The Investment Company Act of 1940 establishes regulations aimed at minimizing conflicts of interest and protecting investors in investment companies. It imposes requirements on disclosure, fiduciary duties, and operational transparency to ensure fair management and safeguard Your investments. Explore the rest of this article to understand how these rules impact investment strategies and compliance.

Table of Comparison

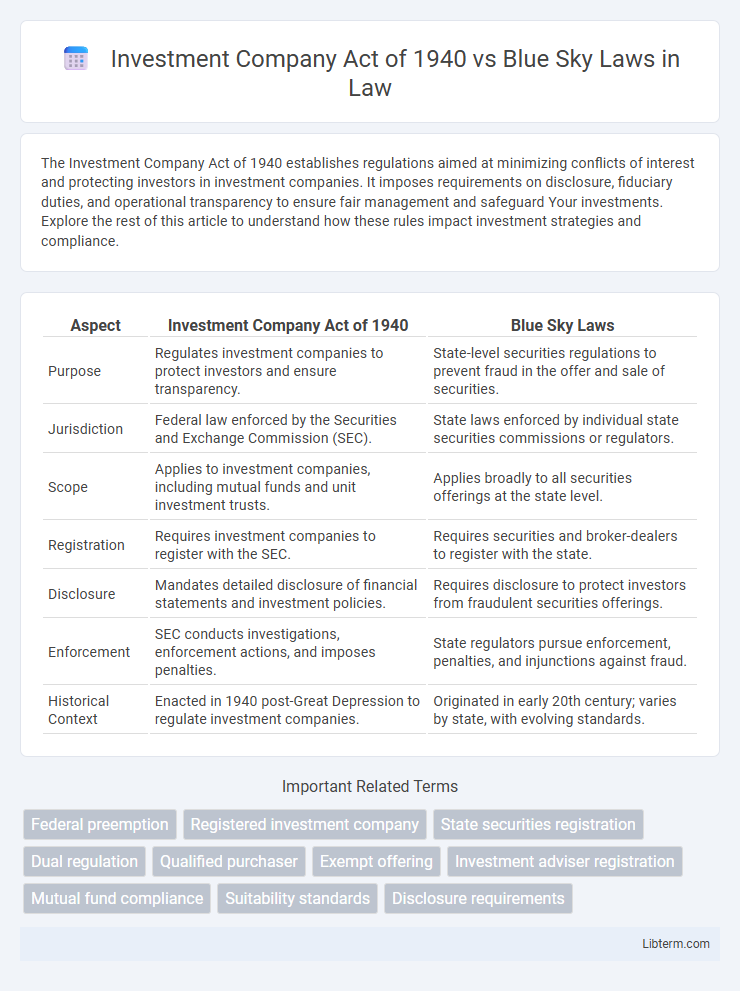

| Aspect | Investment Company Act of 1940 | Blue Sky Laws |

|---|---|---|

| Purpose | Regulates investment companies to protect investors and ensure transparency. | State-level securities regulations to prevent fraud in the offer and sale of securities. |

| Jurisdiction | Federal law enforced by the Securities and Exchange Commission (SEC). | State laws enforced by individual state securities commissions or regulators. |

| Scope | Applies to investment companies, including mutual funds and unit investment trusts. | Applies broadly to all securities offerings at the state level. |

| Registration | Requires investment companies to register with the SEC. | Requires securities and broker-dealers to register with the state. |

| Disclosure | Mandates detailed disclosure of financial statements and investment policies. | Requires disclosure to protect investors from fraudulent securities offerings. |

| Enforcement | SEC conducts investigations, enforcement actions, and imposes penalties. | State regulators pursue enforcement, penalties, and injunctions against fraud. |

| Historical Context | Enacted in 1940 post-Great Depression to regulate investment companies. | Originated in early 20th century; varies by state, with evolving standards. |

Overview of the Investment Company Act of 1940

The Investment Company Act of 1940 regulates investment companies, including mutual funds, focusing on transparency, fiduciary duties, and the protection of investors. It imposes specific registration requirements, disclosure mandates, and governance standards to prevent fraud and conflicts of interest. Unlike Blue Sky Laws, which are state-level securities regulations addressing fraud and registration of securities offerings, the Investment Company Act operates at the federal level with a targeted regulatory framework for investment companies.

Key Provisions of the Investment Company Act

The Investment Company Act of 1940 establishes comprehensive federal regulations for investment companies, including stringent requirements on registration, disclosure, governance, and fiduciary responsibilities to protect investors. Key provisions mandate detailed financial reporting, restrictions on transactions with affiliates, and limits on leverage and capital structure designed to minimize risk and conflicts of interest. In contrast, Blue Sky Laws are state-level regulations that primarily focus on preventing securities fraud through state registration and disclosure requirements but do not provide the same extensive operational oversight as the Investment Company Act.

Understanding Blue Sky Laws

Blue Sky Laws are state-level regulations designed to protect investors from fraudulent securities offerings by requiring registration and disclosure of investment products. These laws vary significantly across states but share the common goal of preventing deceptive practices in the sale of securities. Unlike the federally governed Investment Company Act of 1940, which regulates investment companies nationwide, Blue Sky Laws focus on local compliance and investor protection within individual state jurisdictions.

Scope and Purpose of Blue Sky Laws

Blue Sky Laws are state-level regulations designed to protect investors from fraudulent securities offerings by requiring registration and disclosure before securities can be sold. Unlike the Investment Company Act of 1940, which primarily governs the regulation and registration of investment companies at the federal level, Blue Sky Laws target the prevention of deceptive practices and ensure transparency within individual states. These laws vary widely by state but collectively aim to maintain investor confidence by enforcing local oversight on securities transactions.

Federal vs State Regulation of Securities

The Investment Company Act of 1940 establishes federal regulatory standards for investment companies, ensuring transparency, financial stability, and investor protection across all states. Blue Sky Laws represent state-level securities regulations that vary significantly in scope and enforcement, aiming to prevent fraud and require registration of securities offerings within individual states. Federal oversight under the 1940 Act preempts state regulations for registered investment companies, but Blue Sky Laws remain relevant for unregistered securities and local enforcement.

Registration and Disclosure Requirements Compared

The Investment Company Act of 1940 mandates federal registration and ongoing disclosure for investment companies, requiring comprehensive reporting to the SEC about financial condition, operations, and investment policies to protect investors. Blue Sky Laws operate at the state level with varying registration and disclosure requirements designed to prevent fraud by mandating the registration of securities offerings and brokerage firms, often focusing on initial filings and state-specific disclosures. While the Investment Company Act enforces strict, uniform federal standards, Blue Sky Laws provide additional protections tailored to local jurisdictions, resulting in a dual layer of regulatory oversight in many cases.

Exemptions Under Both Regulatory Frameworks

The Investment Company Act of 1940 provides specific exemptions for private funds, smaller investment companies, and certain foreign issuers, allowing them to avoid registration under defined asset and investor thresholds. Blue Sky Laws, enforced at the state level, offer varied exemptions such as intrastate offerings, limited offerings to accredited investors, and small-scale transactions, which differ significantly among states. Both regulatory frameworks aim to balance investor protection with capital formation by tailoring exemption criteria to the scale and nature of the securities offering.

Enforcement Authorities: SEC vs State Regulators

The Investment Company Act of 1940 is enforced primarily by the Securities and Exchange Commission (SEC), which oversees federally registered investment companies to ensure compliance with strict regulatory standards. In contrast, Blue Sky Laws are enforced by state securities regulators who oversee securities offerings and sales within their respective states to protect investors from fraud and misrepresentation. The SEC's authority under the Investment Company Act enables nationwide oversight, while state regulators apply Blue Sky Laws with jurisdiction limited to their individual states.

Impact on Investment Companies and Mutual Funds

The Investment Company Act of 1940 primarily governs the registration, regulation, and operations of investment companies and mutual funds at the federal level, ensuring transparency, fiduciary responsibility, and investor protection. Blue Sky Laws, enforced at the state level, require registration and disclosure for securities offerings to prevent fraud and protect investors within specific jurisdictions. Together, these regulatory frameworks shape the compliance landscape for investment companies and mutual funds, with the federal act establishing broad operational standards, while Blue Sky Laws impose additional state-specific requirements and filings.

Compliance Challenges and Practical Considerations

The Investment Company Act of 1940 imposes extensive federal regulatory requirements on investment companies, including registration, disclosure, and governance standards, creating a complex compliance landscape. Blue Sky Laws, implemented at the state level, introduce additional layers of regulation, necessitating thorough due diligence to ensure adherence to varying registration and reporting mandates across jurisdictions. Navigating these overlapping frameworks demands robust legal expertise and comprehensive compliance programs to mitigate risks and maintain operational integrity.

Investment Company Act of 1940 Infographic

libterm.com

libterm.com