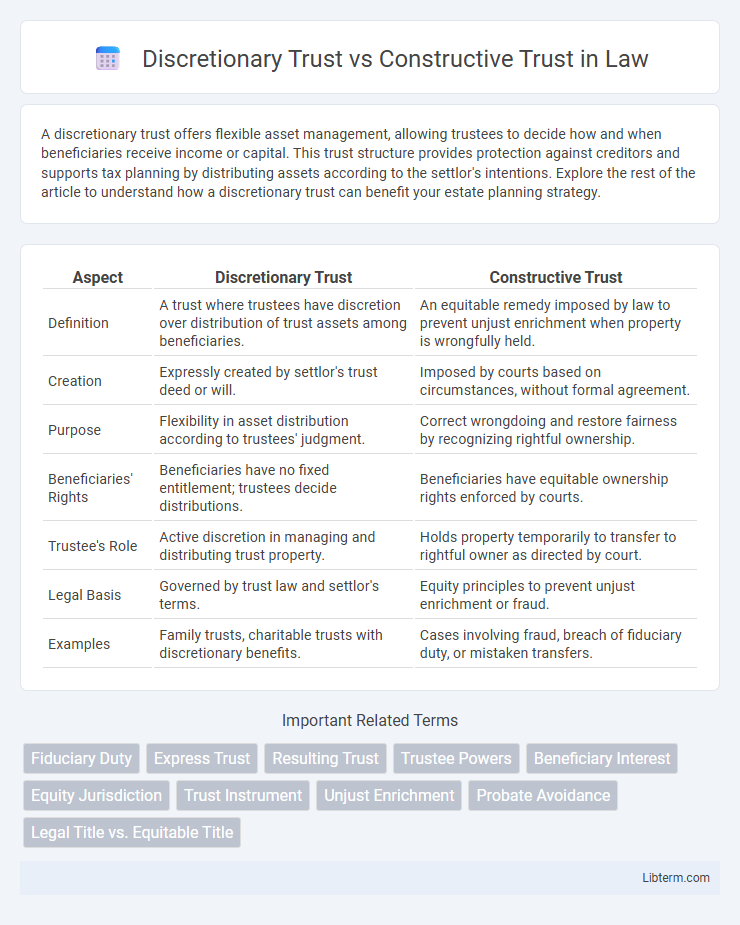

A discretionary trust offers flexible asset management, allowing trustees to decide how and when beneficiaries receive income or capital. This trust structure provides protection against creditors and supports tax planning by distributing assets according to the settlor's intentions. Explore the rest of the article to understand how a discretionary trust can benefit your estate planning strategy.

Table of Comparison

| Aspect | Discretionary Trust | Constructive Trust |

|---|---|---|

| Definition | A trust where trustees have discretion over distribution of trust assets among beneficiaries. | An equitable remedy imposed by law to prevent unjust enrichment when property is wrongfully held. |

| Creation | Expressly created by settlor's trust deed or will. | Imposed by courts based on circumstances, without formal agreement. |

| Purpose | Flexibility in asset distribution according to trustees' judgment. | Correct wrongdoing and restore fairness by recognizing rightful ownership. |

| Beneficiaries' Rights | Beneficiaries have no fixed entitlement; trustees decide distributions. | Beneficiaries have equitable ownership rights enforced by courts. |

| Trustee's Role | Active discretion in managing and distributing trust property. | Holds property temporarily to transfer to rightful owner as directed by court. |

| Legal Basis | Governed by trust law and settlor's terms. | Equity principles to prevent unjust enrichment or fraud. |

| Examples | Family trusts, charitable trusts with discretionary benefits. | Cases involving fraud, breach of fiduciary duty, or mistaken transfers. |

Introduction to Trusts

Trusts serve as legal arrangements where a trustee holds and manages assets on behalf of beneficiaries, with discretionary trusts granting trustees full authority to decide distributions, offering flexibility in asset management. Constructive trusts arise by court order to address situations involving unjust enrichment or wrongdoing, imposing obligations on the party holding the property to return it to the rightful owner. Understanding the distinctions between discretionary and constructive trusts is crucial for effective estate planning and asset protection strategies.

Definition of Discretionary Trust

A discretionary trust is a legal arrangement where the trustee holds assets and has the authority to decide how and when to distribute income or capital to beneficiaries based on their discretion. Unlike a constructive trust, which is imposed by law to prevent unjust enrichment, a discretionary trust is intentionally created to provide flexibility in managing and allocating trust property. This type of trust allows trustees to assess beneficiaries' needs and circumstances before making distributions.

Definition of Constructive Trust

A constructive trust is an equitable remedy imposed by courts to prevent unjust enrichment when one party wrongfully holds legal title to property. Unlike discretionary trusts, which are intentionally created by a settlor to manage assets, constructive trusts arise by operation of law without the parties' consent. The key element of a constructive trust is the court's determination that the holder of the property must convey it to the rightful beneficiary to rectify wrongdoing.

Key Differences Between Discretionary and Constructive Trusts

Discretionary trusts grant trustees the authority to decide how and when to distribute trust assets among beneficiaries, offering flexibility and control subject to the settlor's intentions, while constructive trusts arise by operation of law to address unjust enrichment or fraud, imposing obligations on parties holding property without explicit consent. Discretionary trusts emphasize settlor discretion and beneficiary uncertainty, whereas constructive trusts focus on remedying wrongful conduct and ensuring equitable ownership rights. The former is created intentionally through explicit trust deeds, whereas the latter is imposed judicially to prevent unjust enrichment or wrongful retention of property.

Legal Framework Governing Each Trust Type

Discretionary trusts operate under statutory laws like the Trustee Act 1925, granting trustees authority to decide how income or capital is distributed among beneficiaries. Constructive trusts arise by operation of law to prevent unjust enrichment, based on equitable principles recognized in landmark cases such as *Gissing v Gissing* (1971) and *Westdeutsche Landesbank v Islington LBC* (1996). The legal framework for constructive trusts involves court intervention to impose trust obligations where formal trusts are absent, ensuring fair treatment of parties with legitimate expectations.

Purposes and Typical Uses

Discretionary trusts serve estate planning and asset protection by allowing trustees to decide how and when to distribute income or capital among beneficiaries, often used to provide financial flexibility and tax efficiency. Constructive trusts arise by operation of law to remedy unjust enrichment or wrongful conduct, typically in cases of fraud, breach of fiduciary duty, or recognition of beneficial interest despite legal title. The purpose of constructive trusts is equitable restitution, whereas discretionary trusts focus on controlled wealth distribution and beneficiary benefit management.

Rights and Obligations of Beneficiaries

In a discretionary trust, beneficiaries have no fixed entitlement and the trustee holds the power to decide distributions, creating flexible rights subject to the trustee's discretion. Conversely, in a constructive trust, beneficiaries possess equitable rights enforced by the court to prevent unjust enrichment, obligating the trustee to act in their clear interest. Beneficiaries under a constructive trust have enforceable claims to specific assets, while those under a discretionary trust must rely on the trustee's judgment without guaranteed benefits.

Trustee Powers and Duties

Discretionary trusts grant trustees broad powers to decide how and when to distribute trust assets among beneficiaries, allowing flexible management tailored to beneficiaries' needs. Trustees must exercise discretion prudently, acting in good faith and considering beneficiaries' best interests without fixed entitlements. In contrast, constructive trusts impose fiduciary duties on trustees by operation of law, requiring them to hold property for equitable purposes, often to remedy unjust enrichment, with limited discretionary power over trust property.

Tax Implications and Considerations

Discretionary trusts offer flexibility in asset distribution, allowing trustees to allocate income and capital to beneficiaries in a tax-efficient manner, often minimizing beneficiaries' tax liabilities. Constructive trusts, imposed by courts to address unjust enrichment, do not provide the same tax planning opportunities and can trigger immediate tax consequences, including capital gains tax and income tax liabilities. Understanding the specific tax implications of each trust type is crucial for effective estate planning and compliance with tax regulations.

Choosing the Right Trust: Factors to Consider

Choosing the right trust involves evaluating the purpose, control, and flexibility required for asset management. Discretionary trusts offer trustees broad discretion in distributing income and capital, ideal for family wealth preservation and tax planning, whereas constructive trusts arise by operation of law to address unjust enrichment and typically require court intervention. Key factors include the level of beneficiary protection desired, potential tax implications, and the necessity for judicial oversight versus trustee authority.

Discretionary Trust Infographic

libterm.com

libterm.com