An executor plays a crucial role in managing and distributing a deceased person's estate according to their will, ensuring all legal and financial obligations are met. Understanding the responsibilities and legal requirements involved can help you navigate the probate process smoothly. Explore the rest of this article to learn how an executor protects your interests and handles estate matters efficiently.

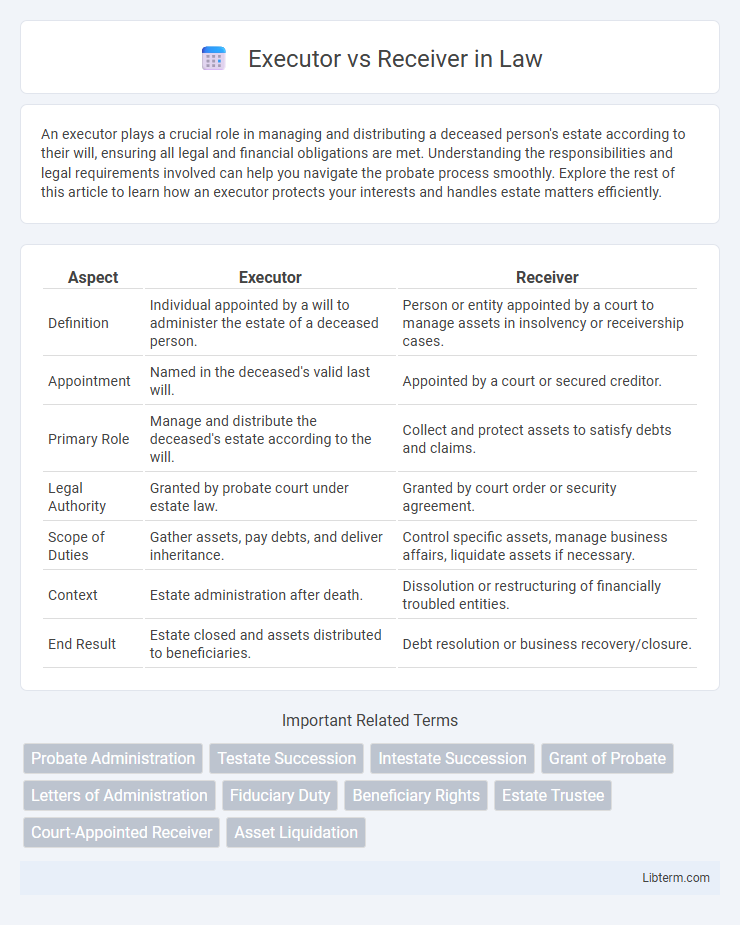

Table of Comparison

| Aspect | Executor | Receiver |

|---|---|---|

| Definition | Individual appointed by a will to administer the estate of a deceased person. | Person or entity appointed by a court to manage assets in insolvency or receivership cases. |

| Appointment | Named in the deceased's valid last will. | Appointed by a court or secured creditor. |

| Primary Role | Manage and distribute the deceased's estate according to the will. | Collect and protect assets to satisfy debts and claims. |

| Legal Authority | Granted by probate court under estate law. | Granted by court order or security agreement. |

| Scope of Duties | Gather assets, pay debts, and deliver inheritance. | Control specific assets, manage business affairs, liquidate assets if necessary. |

| Context | Estate administration after death. | Dissolution or restructuring of financially troubled entities. |

| End Result | Estate closed and assets distributed to beneficiaries. | Debt resolution or business recovery/closure. |

Introduction: Executor vs Receiver

Executor and receiver represent distinct roles in legal and financial contexts concerning asset management and distribution. An executor is a person or institution appointed to administer and settle a deceased individual's estate according to the will, ensuring all debts are paid and assets are distributed to beneficiaries. In contrast, a receiver is typically appointed by a court to take custody of property or funds during litigation or insolvency, managing assets impartially to protect creditors' or stakeholders' interests.

Defining Executor and Receiver

An Executor is an individual or institution appointed to manage and distribute the assets of a deceased person's estate according to the will, ensuring legal compliance and debt settlement. A Receiver is a court-appointed entity tasked with managing and protecting property or assets during legal disputes or insolvency proceedings. Both roles involve fiduciary duties but differ in appointment methods and specific responsibilities within estate or asset management contexts.

Key Roles and Responsibilities

The executor manages the administration of a deceased person's estate, ensuring debts are paid and assets are distributed according to the will. The receiver oversees the management and protection of assets during legal or financial processes, often appointed by a court to handle insolvency or disputes. Executors prioritize estate settlement while receivers focus on asset preservation and resolution of claims.

Legal Basis and Authority

An executor is legally appointed through a valid will to administer the deceased's estate, holding authority granted by probate law to collect assets, pay debts, and distribute property according to the testator's wishes. A receiver, appointed by a court often in insolvency or dispute scenarios, operates under judicial authority to manage and protect assets during litigation or bankruptcy. The executor's authority originates from testamentary documents and probate statutes, whereas the receiver's power derives from court orders and equitable jurisdiction.

Appointment Process Differences

The appointment process for an Executor typically involves the testator naming the individual in their will, followed by court validation through probate to confirm the executor's authority. In contrast, a Receiver is appointed by a court or regulatory agency, often during disputes or insolvency proceedings, without requiring a will. Unlike Executors who are chosen based on the decedent's wishes, Receivers are selected for their ability to manage and protect assets under legal supervision.

Scope of Powers and Limitations

The executor's scope of powers primarily involves managing the deceased's estate, including paying debts, distributing assets, and handling legal and financial obligations according to the will. In contrast, a receiver's powers are court-appointed with authority limited to overseeing and protecting specific assets during litigation or insolvency, often focusing on preserving value rather than distributing it. Limitations for executors include probate court supervision and adherence to the will, whereas receivers operate under strict judicial orders with narrowly defined responsibilities and timeframes.

Duration of Duties

Executors typically remain in their role until the estate is fully settled, which can take several months to over a year depending on the complexity of the estate and any probate delays. Receivers, however, are appointed by courts to manage specific assets or disputes and serve only for the duration necessary to fulfill their assigned duties, often concluding once the court's objectives are met. The duration of an executor's duties is generally longer and more comprehensive, while a receiver's responsibilities are more limited and temporary.

Impact on Beneficiaries and Creditors

The executor manages estate assets to ensure beneficiaries receive their inheritance according to the will, preserving the estate's value and protecting creditor interests by settling debts before distribution. The receiver, often appointed by a court, takes control of assets primarily to satisfy creditor claims, potentially limiting immediate benefits to heirs. This distinction influences how quickly beneficiaries obtain assets and the extent to which creditors recover debts from the estate.

Common Scenarios for Use

Executors manage the distribution and administration of estates, commonly involved in probate processes when a person passes away, ensuring that debts and taxes are paid and assets are distributed according to the will or state law. Receivers are appointed by courts to oversee and preserve assets during ongoing litigation or bankruptcy cases, often managing business operations or securing property until the legal matters are resolved. Common scenarios include Executors handling personal estate settlements after death, while Receivers address disputes over property management, creditor claims, or corporate insolvency.

Choosing Between Executor and Receiver

Choosing between an Executor and a Receiver depends on the specific legal and financial responsibilities required in managing an estate or trust. Executors are responsible for administering wills, managing assets, and ensuring debts and taxes are paid according to the deceased's wishes, while Receivers are appointed by courts to manage property or assets during litigation or bankruptcy. Understanding the scope of authority, legal obligations, and the context of the appointment helps determine the appropriate role for estate or asset management.

Executor Infographic

libterm.com

libterm.com