Trust forms the foundation of every successful relationship, influencing personal connections and business interactions alike. Building trust requires consistent honesty, reliability, and transparency, which fosters a sense of security and loyalty. Discover how you can cultivate trust in various aspects of your life by exploring the rest of this article.

Table of Comparison

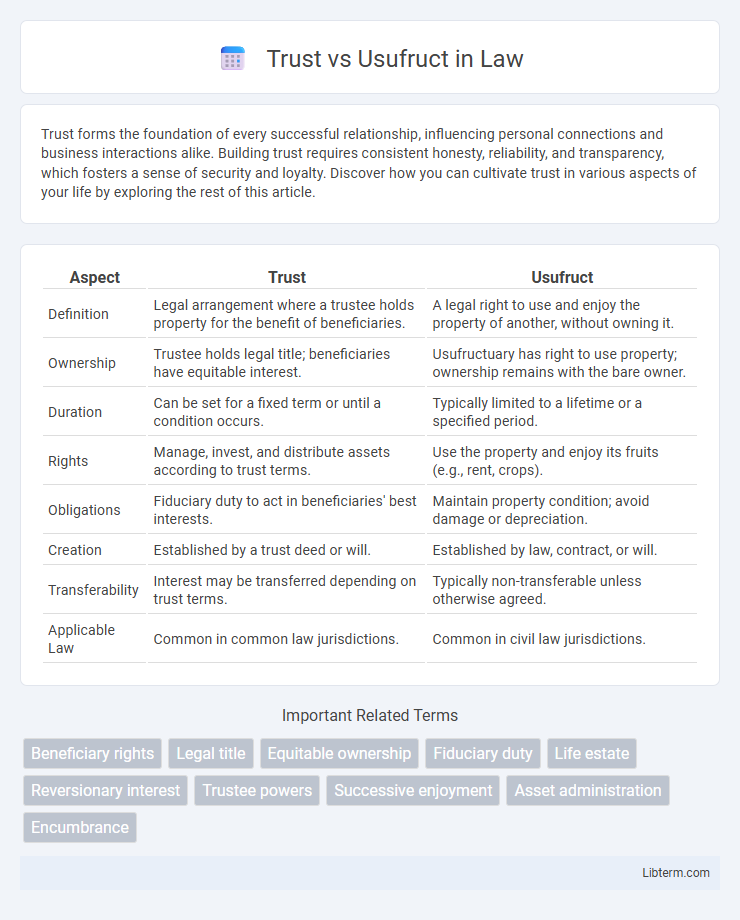

| Aspect | Trust | Usufruct |

|---|---|---|

| Definition | Legal arrangement where a trustee holds property for the benefit of beneficiaries. | A legal right to use and enjoy the property of another, without owning it. |

| Ownership | Trustee holds legal title; beneficiaries have equitable interest. | Usufructuary has right to use property; ownership remains with the bare owner. |

| Duration | Can be set for a fixed term or until a condition occurs. | Typically limited to a lifetime or a specified period. |

| Rights | Manage, invest, and distribute assets according to trust terms. | Use the property and enjoy its fruits (e.g., rent, crops). |

| Obligations | Fiduciary duty to act in beneficiaries' best interests. | Maintain property condition; avoid damage or depreciation. |

| Creation | Established by a trust deed or will. | Established by law, contract, or will. |

| Transferability | Interest may be transferred depending on trust terms. | Typically non-transferable unless otherwise agreed. |

| Applicable Law | Common in common law jurisdictions. | Common in civil law jurisdictions. |

Introduction to Trust and Usufruct

A trust is a legal arrangement where a trustee holds and manages assets on behalf of beneficiaries, ensuring asset protection and controlled distribution. Usufruct grants a person the right to use and benefit from another's property without owning it, preserving the property's substance for the owner. Both concepts serve distinct purposes in asset management and property rights, offering varied legal protections and benefits.

Defining Trust: Key Features and Functions

A trust is a legal arrangement where one party, the trustee, holds and manages assets for the benefit of another, the beneficiary, under terms set by the trustor. Key features include fiduciary duties imposed on the trustee to act in the best interests of beneficiaries and the separation of legal ownership from beneficial ownership. Trusts provide flexible asset management, protection, and estate planning advantages distinct from usufruct rights, which grant only the temporary use and enjoyment of property without altering ownership.

Understanding Usufruct: Core Concepts

Usufruct grants a legal right to use and derive benefits from someone else's property without owning it, distinct from a trust where assets are managed by a trustee for beneficiaries. The usufructuary possesses temporary control, maintaining the property's substance while enjoying its fruits, such as rental income or harvests. Understanding usufruct involves recognizing its limited duration, the obligation to preserve the property's value, and the reversion of full ownership to the original owner or heirs once the usufruct ends.

Legal Foundations of Trust vs Usufruct

Trusts are legal arrangements where a trustee holds and manages property for the beneficiary's benefit, governed by trust law rooted in common law jurisdictions. Usufruct is a civil law concept granting a usufructuary the right to use and derive benefit from someone else's property without altering its substance, typically established under civil codes. The key legal distinction lies in ownership transfer: trusts separate legal and equitable title, while usufruct preserves ownership with the original owner but grants usage rights to the usufructuary.

Ownership Structure: Trust vs Usufruct

Ownership structure in a trust involves legal title held by the trustee for the benefit of beneficiaries, separating control and enjoyment of assets. In contrast, usufruct grants the usufructuary the right to use and derive profit from the property without owning it, with ownership remaining with the bare owner. Trusts provide more flexibility in managing and protecting assets, while usufruct focuses on the temporary use rights without transferring full ownership.

Rights and Obligations of Beneficiaries

Beneficiaries of a trust hold equitable rights to trust assets, allowing them to receive income or capital distributions as stipulated by the trust deed, while trustees manage the legal title and fiduciary responsibilities. In contrast, usufruct beneficiaries possess the right to use and derive benefits from the property without owning it, accompanied by obligations to preserve the asset's substance and return it undiminished. Trust beneficiaries have limited control over asset management, relying on trustees' adherence to fiduciary duties, whereas usufruct beneficiaries exercise direct enjoyment rights but must avoid causing permanent damage or waste.

Duration and Termination Differences

Trusts can have fixed or indefinite durations, often lasting for decades or even generations, depending on jurisdictional rules and settlor intent. Usufructs typically have limited durations, often defined by a term of years, the lifetime of the usufructuary, or until a specific event occurs. Termination of a trust generally occurs upon fulfillment of its purpose, expiration of a term, or court order, while usufructs end automatically upon expiration of the agreed term, death of the usufructuary, or destruction of the property.

Advantages and Disadvantages: Trust vs Usufruct

Trusts offer flexibility in asset management and protection from creditors, allowing the grantor to specify detailed terms and beneficiaries, which is advantageous for estate planning and tax optimization; however, they can be costly to establish and maintain, with complex legal requirements. Usufruct grants the right to use and derive income from property without transferring ownership, providing a simpler and often less expensive arrangement focused on usufructuary rights, but it limits the usufructuary's control, typically expires upon death or a set term, and offers less protection against creditors. Choosing between a trust and usufruct depends on the desired level of control, duration, legal complexity, and financial implications related to asset transfer and use rights.

Common Use Cases and Practical Applications

Trusts are commonly used for estate planning, asset protection, and managing wealth across generations, offering flexibility in controlling property distribution. Usufruct rights are typically applied in real estate for granting temporary possession and usage of property without transferring ownership, often seen in agricultural land leases or life estates. Both legal arrangements serve distinct practical purposes: trusts facilitate long-term financial management, while usufruct ensures beneficial use and income from assets during a specified period.

Choosing Between Trust and Usufruct: Key Considerations

Choosing between a trust and usufruct depends on factors like control, tax implications, and purpose of asset management. Trusts provide comprehensive control over asset distribution and protection against creditors, while usufruct grants usage rights without ownership transfer, often minimizing estate taxes. Evaluating goals such as inheritance planning, asset protection, and flexibility is crucial for selecting the optimal legal structure.

Trust Infographic

libterm.com

libterm.com