A levy is a legal seizure of property or assets to satisfy a debt or tax obligation imposed by authorities. Understanding the types and processes involved in levies can help you protect your rights and manage financial challenges effectively. Explore the rest of the article to learn how levies work and what steps you can take if faced with one.

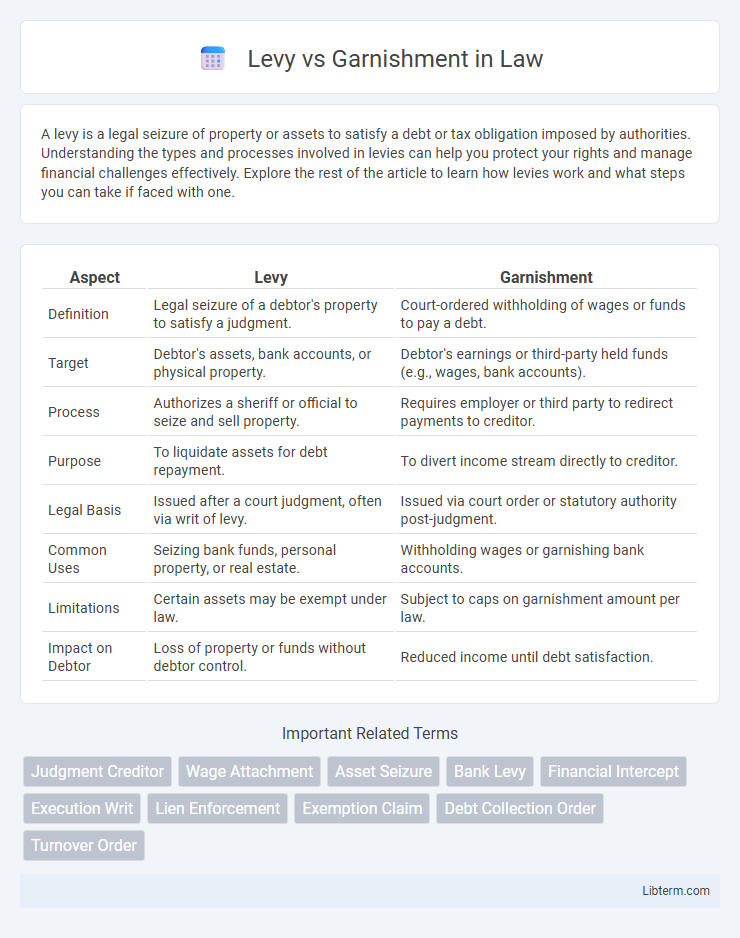

Table of Comparison

| Aspect | Levy | Garnishment |

|---|---|---|

| Definition | Legal seizure of a debtor's property to satisfy a judgment. | Court-ordered withholding of wages or funds to pay a debt. |

| Target | Debtor's assets, bank accounts, or physical property. | Debtor's earnings or third-party held funds (e.g., wages, bank accounts). |

| Process | Authorizes a sheriff or official to seize and sell property. | Requires employer or third party to redirect payments to creditor. |

| Purpose | To liquidate assets for debt repayment. | To divert income stream directly to creditor. |

| Legal Basis | Issued after a court judgment, often via writ of levy. | Issued via court order or statutory authority post-judgment. |

| Common Uses | Seizing bank funds, personal property, or real estate. | Withholding wages or garnishing bank accounts. |

| Limitations | Certain assets may be exempt under law. | Subject to caps on garnishment amount per law. |

| Impact on Debtor | Loss of property or funds without debtor control. | Reduced income until debt satisfaction. |

Understanding Levy vs Garnishment: Key Differences

Levy and garnishment are both legal methods used by creditors to collect debts, but they differ in execution and scope. A levy allows creditors to seize a debtor's property or funds directly from assets like bank accounts or personal belongings, whereas garnishment involves a third party, such as an employer, withholding wages or funds before they reach the debtor. Understanding these distinctions is crucial for managing debt collection processes and protecting debtor rights under laws like the Fair Debt Collection Practices Act (FDCPA).

Definitions: What Is a Levy?

A levy is a legal action allowing a creditor to seize a debtor's property or funds to satisfy a judgment. It typically involves taking money directly from a bank account, wages, or personal assets. This process is distinct from garnishment, which specifically targets third parties, such as employers, to withhold funds owed to the debtor.

Definitions: What Is Garnishment?

Garnishment is a legal process through which a creditor collects a portion of a debtor's wages or funds directly from a third party, such as an employer or bank, to satisfy an outstanding debt. Unlike a levy, which involves seizing assets directly from a debtor's account or property, garnishment targets income before it reaches the debtor. This method ensures consistent payment toward debts like child support, tax obligations, or court judgments.

Types of Debts Involved in Levy and Garnishment

Levies typically target debts owed to government agencies, such as unpaid taxes or federal student loans, allowing authorities to seize assets directly from the debtor's bank account or property. Garnishments primarily address unpaid consumer debts, including child support, credit card balances, and personal loans, by deducting a portion of the debtor's wages or bank accounts through employer or third-party involvement. Both levy and garnishment procedures are frequently used to enforce judgments for various financial obligations but differ significantly in the types of debt they commonly address and their mechanisms for asset collection.

How the Levy Process Works

The levy process allows creditors to seize a debtor's property or funds directly from financial accounts, wages, or assets to satisfy a judgment. Once a court issues a levy, the appropriate authority, such as the IRS or a court marshal, freezes the debtor's assets and transfers the owed amount to the creditor. Key legal steps include notice to the debtor and the opportunity to dispute before enforcement, ensuring compliance with state and federal laws.

How Wage Garnishment Is Implemented

Wage garnishment is implemented by a court order requiring an employer to withhold a portion of an employee's earnings and send it directly to the creditor to satisfy a debt. The process typically begins after the creditor obtains a judgment and serves the garnishment notice to the employer, who must comply without reducing the employee's income below federal or state exemption limits. Limits on garnishment amounts are governed by the Consumer Credit Protection Act (CCPA), which restricts withholding to no more than 25% of disposable earnings or the amount by which weekly wages exceed 30 times the federal minimum wage.

Legal Rights and Protections for Consumers

Consumers facing levy or garnishment actions have distinct legal rights and protections under federal and state laws designed to prevent undue hardship. Wage garnishments typically limit the amount that can be withheld based on the Consumer Credit Protection Act, ensuring a portion of income remains exempt to cover living expenses. Levies, which allow creditors to seize funds directly from bank accounts, require prior notification and are subject to exemptions exempts like Social Security benefits, offering essential safeguards for consumers.

Common Scenarios Triggering Levy or Garnishment

Common scenarios triggering a levy include unpaid federal tax debts where the IRS directly seizes assets such as bank accounts or wages. Garnishments often arise from court judgments involving credit card debts, child support, or unpaid loans, leading employers or third parties to withhold a portion of an individual's wages or bank account funds. Both levy and garnishment actions are typically initiated after failure to satisfy outstanding debts or legal obligations.

Steps to Respond to a Levy or Garnishment Notice

When responding to a levy or garnishment notice, the first step is to carefully review the documents to understand the amount owed, the creditor's information, and deadlines for response. Next, contact the creditor or the agency issuing the levy or garnishment to discuss possible payment plans, exemptions, or to clarify any errors in the notice. Finally, consider consulting a financial advisor or attorney to explore legal defenses, exemption claims, and to ensure compliance with state and federal laws governing garnishments and levies.

Preventing and Resolving Levy or Garnishment Actions

Preventing a levy or garnishment involves timely communication with creditors and understanding your state's exemption laws to protect a portion of your wages or assets. Resolving these actions may include negotiating payment plans, filing for a release through the court, or proving financial hardship to reduce or eliminate the garnishment amount. Consulting with a legal professional can provide tailored strategies and ensure your rights are upheld throughout the process.

Levy Infographic

libterm.com

libterm.com