An indemnifier is a party who agrees to compensate another for any losses or damages incurred, providing financial protection and risk transfer. This role is crucial in contracts, insurance policies, and legal agreements to ensure liability is clearly assigned. Explore the full article to understand how an indemnifier safeguards your interests and the key considerations involved.

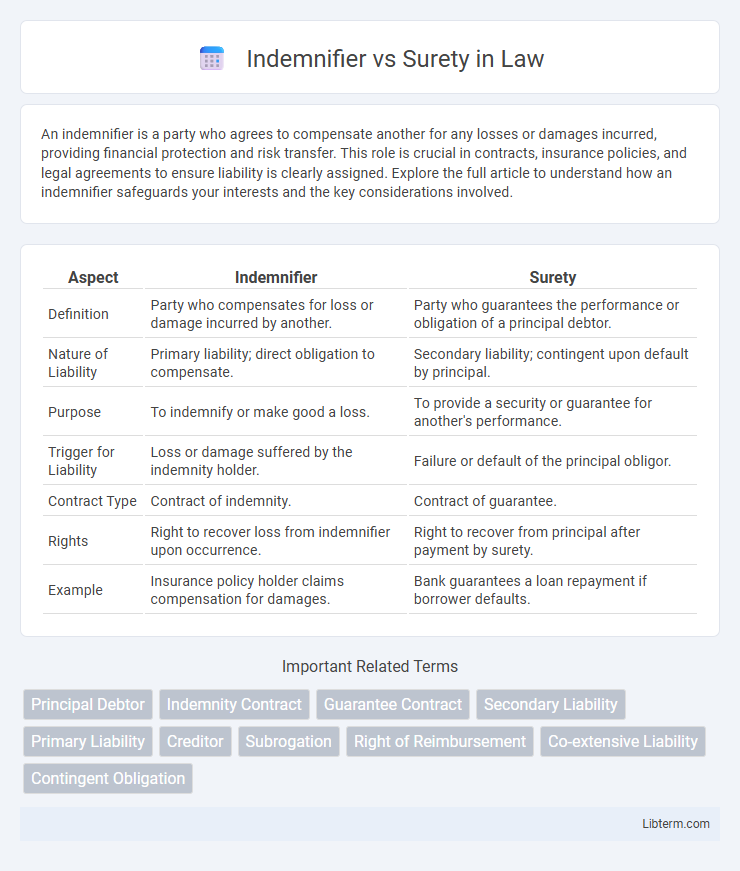

Table of Comparison

| Aspect | Indemnifier | Surety |

|---|---|---|

| Definition | Party who compensates for loss or damage incurred by another. | Party who guarantees the performance or obligation of a principal debtor. |

| Nature of Liability | Primary liability; direct obligation to compensate. | Secondary liability; contingent upon default by principal. |

| Purpose | To indemnify or make good a loss. | To provide a security or guarantee for another's performance. |

| Trigger for Liability | Loss or damage suffered by the indemnity holder. | Failure or default of the principal obligor. |

| Contract Type | Contract of indemnity. | Contract of guarantee. |

| Rights | Right to recover loss from indemnifier upon occurrence. | Right to recover from principal after payment by surety. |

| Example | Insurance policy holder claims compensation for damages. | Bank guarantees a loan repayment if borrower defaults. |

Introduction to Indemnifier and Surety

An indemnifier is a party that agrees to compensate for any loss or damage incurred by another, usually under an indemnity agreement to hold the indemnitee harmless. A surety is a guarantor who promises to fulfill the obligations of a principal debtor to a creditor if the principal defaults, typically under a surety bond. While indemnifiers provide primary compensation for losses, sureties offer secondary liability ensuring debt or duty fulfillment.

Definition of Indemnifier

An indemnifier is a party that agrees to compensate for any loss, damage, or liability incurred by another, providing financial security against specified risks. Unlike a surety, who guarantees the performance or obligations of a principal, the indemnifier directly reimburses losses or expenses without guaranteeing a third party's obligations. This distinction highlights the indemnifier's primary role in risk management through direct compensation rather than guarantee enforcement.

Definition of Surety

A surety is a legally bound party who guarantees the performance or obligations of a principal to an obligee, stepping in to fulfill the obligation if the principal defaults. Unlike an indemnifier, who compensates for loss after a default occurs, a surety provides a financial guarantee upfront, ensuring the principal's duties are met. The surety's liability is contingent and secondary, activated only upon the principal's failure to perform.

Key Legal Differences

An indemnifier primarily promises to compensate for loss or damage incurred, creating a primary liability independent of any third party's failure, while a surety guarantees the performance or obligation of a principal debtor, holding secondary liability contingent upon the principal's default. The indemnifier's liability arises upon the occurrence of a specified event, whereas the surety's liability is accessory and arises only when the principal debtor fails to fulfill their obligation. Courts often interpret suretyship contracts strictly, requiring clear evidence of the surety's consent to be bound, contrasting with indemnity contracts which are construed more broadly to uphold the indemnifier's obligation.

Roles and Responsibilities

An indemnifier assumes primary liability by agreeing to compensate the indemnitee for any loss or damage, often stepping in only after the indemnitee suffers a loss. A surety provides a guarantee to the obligee that the principal debtor will fulfill their obligations, stepping in immediately upon default to fulfill or repay the debt. The indemnifier's role centers on reimbursement and risk transfer, while the surety's responsibility focuses on assurance and direct performance to protect the obligee.

Nature of Liability

Indemnifiers bear primary and direct liability, obligated to fully compensate the indemnitee for any losses without requiring prior action against the principal. Sureties hold secondary or contingent liability, stepping in only if the principal fails to fulfill their obligations under the bond or agreement. This fundamental difference in the nature of liability affects the enforceability and risk exposure for both indemnifiers and sureties in contractual arrangements.

Rights Against Principal Debtor

Indemnifiers have a direct right to claim from the principal debtor upon default, often allowing immediate reimbursement without exhausting remedies against the surety. Sureties possess a right of subrogation, enabling them to pursue the principal debtor only after fulfilling the creditor's claim, which makes their rights inherently secondary. The distinction significantly impacts enforcement strategies and risk allocation in contractual obligations involving guarantees.

Termination of Liability

Indemnifier liability typically ends once a specified event or obligation is fulfilled, often detailed explicitly in the contract, whereas a surety's liability generally terminates only after the principal's debt or obligation is fully discharged or the surety is formally released. Surety obligations are continuing and secondary, remaining in effect until all conditions are satisfied or the surety provides a lawful discharge. In contrast, indemnifier responsibility is primary and may cease upon indemnification payment or contract termination terms.

Common Use Cases

Indemnifiers are commonly used in contractual agreements to compensate for losses or damages, providing financial security between private parties. Sureties typically appear in construction projects, guaranteeing that contractors fulfill their obligations and ensuring payment to subcontractors or suppliers. Both roles mitigate risk but differ as indemnifiers assume responsibility post-loss, while sureties act as third-party guarantors upfront.

Conclusion: Choosing Between Indemnifier and Surety

Choosing between an indemnifier and a surety hinges on the nature of financial responsibility and risk management in contractual agreements. An indemnifier provides direct reimbursement for losses, offering a broader scope of protection, while a surety guarantees performance or payment only if the primary party defaults, focusing on credit assurance. Selecting the appropriate option depends on the specific risk exposure, legal requirements, and the desired level of assurance in the contractual relationship.

Indemnifier Infographic

libterm.com

libterm.com