Integration streamlines your systems by connecting various software and applications, enhancing workflow efficiency and data consistency. It reduces manual tasks and errors, allowing teams to focus on strategic goals. Discover how effective integration can transform your operations by reading the full article.

Table of Comparison

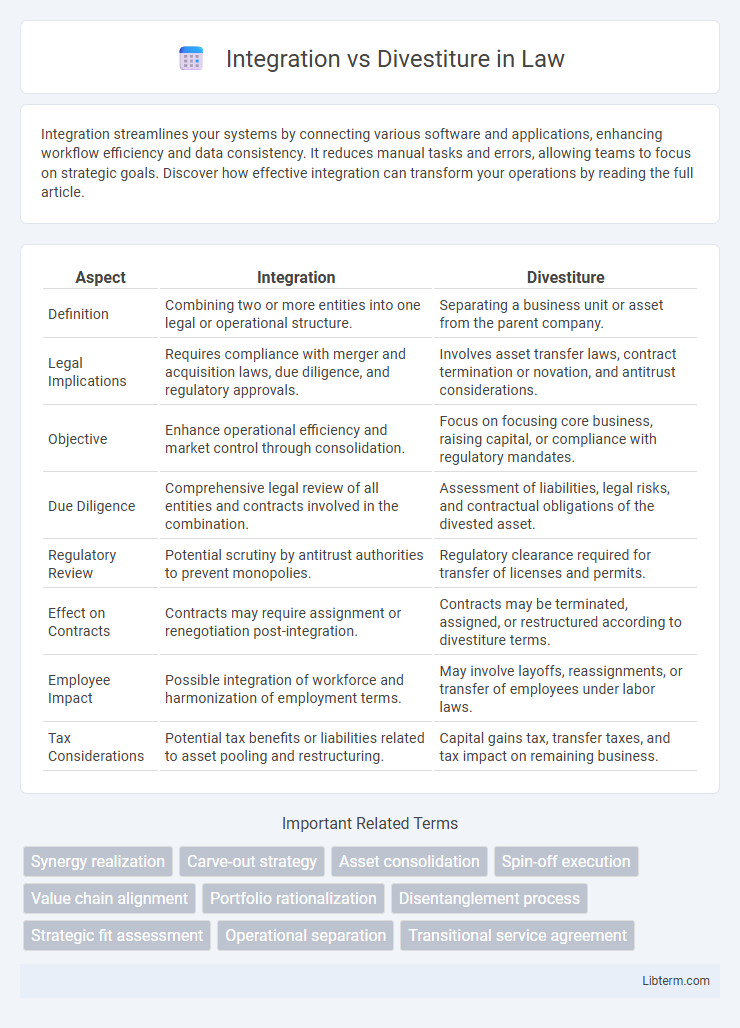

| Aspect | Integration | Divestiture |

|---|---|---|

| Definition | Combining two or more entities into one legal or operational structure. | Separating a business unit or asset from the parent company. |

| Legal Implications | Requires compliance with merger and acquisition laws, due diligence, and regulatory approvals. | Involves asset transfer laws, contract termination or novation, and antitrust considerations. |

| Objective | Enhance operational efficiency and market control through consolidation. | Focus on focusing core business, raising capital, or compliance with regulatory mandates. |

| Due Diligence | Comprehensive legal review of all entities and contracts involved in the combination. | Assessment of liabilities, legal risks, and contractual obligations of the divested asset. |

| Regulatory Review | Potential scrutiny by antitrust authorities to prevent monopolies. | Regulatory clearance required for transfer of licenses and permits. |

| Effect on Contracts | Contracts may require assignment or renegotiation post-integration. | Contracts may be terminated, assigned, or restructured according to divestiture terms. |

| Employee Impact | Possible integration of workforce and harmonization of employment terms. | May involve layoffs, reassignments, or transfer of employees under labor laws. |

| Tax Considerations | Potential tax benefits or liabilities related to asset pooling and restructuring. | Capital gains tax, transfer taxes, and tax impact on remaining business. |

Understanding Integration and Divestiture

Integration involves combining separate business units, assets, or companies to achieve synergy, improve operational efficiency, and enhance market presence, often seen in mergers and acquisitions. Divestiture refers to the process of selling, liquidating, or spinning off assets, subsidiaries, or business units to refocus on core operations, raise capital, or reduce risks. Understanding integration and divestiture requires analyzing strategic goals, financial implications, and organizational impact to optimize business portfolio management.

Key Differences Between Integration and Divestiture

Integration involves combining businesses or operations to enhance synergy, improve efficiency, and expand market reach, whereas divestiture entails selling or liquidating assets to streamline operations or raise capital. Key differences include strategic objectives, with integration aiming for consolidation and growth, while divestiture focuses on reduction and refocusing core business activities. Financial impact diverges as integration often requires significant investment, whereas divestiture generates immediate cash inflow and reduces operational complexity.

Strategic Objectives: Why Companies Choose Integration or Divestiture

Companies pursue integration to achieve strategic objectives such as enhancing market share, realizing synergies, reducing costs, and gaining control over supply chains. Divestiture is chosen to focus on core business units, improve financial health by shedding underperforming assets, and reallocate resources toward higher-growth opportunities. Strategic decisions between integration and divestiture hinge on long-term value creation and alignment with corporate goals.

Types of Corporate Integration

Types of corporate integration include vertical integration, where companies control multiple stages of production or distribution within the same industry, and horizontal integration, which involves acquiring or merging with competitors to increase market share. Conglomerate integration occurs when firms diversify by entering unrelated business areas, aiming to reduce risk and leverage synergies. These integration strategies contrast with divestiture, where companies sell off assets or business units to focus on core operations or improve financial stability.

Common Divestiture Strategies

Common divestiture strategies include asset sales, spin-offs, equity carve-outs, and management buyouts, each tailored to optimize financial performance and strategic focus. Asset sales involve transferring ownership of business units to external buyers to streamline operations. Spin-offs create independent companies from existing divisions, enabling enhanced market valuation and operational agility.

Benefits and Risks of Integration

Integration enhances operational efficiency by streamlining processes, reducing costs, and fostering synergy between merged entities, leading to increased market share and competitive advantage. Risks of integration include cultural clashes, disruption of existing workflows, and the potential for overestimating synergy benefits, which can result in financial losses and declining employee morale. Effective integration requires meticulous planning, clear communication, and alignment of strategic goals to mitigate these challenges and maximize value creation.

Advantages and Challenges of Divestiture

Divestiture offers companies strategic advantages such as improved focus on core operations, enhanced financial flexibility, and the ability to unlock shareholder value by shedding non-core or underperforming assets. Challenges include potential loss of economies of scale, disruption to existing customer relationships, and the complexity of restructuring operations or managing employee transitions. Effective divestiture requires careful planning to mitigate risks like valuation discrepancies and regulatory hurdles.

Impact on Stakeholders

Integration often enhances stakeholder value by streamlining operations, improving communication, and increasing resource sharing, which can lead to higher employee satisfaction and customer loyalty. Divestiture impacts stakeholders differently, frequently triggering uncertainty among employees, shifts in supplier relationships, and changes in customer engagement due to the refocusing of business priorities. Both strategies require careful management of stakeholder expectations to maintain trust and ensure long-term organizational success.

Integration vs Divestiture: Real-World Case Studies

Integration and divestiture strategies are critical in corporate restructuring, with real-world case studies highlighting their impact on business performance. For instance, Disney's acquisition and integration of Pixar enhanced its animation capabilities, driving revenue growth and innovation. Conversely, General Electric's divestiture of its financial arm allowed the company to refocus on core industrial operations, improving operational efficiency and shareholder value.

Choosing the Right Path: Factors to Consider

Choosing between integration and divestiture requires a thorough assessment of financial health, market conditions, and strategic goals. Companies must evaluate synergy potential, operational efficiency, and the impact on core competencies to determine the best path. Risk tolerance, cultural alignment, and regulatory environment also play a crucial role in shaping the decision for optimal long-term value creation.

Integration Infographic

libterm.com

libterm.com