Fraud involves intentional deception to secure unfair or unlawful gain, impacting businesses and individuals alike. Recognizing common fraud tactics can protect your assets and maintain trust in personal and professional relationships. Explore the rest of this article to learn how to identify fraud and safeguard yourself effectively.

Table of Comparison

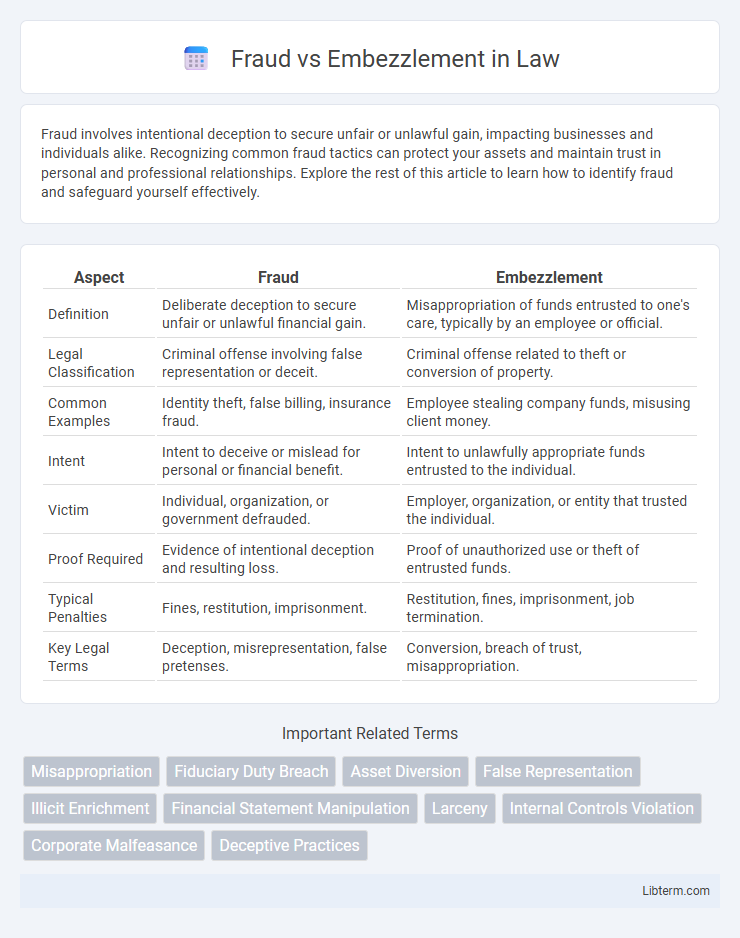

| Aspect | Fraud | Embezzlement |

|---|---|---|

| Definition | Deliberate deception to secure unfair or unlawful financial gain. | Misappropriation of funds entrusted to one's care, typically by an employee or official. |

| Legal Classification | Criminal offense involving false representation or deceit. | Criminal offense related to theft or conversion of property. |

| Common Examples | Identity theft, false billing, insurance fraud. | Employee stealing company funds, misusing client money. |

| Intent | Intent to deceive or mislead for personal or financial benefit. | Intent to unlawfully appropriate funds entrusted to the individual. |

| Victim | Individual, organization, or government defrauded. | Employer, organization, or entity that trusted the individual. |

| Proof Required | Evidence of intentional deception and resulting loss. | Proof of unauthorized use or theft of entrusted funds. |

| Typical Penalties | Fines, restitution, imprisonment. | Restitution, fines, imprisonment, job termination. |

| Key Legal Terms | Deception, misrepresentation, false pretenses. | Conversion, breach of trust, misappropriation. |

Understanding the Basics: What is Fraud?

Fraud involves intentional deception to secure unfair or unlawful financial gain, often through false representation or concealment of material facts. It encompasses various schemes such as identity theft, credit card fraud, and securities fraud, targeting individuals or organizations. Understanding fraud is essential for recognizing how criminals exploit trust and manipulate financial systems for personal benefit.

Defining Embezzlement: Key Characteristics

Embezzlement is the illegal appropriation of funds or property entrusted to an individual's care, often occurring within employment or fiduciary relationships. Key characteristics include the violation of trust, the intentional misappropriation of assets, and the concealed nature of the act to avoid detection. Unlike general fraud, embezzlement specifically involves the betrayal of trust by a person in a position of responsibility.

Fraud vs Embezzlement: Core Differences

Fraud involves intentionally deceiving someone to gain a financial or personal benefit, often through false representation or concealment of facts, while embezzlement specifically refers to the illegal appropriation of funds or property entrusted to an individual's care. Fraud can encompass a wide range of deceptive practices including identity theft, forgery, and scams, whereas embezzlement is a subset of fraud that requires a fiduciary relationship between the victim and the perpetrator. The key difference lies in the nature of the crime: fraud centers on deceit and misrepresentation, while embezzlement focuses on the misappropriation of assets by someone in a position of trust.

Common Methods of Fraud and Embezzlement

Common methods of fraud include identity theft, credit card scams, phishing attacks, and insurance fraud, where perpetrators manipulate information to gain financial benefits unlawfully. Embezzlement typically involves the misappropriation of funds by employees or trusted individuals, such as skimming cash, falsifying expense reports, or diverting company funds into personal accounts. Both fraud and embezzlement rely heavily on deception, but fraud often targets external victims, while embezzlement abuses internal trust within organizations.

Legal Definitions and Statutes

Fraud involves intentional deception to secure unfair or unlawful financial gain, typically defined under state and federal statutes such as the U.S. Code Title 18, Section 1341 (mail fraud) and Section 1343 (wire fraud). Embezzlement is the fraudulent appropriation of funds or property entrusted to an individual, governed by specific state laws that classify it as a form of theft or larceny, with penalties varying by jurisdiction. Legal statutes distinguish fraud by the act of deception, while embezzlement centers on the breach of trust over assets legally possessed.

Real-Life Examples: Fraud and Embezzlement Cases

Fraud and embezzlement cases often involve distinct methods and settings, with fraud usually encompassing deceptive practices like Ponzi schemes, exemplified by Bernie Madoff's $65 billion scandal, while embezzlement typically involves the misappropriation of funds by trusted employees, such as the case of Rita Crundwell, who embezzled $53 million from her small town's public funds. Real-life examples highlight how fraud schemes manipulate investors or the public through false information, contrasting with embezzlement cases where individuals exploit access to company or organizational funds. High-profile instances demonstrate varying legal repercussions, with fraud often resulting in federal charges and long prison sentences, whereas embezzlement may involve internal investigations and restitution requirements.

Signs and Red Flags to Watch For

Signs of fraud include unexpected changes in financial records, discrepancies in invoices, and unauthorized transactions frequently missing from audit trails. Embezzlement often presents red flags such as unexplained depletion of company funds, altered accounting documents, and employees living beyond their means. Close monitoring of irregular financial activities and timely internal audits serve as crucial measures to detect both fraud and embezzlement early.

Prevention Strategies for Organizations

Fraud prevention strategies for organizations include implementing robust internal controls, conducting regular audits, and fostering a culture of transparency and accountability among employees. Embezzlement can be deterred through segregation of duties, continuous monitoring of financial transactions, and using technology such as fraud detection software to identify suspicious activities early. Employee training on ethical behavior and clear policies regarding fraud reporting channels strengthen organizational defenses against both fraud and embezzlement risks.

Legal Consequences and Penalties

Fraud and embezzlement both carry severe legal consequences, including criminal charges that can result in fines, restitution, and imprisonment. Fraud typically involves intentional deception to secure unfair or unlawful gain, often leading to penalties such as felony convictions and long-term incarceration. Embezzlement, characterized by the misappropriation of funds entrusted to an individual, often results in similar criminal charges but may also include specific penalties like asset forfeiture and mandatory restitution to victims.

Reporting and Responding to Suspicious Activities

Reporting suspicious activities related to fraud and embezzlement requires immediate notification to internal compliance officers and external regulatory bodies such as the SEC or local law enforcement. Organizations must implement clear protocols for documenting evidence, preserving audit trails, and initiating internal investigations to mitigate financial losses and legal exposure. Prompt response, including freezing assets and collaborating with forensic accountants, is critical to protect organizational integrity and support potential prosecution.

Fraud Infographic

libterm.com

libterm.com