avoids litigation by pre-setting damage amount. |

| Examples | Monetary loss proven post breach, e.g., lost profits. | Delay penalties, fixed penalty clauses. |

Understanding Damages in Contract Law

Unliquidated damages refer to compensation for losses that are not predetermined and require proof of actual harm, whereas liquidated damages are specific amounts agreed upon in a contract to be paid if a breach occurs. Contract law distinguishes these to provide clarity and predictability, with liquidated damages serving as a genuine pre-estimate of loss, and unliquidated damages awarded based on actual inflicted damages. Courts enforce liquidated damages when they reflect a reasonable forecast of harm, but reject penalties disguised as such, ensuring fairness in contractual remedies.

What Are Liquidated Damages?

Liquidated damages are predetermined sums agreed upon in a contract to compensate the non-breaching party for specific losses if the other party fails to fulfill contractual obligations, especially in construction and service agreements. These damages serve as a genuine pre-estimate of loss when actual harm is difficult to quantify, providing certainty and reducing litigation risks. Courts typically enforce liquidated damages clauses if the amount is reasonable and not punitive, distinguishing them from unliquidated damages, which require proof of actual loss.

What Are Unliquidated Damages?

Unliquidated damages refer to losses or harm that have not been predetermined or fixed in a contract, requiring the injured party to prove the actual extent of damages through litigation or negotiation. These damages are assessed based on the real harm caused by a breach, considering evidence like financial loss, disruption, or injury. Unlike liquidated damages, which represent a pre-agreed fixed sum, unliquidated damages are flexible and seek fair compensation reflective of the actual impact experienced.

Key Differences Between Liquidated and Unliquidated Damages

Unliquidated damages are damages that are not predetermined or specified in a contract and must be proven and quantified through evidence after a breach occurs. Liquidated damages are a fixed sum agreed upon by parties in the contract as compensation for a breach, designed to estimate potential losses in advance. The key difference lies in certainty: liquidated damages represent an agreed and enforceable amount for damages, while unliquidated damages require judicial determination and proof of actual loss.

Legal Basis for Damages in Contracts

Liquidated damages are predetermined amounts agreed upon by parties in a contract, serving as a genuine pre-estimate of loss in case of breach, thus legally enforceable under contract law principles. Unliquidated damages, on the other hand, are damages not specified in the contract and must be proven and assessed by the court based on actual loss incurred due to the breach. The legal basis for liquidated damages lies in contract clauses designed to avoid litigation, while unliquidated damages rely on tort or contract law remedies requiring factual evidence of damage.

When to Use Liquidated Damages Clauses

Liquidated damages clauses are essential in contracts where actual damages from a breach are difficult to quantify, providing a predetermined sum agreed upon by both parties to cover potential losses. These clauses are most effective in construction, service contracts, and project delivery agreements where delays or non-performance can result in significant financial impact but are challenging to assess precisely. Courts typically enforce liquidated damages when the amount is a reasonable estimate of probable loss and not punitive, ensuring clarity and reducing litigation risks compared to unliquidated damages, which require proving actual losses.

Examples of Liquidated vs Unliquidated Damages

Liquidated damages are predetermined sums agreed upon in a contract, such as a fixed penalty of $1,000 per day for each day of delayed project completion. Unliquidated damages require actual proof and quantification of loss, for example, a contractor seeking compensation for additional costs incurred due to unforeseen work delays. Courts typically enforce liquidated damages when the amount is reasonable and difficult to estimate at contract signing, whereas unliquidated damages are assessed based on evidence presented after breach occurrence.

Enforceability of Damages Clauses

Enforceability of liquidated damages clauses depends on whether the stipulated amount is a reasonable pre-estimate of actual damages at the time of contract formation, ensuring it is not deemed a penalty under contract law. Courts scrutinize unliquidated damages claims by requiring proof of actual losses suffered, which can lead to prolonged litigation and uncertainty. Liquidated damages provide certainty and efficiency by pre-defining compensation, whereas unliquidated damages require detailed assessment and justification to be enforceable.

Court Approaches to Damages Disputes

Courts distinguish unliquidated damages as losses assessed post-breach, requiring proof of actual harm, while liquidated damages represent pre-agreed sums specified in contracts to estimate potential breaches. Judicial scrutiny emphasizes the enforceability of liquidated damages clauses, assessing reasonableness and whether the sum constitutes a genuine pre-estimate of loss, avoiding punitive penalties. In disputes, courts may reject liquidated damages if deemed a penalty, reverting to unliquidated damages subject to claimant's demonstration of proximate causation and quantifiable injury.

Best Practices for Drafting Damages Provisions

Liquidated damages provisions should clearly define a reasonable pre-estimate of actual harm to ensure enforceability and avoid classification as penalties. Unliquidated damages allow parties to seek compensation based on actual losses, requiring detailed documentation and proof to substantiate claims. Best practices include specifying calculation methods, limiting caps on recoverable amounts, and incorporating dispute resolution mechanisms to minimize litigation risks.

Unliquidated Damages Infographic

libterm.com

libterm.com